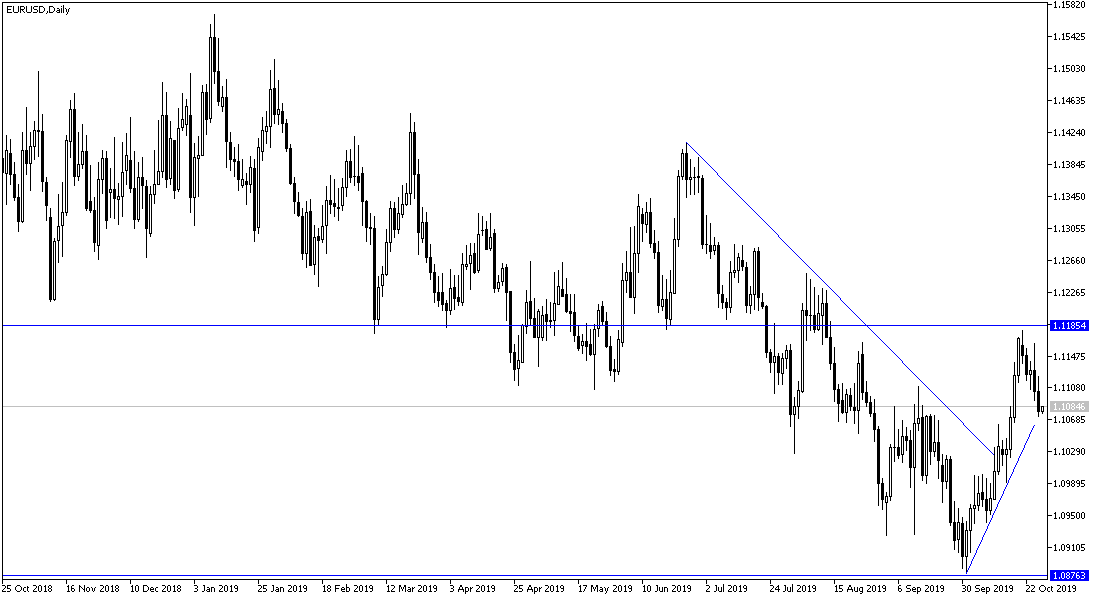

After weeks later, the EUR/USD pair corrected up to 1.1179, the pair's highest resistance in more than two months, following optimism from the recent US-China trade agreement and the Brexit deal which is still looking for a way out. The pair has been in a sell-off throughout last week's trading, moving to the 1.1072 support, where it closed the week around. Approaching 1.1000 support threatens future upward correction higher. The latest IFO reading indicates a quiet start to the final quarter in Europe's largest economy, but also revealed temporary signs of stability.

The German IFO was unchanged at 94.6 in October, and expectations were for a decline to 94.5, and as the outlook improved for six months, it covered the deterioration in the current conditions component of the index. The IFO said the downturn in manufacturing, the main driver for the economic downturn, is over. The IFO survey surveyed more than 7,000 German companies and asked them to assess the relative level of current business conditions in addition to the forecast for the next six months. Investors and economists monitor this survey very closely.

Overall, Germany's IFO index fell 13 out of 16 months and is now near its lowest level since the global financial crisis of 2008-2009, driven by the disastrous impact of President Trump's trade war on the export-led manufacturing sector. That in addition to the chronic uncertainty about the possible outcome of Brexit, not to mention the impact of US interest rate policy on the rest of the world.

According to the technical analysis of the pair: if the EURUSD breaks the 1.1000 psychological support, the sell-off will increase and the pair's bullish correction expectations will collapse. The nearest support levels for the pair are currently at 1.1020, 1.0945 and 1.0880 respectively. The strength of the correction expectations will return if the pair returns to stability above 1.1120 resistance according to our previous expectations. Taking into account investors waiting for the decision of the US interest rate cut this week, inflation figures in the Eurozone and clarity of vision on the plans of the new European Central Bank Governor Christine Laggard.

As for today's economic data: German import price index, money supply and private loans data are expected from the Eurozone. From the US, trade balance of goods will be released.