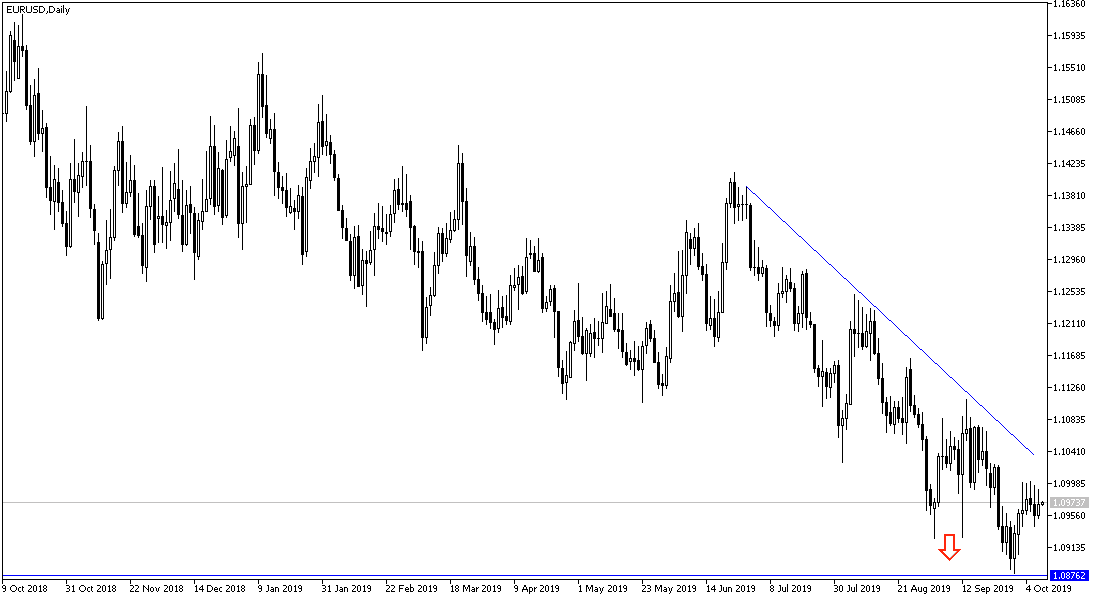

For 5 consecutive sessions, the EUR/USD attempted to break the 1.1000 resistance, which would give it hope in a bullish correction. All of these attempts failed with the weak investors’ confidence in the Euro in light of continued weak economic performance from the Eurozone. This was opposed to the US economic performance that is still holding on despite the weakness of some economic sectors, which is due to continued trade dispute with China.

With the markets aware of the last Federal Reserve Meeting records, it showed that a few of the bank monetary policy members expressed their concerns during September meeting that the markets are expecting more rate cuts than is appropriate, and some members felt that it is necessary for the Federal Reserve to seek achieving better alignment between market expectations regarding interest rate path and policy makers expectations.

"Many participants suggested that the committee's statement after the meeting should provide more clarity as to when the rate adjustment process is likely to end in response to trade uncertainty," the Fed said in the minutes.

Currently, markets are widely expecting a 25bp US rate cut at the next Fed meeting later this month and a 45.3 per cent chance of a 25bp rate cut at the December meeting.

Ahead of the round of trade talks between the United States and China today, US President Trump has shown little interest in a partial agreement, as happened with Japan, and at the same time, China seems more sympathetic. It will do what it was and what it has to do, buy more US agricultural products, and in return, the United States does not impose any additional fees on China. In fact, China has offered to buy $ 10 billion in US agricultural products. The WTO allows bilateral free trade agreements as long as they are comprehensive. There is cautious anticipation of the final announcement of that round and the resulting decisions.

According to the technical analysis of the pair: little change in our technical outlook for the EUR/USD performance, which is still under downward pressure supported by stability below the 1.1000 resistance. The recent performance predicts a stronger technical move ahead, which is closer to continue the drop towards support areas at 1.0955, 1.0880 and 1.0790 respectively. There can’t be talks about a reversal of the trend without breaching the 1.1120 resistance.

As for the economic data today: From the Euro-Zone, the German Trade Balance and French Industrial Production will be released. From the US, the consumer price index figures to measure US inflation, as well as jobless claims.