Economic data out of New Zealand showed that its service sector continued to expand in September, but at a slightly slower pace. The Chinese slump in exports as well as imports was the dominant factor during the Asian trading session. Initial optimism about the announced partial trade deal between the US and China, which is expected to lack any significant improvements once details will be announced, is slowly fading and economic reality will set in. The EUR/NZD pushed above its 50.0 Fibonacci Retracement Fan Resistance Level, turning it into support, after Chinese data was released. Eurozone industrial production data scheduled for release later in today’s session could provide the next fundamental catalyst.

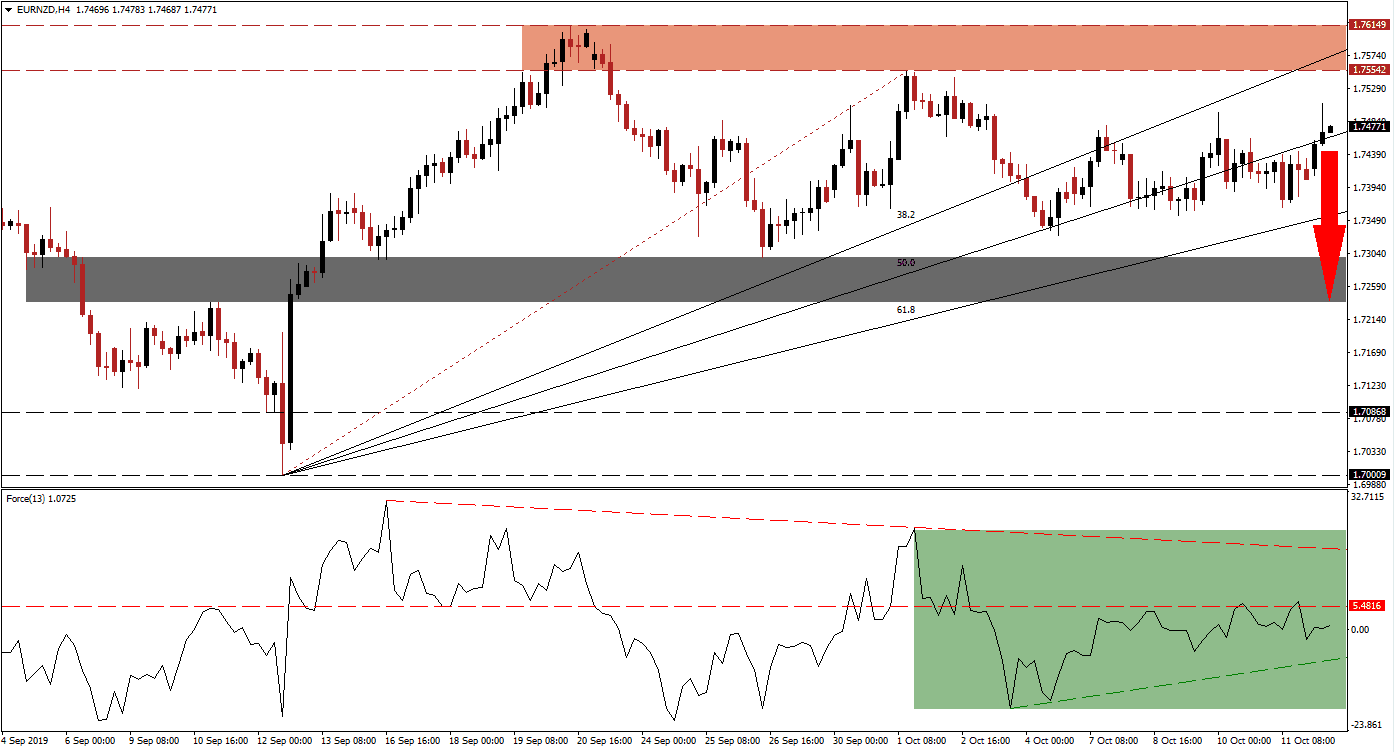

The Force Index, a next generation technical indicator, shows the loss in bullish momentum as price action in the EUR/NZD entered a sideways trend. The Force Index is struggling to eclipse its horizontal resistance level and its shallow, descending resistance level is closing the gap. While this technical indicator remains above 0 as marked by the green rectangle, suggesting that bulls are in charge, the general downtrend is likely to result in a breakdown which will lead this currency pair to the downside. Its ascending support level is increasing pressures for the next move. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

Price action is currently located above its 50.0 Fibonacci Retracement Fan Support Level and below its 38.2 Fibonacci Retracement Fan Resistance Level which is passing through its resistance zone. The resistance zone is located between 1.75542 and 1.76149 which is marked by the red rectangle. After the sideways trend emerged in this currency pair, the Fibonacci Retracement Fan sequence was re-drawn with the endpoint also representing the bottom range of the resistance zone in the EUR/NZD. The rise in bearish pressures, bot from a fundamental as well as technical perspective, point towards the likelihood of a breakdown.

Forex traders are advised to monitor the Force Index as a move into negative conditions is expected to lead the EUR/NZD into a price action reversal. A sustained move below the intra-day low of 1.74510 could result in the next wave of sell orders; this level marks the low of the most recent advance above the 50.0 Fibonacci Retracement Fan Resistance Level which turned it into support. The next short-term support zone is located between 1.72368 and 1.72983 which is marked by the grey rectangle. Eurozone economic weakness is expected to prevail and result in a weaker Euro moving forward, further driving a corrective phase in price action. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

EUR/NZD Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 1.74750

- Take Profit @ 1.72650

- Stop Loss @ 1.75100

- Downside Potential: 210 pips

- Upside Risk: 35 pips

- Risk/Reward Ratio: 6.00

In case the Force Index will be able to complete a breakout above its horizontal resistance level, turning it into support, the EUR/NZD may extend its current advance until it reaches its resistance zone from where a breakout is unlikely to follow. Any short-term advance by this currency pair into its resistance zone should be considered and excellent short selling opportunity.

EUR/NZD Technical Trading Set-Up - Limited Breakout Extension Scenario

- Long Entry @ 1.75250

- Take Profit @ 1.76100

- Stop Loss @ 1.74900

- Upside Potential: 85 pips

- Downside Risk: 35 pips

- Risk/Reward Ratio: 2.43