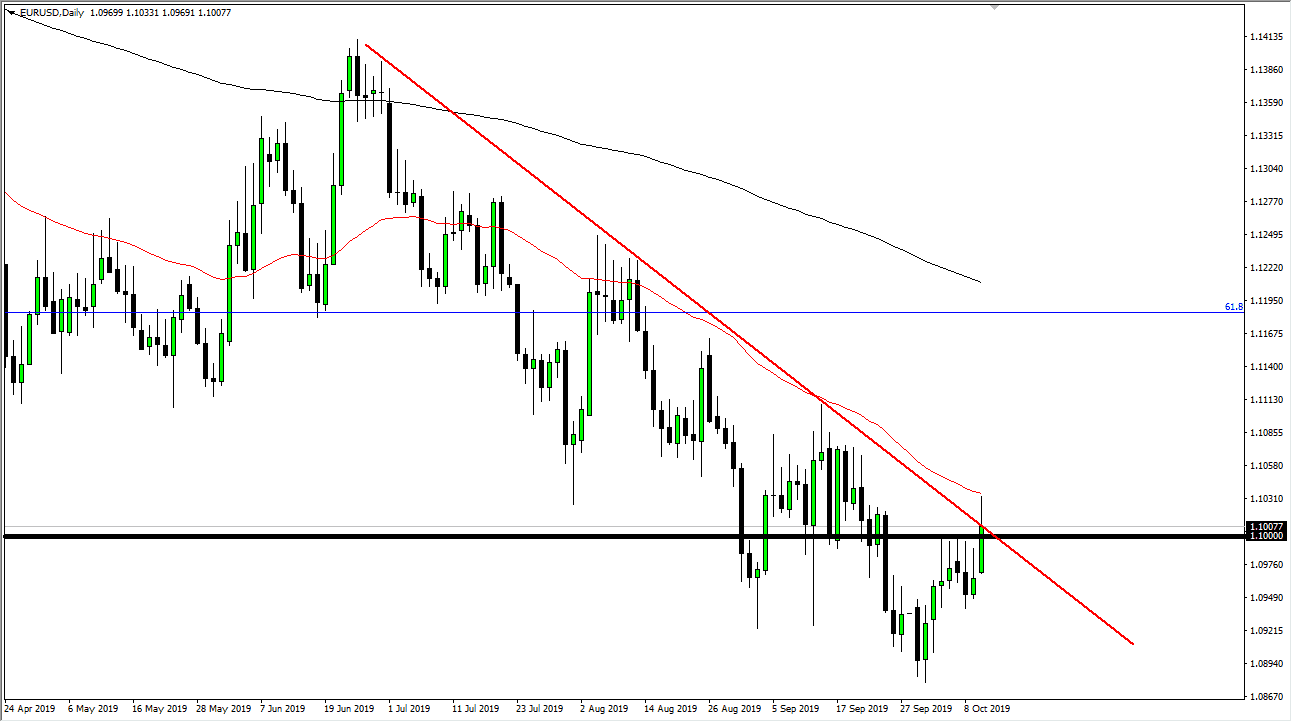

The Euro has had a very strong session on Thursday, breaking above the 1.10 level finally. When you look at the previous five trading candlesticks, you can see that there are long wicks to the upside that just got smashed through. However, it looks as if the market is going to close below the trend line, and it most certainly is going to close below the 50 day EMA. That to me suggests that although we have seen a very bullish move, there is still a lot of resistance above.

Ultimately, as the market breaks down below the 1.10 level it’s very likely that a lot of the buyers will step away as they are in a countertrend move, and they will more than likely want to get away from any situation where they can lose money in what would have been a risky proposition to say the least. Beyond that, the fundamentals still do not add up for a stronger Euro and it’s possible that a lot of this was done due to a bit of a sympathy play as the British pound rallied. Ultimately, the market would be looking at the possibility of the Brexit being solved, and in theory that should be good for the European Union.

That being said though, the European Union is heading into recession, and they have an agreement with the United Kingdom at the moment. In other words, this isn’t going to settle the economy right now. Ultimately, I believe that the market will continue to look at the stronger economy in the United States as a place to sock away money. Treasury markets continue to show signs of strength longer term, so it makes sense that money will continue to flow away from negative yields in the European Union and into the positive yields found in America.

All things being equal, the market is still in a major downtrend, but if we were to break above the top of the candle stick for the trading session on Thursday, that would be an extraordinarily bullish sign and could have longer-term traders looking to buy the Euro at these low levels. All things being equal though, even though it has been an impressive day, we have not changed the attitude of the longer-term trend, which still has a gap to fill underneath at the 1.0750 level from months ago.