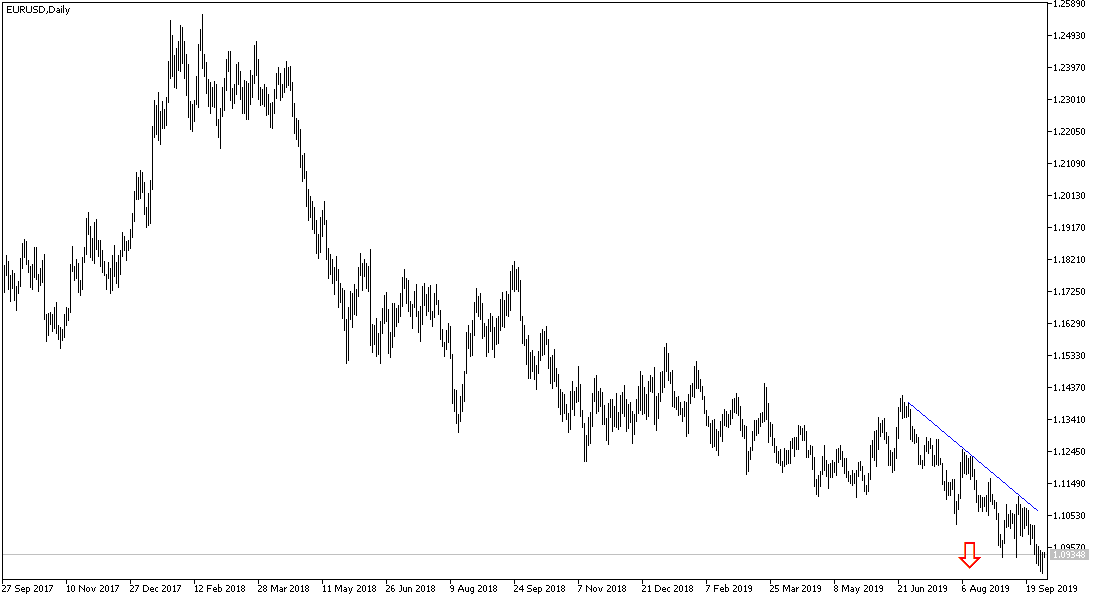

Weak inflation in the Eurozone has raised expectations that the ECB will have more stimulus plans alongside its recent announcement. This added to the downward pressure on the EUR / USD, which collapsed to the support level of 1.0880, its lowest level in 28 months, before rebounding around 1.0935 at the time of writing, with the decline of the US manufacturing PMI which confirms the extent of the effect on the US economy, especially the manufacturing sector, by the trade dispute with China.

Eurostat data showed that Eurozone inflation unexpectedly fell in September, driven by lower food and energy prices. Inflation slowed to 0.9 percent in September from 1 percent in August. The rate was expected to remain unchanged at 1 percent. This was the lowest inflation rate since November 2016, when the price growth rate was 0.6 percent.

Inflation remained well below the ECB's target of “below, but close to 2 percent”. Meanwhile, core inflation, which excludes volatile energy, food, alcohol and tobacco, rose to a three-month high of 1 percent from 0.9 percent in August. The rate was in line with expectations.

Outgoing ECB President, Mario Draghi, announced a series of stimulus measures at his final policy session in September. The bank cut its deposit rate by 10 basis points to -0.50 percent. European Central Bank officials cut Eurozone inflation forecasts for this year to 1.2 percent from 1.3 percent and forecasts for next year have shrunk to 1 percent from 1.4 percent.

From the US, the ISM Manufacturing PMI fell to 47.8 in September from 49.1 in August, and any reading below the 50 level indicates a contraction in manufacturing activity. Economists had expected the index to rise to 50.1. With the unexpected drop, the index fell to its lowest level since it hit 46.3 in June 2009, the last month of the Great Recession.

According to the technical analysis of the pair: EUR / USD stability around and below the 1.0900 psychological support level will support the strength of the general trend, which is still bearish. On the daily chart below, it appears clear that the pair has reached overbought areas and the unwillingness of investors to buy the Euro is due to continued weak economic indicators in the Eurozone led by Germany. On the upside, without returning to the 1.1100 resistance area, the bounce opportunity will not be of value.

As for today's economic data: From the Eurozone, the Spanish Unemployment Change will be announced. From the US, the first US jobs data from the ADP Non-Farm Payrolls and Crude Oil Inventories survey will be released.