The Euro has rallied a bit during the trading session on Friday, as the jobs number came out a little bit softer than anticipated in the top line, but had several strong revisions attached to it. Beyond that, the unemployment rate in the United States is at a 50 year low. This had people jumping into more of a “risk on” scenario, but the Euro isn’t necessarily the place I’m looking to go to find some type of “risk on” trade.

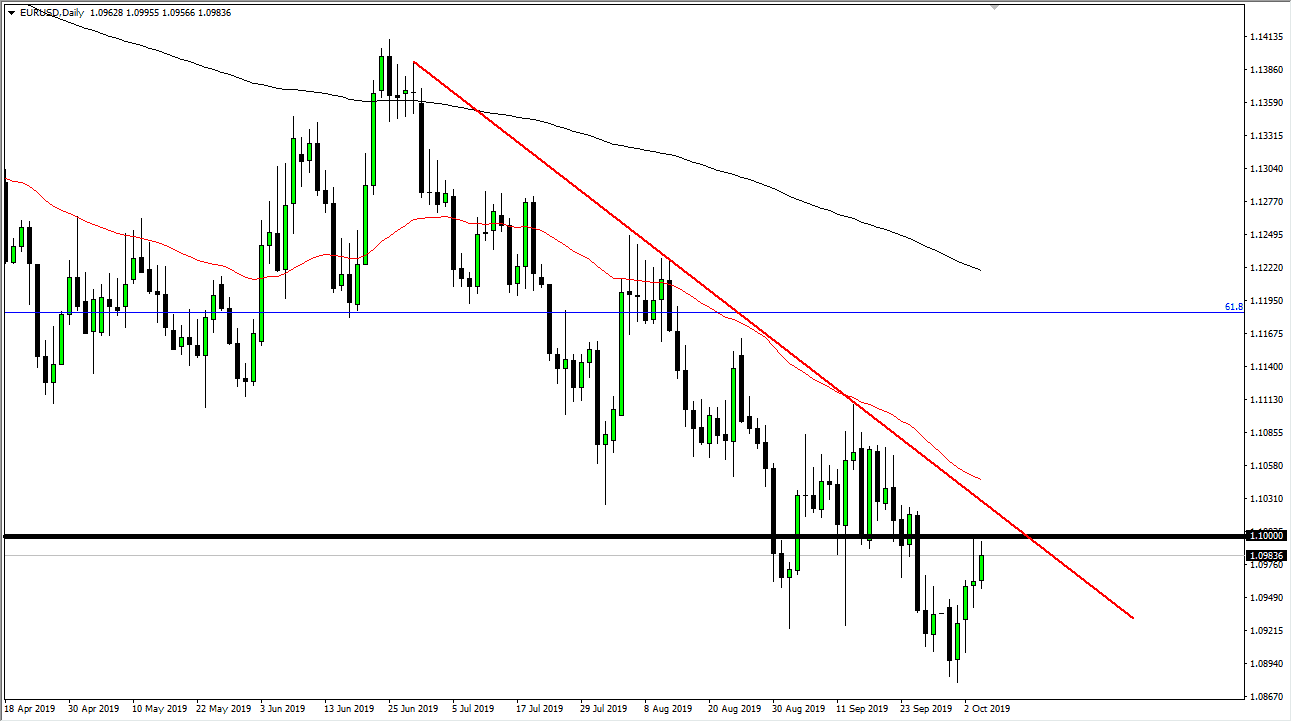

At this point, the 1.10 level looks to be significant resistance as it was significant support. At this point in time the downtrend line that I have marked on the chart should also come into play, which is backed by the 50 day EMA, a very powerful technical indicator indeed. We have been in a strong downtrend for quite some time and although Friday does look a little bit more bullish than Thursday, the reality is that there is a ton of resistance above that will come into play. There’s no need to fight a longer-term trend like this, and therefore taking advantage of “cheap dollars” will be the way to trade this market going forward.

The European Union continues to struggle with negative yields, and of course that does weigh upon the currency. Beyond that, the German economy looks likely to slip into recession, and that could also weigh upon the Euro in general. At this point, there seems to be massive resistance from the 1.10 level to the 1.1025 handle based upon the breakdown candle as well, so that’s another reason to think that we fall. Italy has already hit recession, and with the jobs number coming out stronger in the United States, it makes sense that people will continue to throw money at America. To the downside, I think the 1.09 level will be targeted and this is just simply going to be a continuation of the longer-term choppy downward trend that we have been in for almost 2 years.

If we do break above the downtrend line or the 50 day EMA, then we could make a move towards 1.12 level where we will run into the 200 day EMA which of course is massive resistance as well. Ultimately, that seems to be unlikely but it is a real possibility. You should keep this in mind but until proven otherwise I believe in the downside more than anything else.