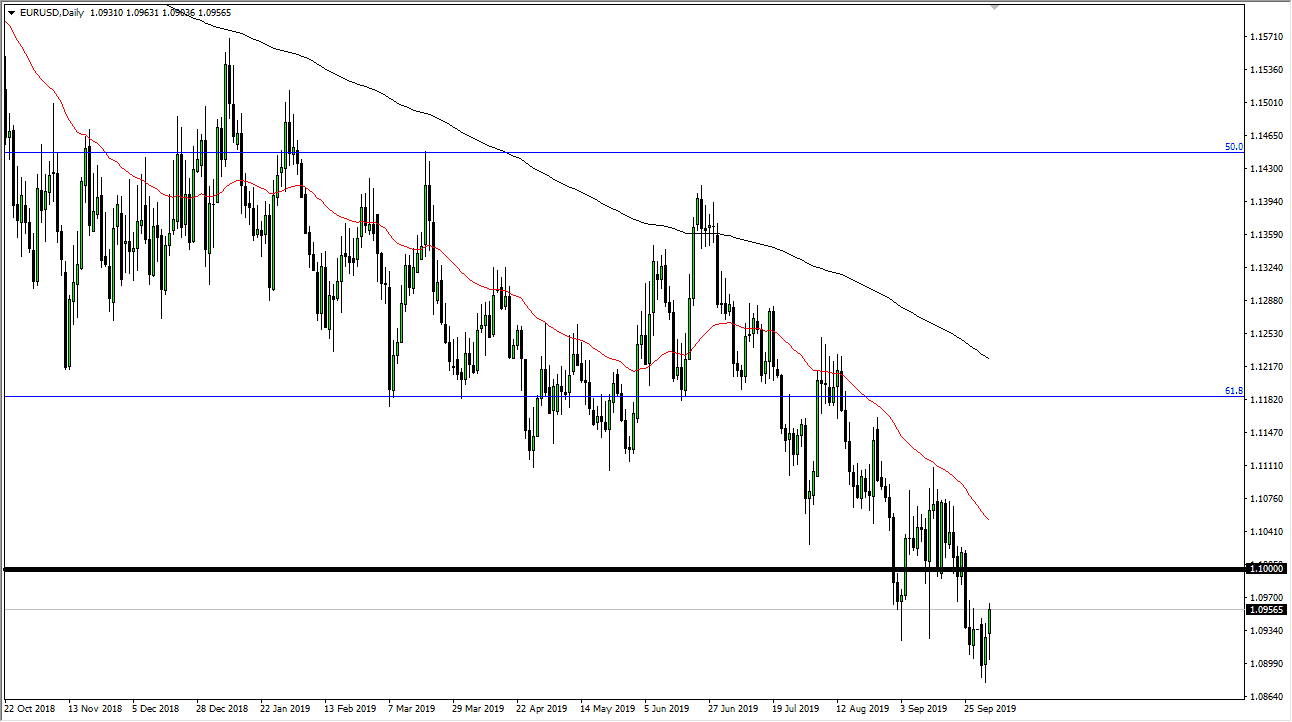

The Euro initially fell during trading on Wednesday but then turned around to show signs of resiliency as we continue to see a bit of a bottom forming. At this point in time though, this is simply more of the same that we have seen over the last 18 months or more in this pair. We get a break down like this, and then we chop higher, only to see sellers come right back in and push lower. After all, the European Union is heading into recession, and even though the ISM numbers in the United States were a big disappointment, we do have the jobs number coming on Friday and I suspect that is probably what the market is trying to set up for next.

At the 1.10 USD level, there should be a certain amount of psychological resistance, as well as structural. The 50 day EMA above that should also offer resistance, just as the 1.11 USD level will be and then the 1.12 level will be. Ultimately, this is a market that is in a downtrend for or quite a few different reasons, not the least of which is going to be the lackluster economic performance of Germany. Because of this, I do think that it is only a matter of time before we break down and reach towards the lows again but we may get a bit of a pop over the next day or so. There will also be a lot of volatility around Friday at 8:30 AM New York time, as the crucial jobs number gets released. Ultimately though, the trend is lower and with good reason.

I continue to fade signs of exhaustion, although we may not get that opportunity for the next 24 hours. I anticipate that we will eventually see sellers jump back in and push this market lower, but as you have seen over the last several months, every time we reach a new handle, in this case the 1.09 level, we get a bit of a bounce and then start selling again. This seems to be more of the same, and I anticipate that the trade continues to be the same, simply waiting for rallies to get involved in start shorting again. I have no interest in buying the Euro until we break the 1.12 level above with a daily close at the very least.