For the third day in a row, EUR / USD failed to break above the 1.1000 resistance level, confirming the strength of the downtrend, and is stable around 1.0965 in early Tuesday trading. Traders will remain cautiously awaiting the upcoming round of trade talks between the United States and China later this week. Expectations remain low that this week's talks will lead to a breakthrough or will be enough to postpone the next round of tariff increases scheduled for next week.

At the economic level. German factory orders fell by -0.6%, double the expected decline. The decline in July was adjusted to - 2.1% instead of - 2.7%. The year-on-year contraction reached -6.7%, down from a revised -5% decline in July. The year-on-year decline was the 15th in a row. At the same time, there were a few bright spots in the disappointing report. Foreign orders rose (0.9%) but did not offset a 2.6% drop in domestic orders. Second, commodity orders rose by -1.1% (July -1.5%) and cuts in investment and consumer goods declined as of July. Germany is to release industrial production figures for August today, and a slight decline is expected.

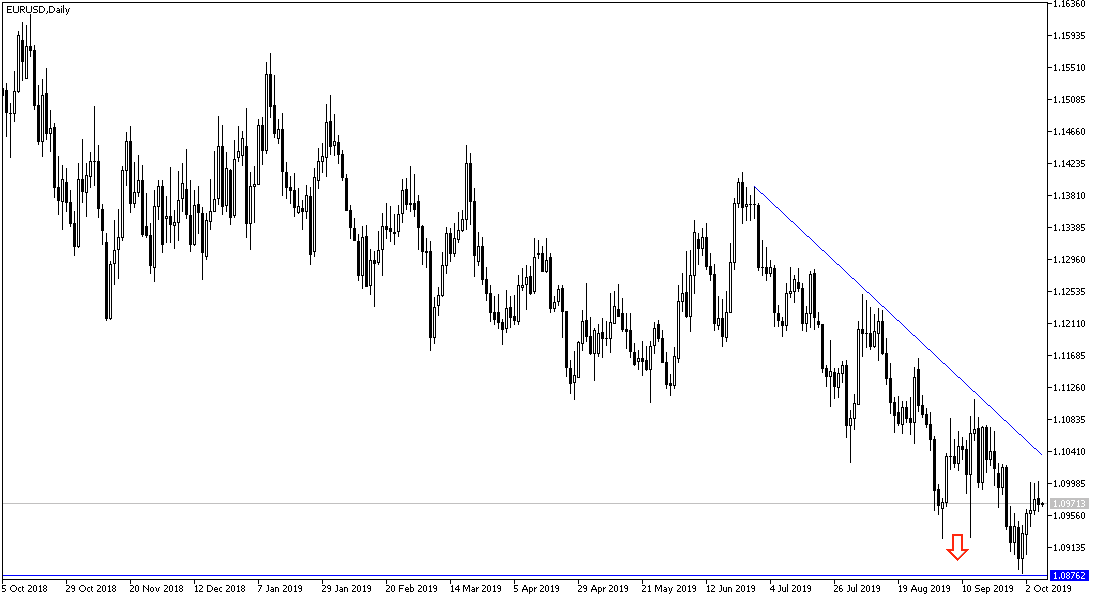

EUR / USD recovered from its lowest level since mid-2017 at the beginning of the week, near the $1.0880 support. It had a four-session corrective momentum for the first time in 3.5 months. In the long term, the general trend is still bearish and is reinforced by the pair's failure to move towards 1.1000 and 1.1120 resistance levels. Currently the closest support levels are 1.0960, 1.0880 and 1.0790 respectively. Weak economic data from the Eurozone, especially from Germany, remains a negative factor for any gains in the single European currency.

As for the economic calendar data today: From the Eurozone, German industrial production and French trade balance will be announced. From the US, the producer price index, the first of the US inflation figures, and later, the remarks by Federal Reserve Governor Jerome Powell.