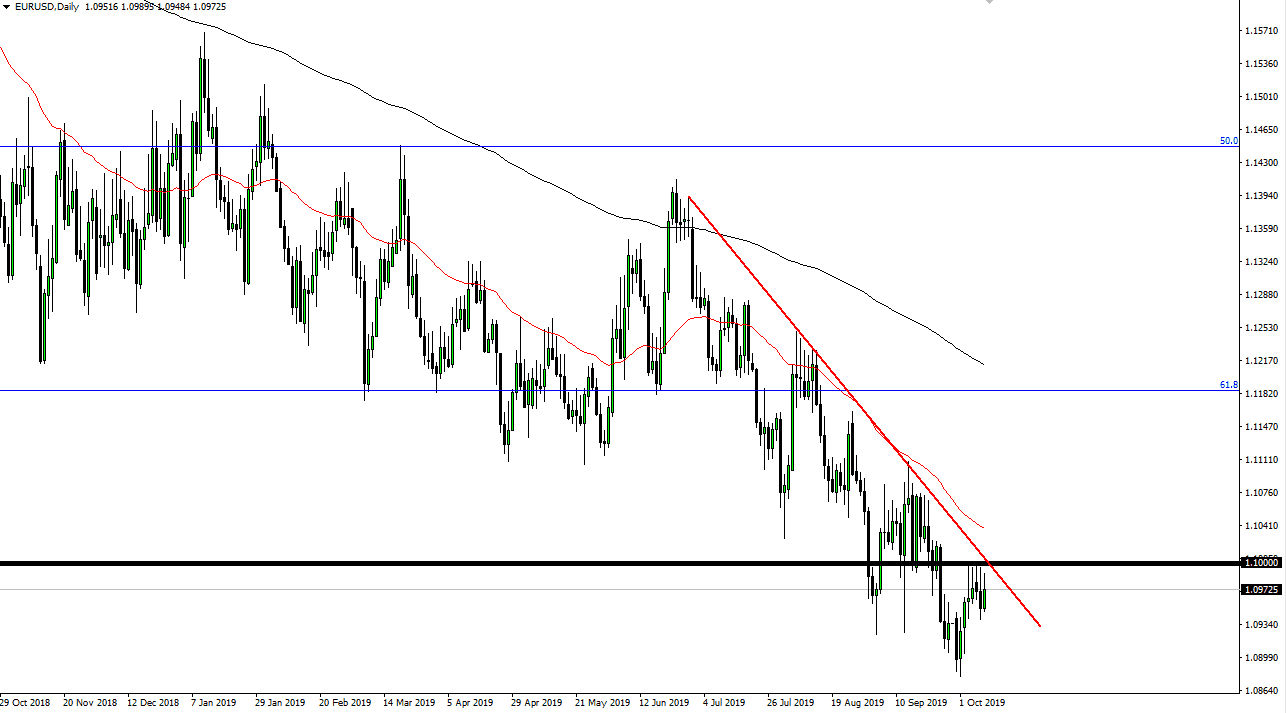

The Euro rallied a bit during the trading session on Wednesday but continues to see a lot of resistance above at the 1.10 level. This level continues to be very difficult for buyers to overcome, and of course the action during Wednesday was no different than it was the previous four sessions. The one lone exception to that is the fact that the high was actually slightly lower. So what does this tell us? That there is still significant selling pressure and that more than likely going to continue to find plenty of people jumping into the market.

That being said, I would add the caveat that a daily close above the 1.10 level could be the beginning of something rather special and a huge move to the upside. When I say that, I don’t mean 1.1001, rather somewhere closer to about 30 pips above that level. Remember, support and resistance should be thought of as essentially “an area” than anything else.

The European Union is very likely to go into recession, so having said that it’s likely that the market will continue to favor the US dollar in general. Beyond that, there is a whole host of geopolitical concerns out there that has money flowing into the US Treasury markets, although they did sell off a bit during the session on Wednesday. All things been equal though, the 50 day EMA above is starting to reach towards that resistance barrier, so I think it’s probably only a matter of time before people jump into the market and fading any rally.

To the downside I suspect that the 1.09 level will continue to show support as well, but we have pierced that level couple of times so I think it’s ready to give way on some type of impulsive move lower. We are well below the 61.8% Fibonacci retracement level, so that of course suggests that we are going to continue to see a drive lower, perhaps even down to the 100% Fibonacci retracement level. Beyond that though, there’s also a gap on the daily chart that can be found at the 1.0750 level, which I think use a major support level before we even get to the 100% Fibonacci level. All things being equal I like fading short-term rallies, and simply grinding away to the downside as it has worked out quite well for the last 18 months or so.