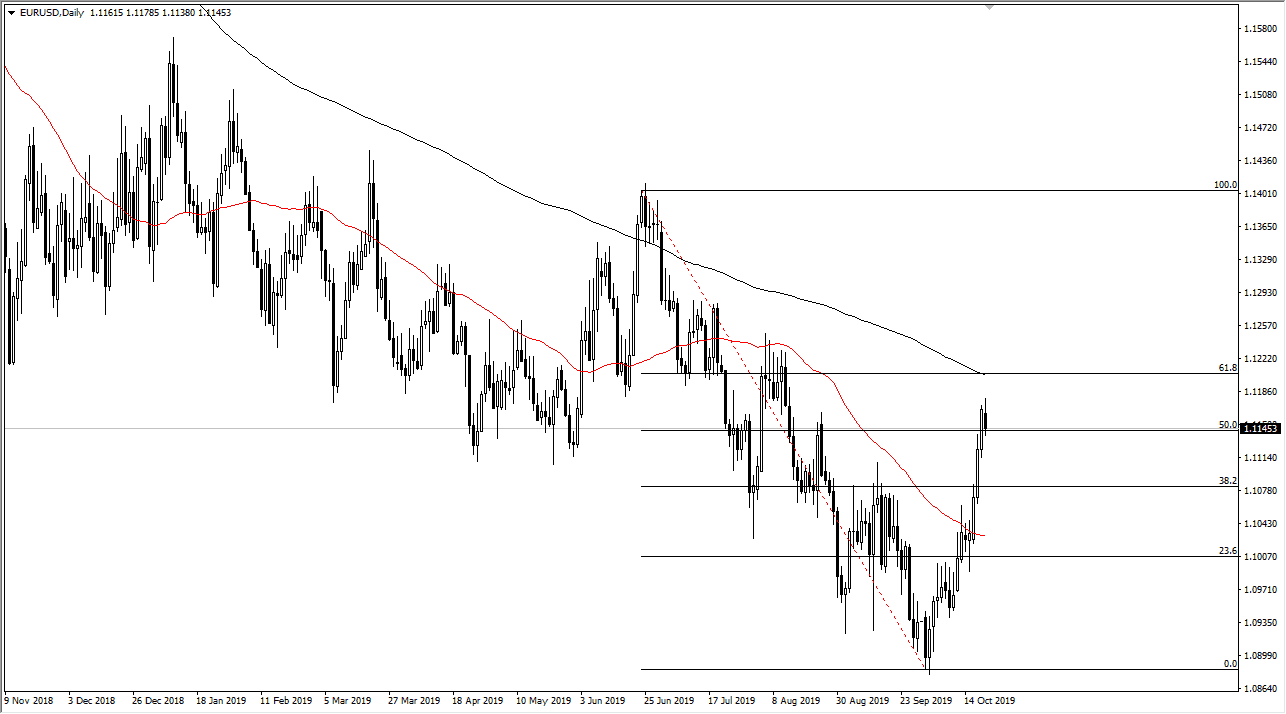

The Euro has pulled back just a bit during the trading session on Monday, breaking below the 1.1150 level. At this point, the market has spiked higher over the last several days but has shown signs of exhaustion and therefore it’s likely that we have finally run out of overly bullish pressure. At this point, it’s likely that the market will probably drop down by 50 pips or so. The 200-day EMA as above though, and at this point it should be noted that the 200-day EMA above will probably offer quite a bit of resistance.

The 200-day EMA attracts a lot of longer-term traders, so keep in mind that will continue to be a major influence on what happens next. At this point, we are overbought on just about any metric you look at, so it makes sense that the Bureau would pull back at the very least. The 200-day EMA is sitting right at the 61.8% Fibonacci retracement level, so that should attract a lot of attention as well In other words, the Euro could be running out of steam in the short term. At this point, if we were to break above the 200-day EMA on a daily close, that would be a very bullish sign.

It’s likely that the market will continue to do the same thing it’s done for the last 18 months: break above the 50-day EMA and then rollover somewhere around the 200-day EMA. This is happening repeatedly, and although things look very bullish in the short term, the reality is that we have seen this move before. To the downside, we could go all the way down to the lows again, but it will take some time to get down there. At this point, the market is testing the downturn, but the question then becomes whether or not the overall trend continues. The question now is whether or not the Euro has any reason to continue to go much higher. All things being equal, I am looking for a selling opportunity in the short term, but I do recognize that if the 200 day gets retaken, then we may have something bigger on her hands.