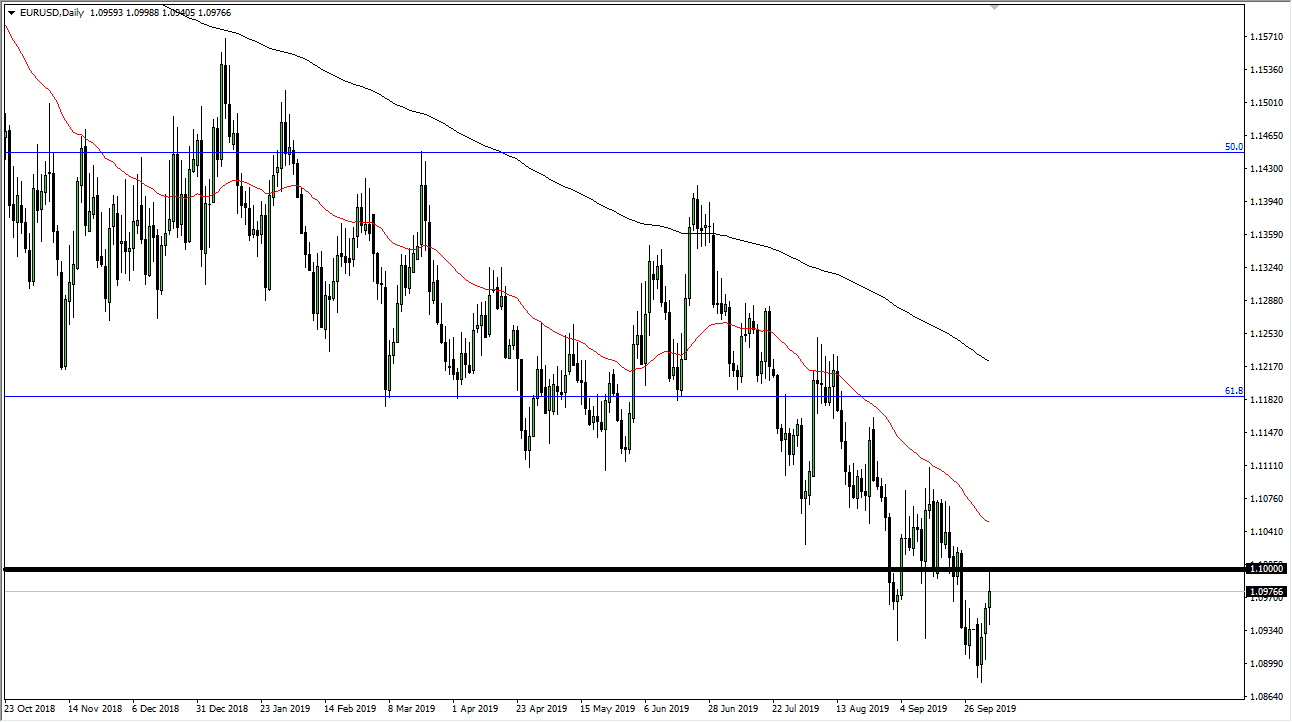

The Euro tried to rally during most of the session on Thursday but gave up the gains towards the end of the session. The ISM Non-Manufacturing figures came out less than anticipated, so this had money running away from the United States, a lease for short-term moves. The market has broken back down though, as we had approached the significant 1.10 level, an area that is obvious support and resistance on longer-term charts. The fact that we failed there that large, round, psychologically significant figure suggests that there is still plenty of bearish pressure on the Euro.

Looking at the last 18 months, every time this market has tried to rally their been sellers jumping in to punish it. The market has been choppy and negative overall, and I don’t see anything on this chart that suggests it’s going to change anytime soon. The 1.10 level of course is psychologically resistant, but we also have the 50 day EMA racing to the downside above that could cause significant pressure as well. Further grinding the gears lower will be the fact that European bonds tend to offer negative yields, while the US Treasury markets offer positive ones. That means money will be flowing into the United States based on that fact alone.

With Germany heading towards a recession and Italy already there, the European Union will continue to be a bit of an economic basket case, and of course we have to worry about headlines coming out about Brexit which has a direct effect on the EU in general. With that being the case, I have my sights on the gap underneath, which is closer to the 1.0750 level, and yet to be filled. With that, markets do typically fill this gap so I think it’s only a matter time before we get down there. That doesn’t mean that it will be tomorrow, but it certainly looks as if we are getting closer over the longer-term. As far as buying is concerned, it’s not until we break above the 200 day EMA which is all the way at the 1.1225 level before I would get bullish, because it would show a longer-term swing trade signal. Remember that this pair is very choppy, so you can’t necessarily expect to see a major move in one direction or the other but keep in mind that the jobs number comes out at 8:30 AM, New York time. Right around then this pair will be all over the place.