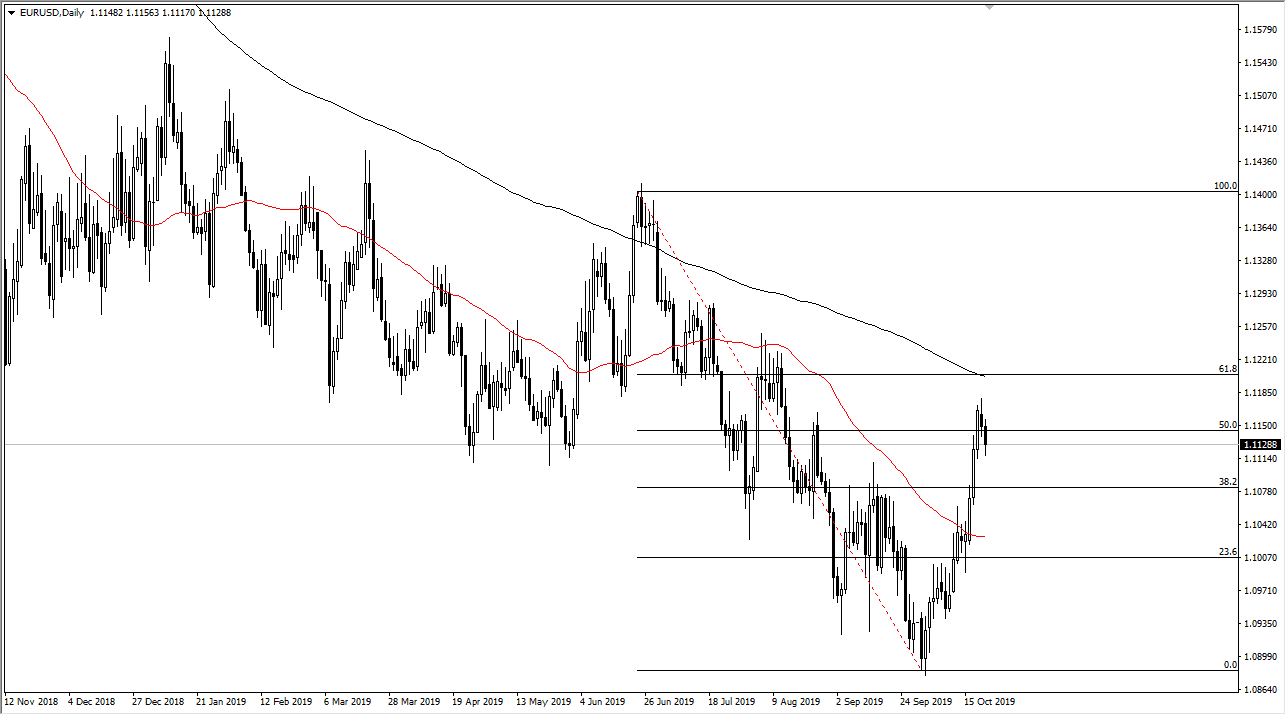

The Euro has rolled over slightly during the trading session on Tuesday, showing signs of lackluster performance of the 50% Fibonacci retracement level, with that being the case and the fact that we are broken below the Monday candlestick, it looks as if we will probably go looking towards lower levels given enough time. I think that this market will continue to favor the downside overall because the European Union is a basket case just waiting to happen, and of course if you look at the longer-term trend it is most decidedly lower.

I have no interest in buying this pair, because it has no business rallying. The 200-day EMA will of course cause significant problems, and I do not think that we will be able to break above there. Even if we do, I would need to see some type of weekly close in order to get excited about it, because we’ve seen this move before. All things being equal I think it’s only a matter of time before the market rolls over and goes looking towards lower levels, as the German economy itself looks to be heading into recession. Remember, the Euro is essentially a proxy for the Deutschmark, and has very little to do with the rest of the continent.

The market is parabolic, so it has no business hanging about after this type of move, unless of course it decides to grind sideways and “kill time.” That could of course happen, but the trend is still down, despite what we have seen over the last couple of weeks so I suspect it’s only a matter of time before some type of catalyst or fear enters the market and has buying of the US dollar paramount. Treasury markets are trying to pick up a little bit during the trading session on Tuesday, so that of course can have effect on the greenback as well. The Federal Reserve has recently done repo operations which has helped ease some of the US dollar liquidity issues, as there have been massive amounts of demand for the greenback around the world. However, that’s a temporary measure and doesn’t approach the longer-term structural issues that will be found in this pair. With this, I remain very bearish and am looking for some type of exhaustive candle or break down below the previous day candlestick to start shorting yet again.