As we expected from the beginning of this week that the EUR/USD price action will be in a limited range until the Fed's monetary policy decisions are announced. In fact, the pair has been moving between the 1.1076 support and 1.1118 resistance, before settling around 1.1108 at the time of writing. Stronger expectations are that the US central bank will cut interest rates by a quarter point for the third time at this meeting to maintain the remaining US economy performance, which is still the best among the developed economies. The bank's actions are trying not to economize quickly with the aftermath of the global trade war. Yesterday, US consumer confidence fell for the third consecutive month.

A report released by the National Association of Realtors showed another significant increase in pending home sales in the United States in September. Pending home sales rose 1.5 percent to 108.7 in September after rising 1.4 percent to 107.1 in August, NAR said. Economists had expected pending home sales to rise by 0.9 per cent compared to the 1.6 per cent increase originally reported the previous month.

With the larger-than-expected monthly increase, pending home sales in September rose 3.9 percent from the same month last year. The sale of pending houses is where the contract was signed but not yet closed. Typically, it takes four to six weeks to close a contracted sale. NAR Chief Economist Lawrence Yoon noted that historically low mortgage rates played an important role in the gains made in two consecutive months.

Investors are still optimistic about the course of trade talks to resolve the dispute between the world's two largest economies. The conflict has contributed significantly to the slowdown in global economic growth.

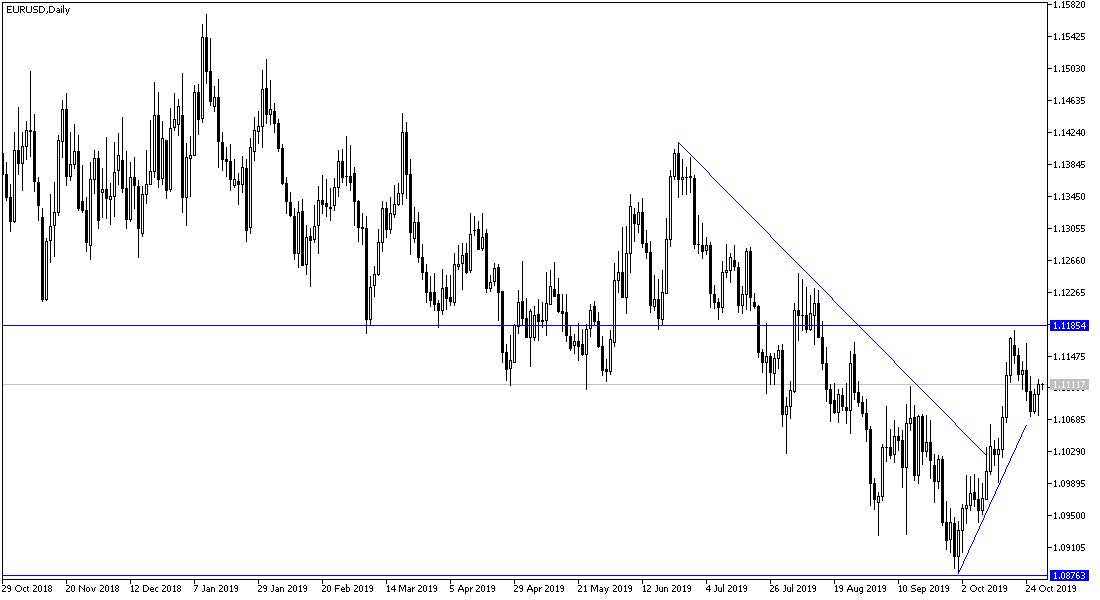

According to the technical analysis of the pair: EUR/USD will still have the opportunity for a bullish correction by stabilizing above 1.1120 resistance, which will trigger a correction towards higher resistance levels that could reach resistance areas at 1.1200, 1.1285 and 1.1340 respectively. The bearish trend, which is still valid in the long term, may return with a break below the 1.1000 support level.

As for the economic calendar data today: From the Eurozone, German and Spanish CPI and France's GDP and consumer spending data will be released. From the United States, the GDP growth rate and the announcement of the Fed's monetary policy decisions will come amid strong expectations of a quarter-point cut in US interest rates the following press conference by Governor Jerome Powell to explain why the bank made its decisions.