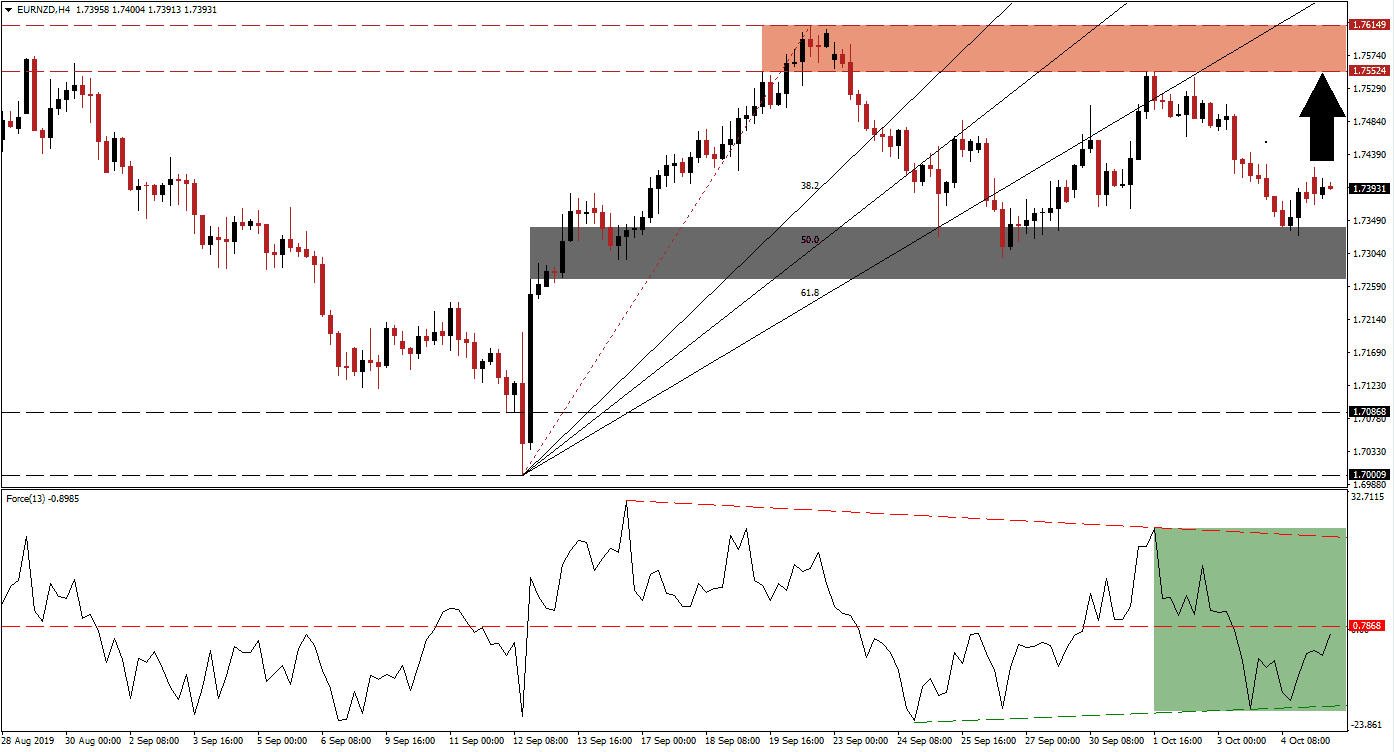

The Eurozone has been battered by disappointing economic reports as well as $7.5 billion worth of new tariffs from the US in response to the WTO ruling in favor of the US against the EU. This has pushed the Euro lower against its peers and forced the EUR/NZD below its entire Fibonacci Retracement Fan sequence, which turned it from support into resistance. Price action managed to stabilize after reaching its short-term support zone from where bearish momentum faded while the gap to its Fibonacci Retracement Fan sequence widened.

The Force Index, a next generation technical indicator, confirmed the breakdown with a contraction into its ascending support level. After reaching this level, it quickly rebounded as price action reached its short-term support zone. The Force Index remains in negative territory below its horizontal resistance level as marked by the green rectangle, but the rise in bullish momentum is expected to result in breakout. This is expected to propel the EUR/NZD to the upside as this technical indicator is set to recover into positive conditions, placing bulls in control of price action. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

As bullish momentum is on the rise and the Force Index is recovering, the short-term support zone which is located between 1.72689 and 1.73399, as marked by the grey rectangle, has been confirmed. Forex traders should now monitor the intra-day high of 1.74215 which marks the high of the bounce off of support, a sustained move above this level is likely to draw the next round of new net long positions in the EUR/NZD. While negative pressures for the Euro remain, the likelihood of a negative outcome out of the US-China trade talks are expected to have a bigger, short-term negative impact on the New Zealand Dollar.

Price action can extend a reversal into its next resistance zone which is located between 1.75524 and 1.76149 as marked by the red rectangle. Heavy resistance is expected at the bottom range of this zone and a breakout is unlikely to materialize, unless a major fundamental development emerges which will provide a catalyst. A breakout in the Force Index into positive territory should provide the required spark for the EUR/NZD to extend to the upside, but as long as this technical indicator will remain below its descending resistance level, the long-term down-trend is valid. German factory orders could increase short-term volatility, especially if the data comes in much worse than expected. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

EUR/NZD Technical Trading Set-Up - Price Action Reversal Scenario

Long Entry @ 1.73750

Take Profit @ 1.75500

Stop Loss @ 1.73200

Upside Potential: 175 pips

Downside Risk: 55 pips

Risk/Reward Ratio: 3.18

Should the Force Index reverse to the downside and push below its ascending support level, a breakdown in the EUR/NZD is expected to follow. This remains unlikely given the current fundamental set-up which is supported by technical factors and any retreat into its short-term support zone should be considered a solid long entry opportunity as long as the Force Index remains above its ascending support level. Given the preceding strong advance in this currency pair, a potential breakdown below its short-term support zone would lead to a bigger sell-off into its next long-term support zone which is located between 1.70009 and 1.70868.

EUR/NZD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.72550

Take Profit @ 1.70900

Stop Loss @ 1.73300

Downside Potential: 165 pips

Upside Risk: 75 pips

- Risk/Reward Ratio: 2.20