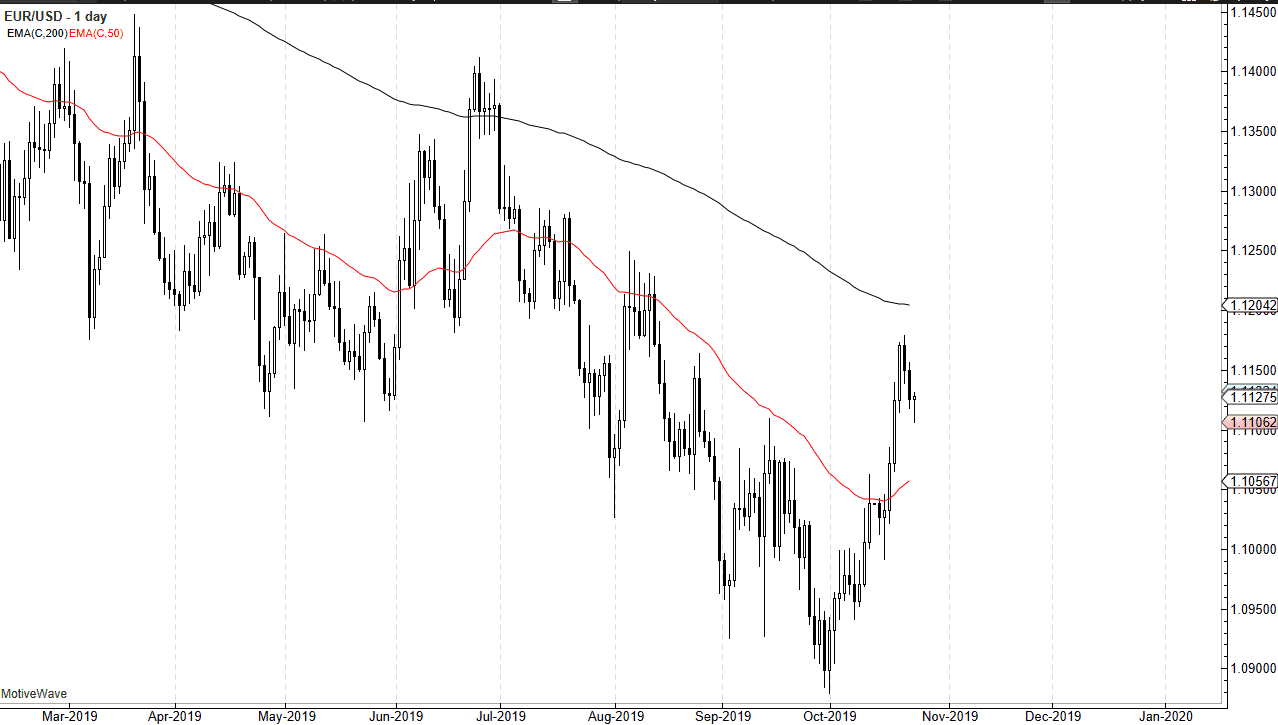

The Euro initially fell during the trading session on Wednesday but found enough support just above the 1.11 level to turn things around and form a bit of a hammer. The hammer of course is a bullish sign even though I think things look like we are likely to bounce from here I can also make an argument that we’ve seen this move before. After all, the market has rallied above the 50-day EMA several times in the past but struggled to get above the 200-day EMA. You can see this when you zoom out about 20 months.

Ultimately, this is a market that is looking for some type of directionality, and although recently we have seen a huge move to the upside, the reality is that it still just a blip on the radar of what has been a very long-term downtrend. At this point, it’s very likely that we are going to see a bit of a fight in this general vicinity. What I find truly interesting is that the crucial 200 day EMA is to be found at the 1.12 level, which of course is a large, round, psychologically significant figure and an area that we have seen quite a bit of support at in the past and it should now be rather resistant.

Remember, this is a market that was greatly influenced by the fact that there was a US dollar shortage around the world, but the Federal Reserve has done massive repo operations to ease the liquidity issues, so it does help value the US dollar a little lower. All things being equal though, I think that the next couple of days will be continued consolidation but if we were to turn around and break down below the bottom of the hammer for the Wednesday session, essentially breaking the 1.11 handle, then I think the market is likely going to break down a bit more. It doesn’t mean that it’s going to be an easy sell and hold type of situation, but it certainly looks as if it would drift lower. On the other hand, if we get a weekly break above the 1.12 level, then you could start to question whether or not the trend is changing. From an economic standpoint, it’s a bit hard to get excited about owning the Euro though. A lot of this will probably come down to statements coming out of the Federal Reserve during the FOMC announcement.