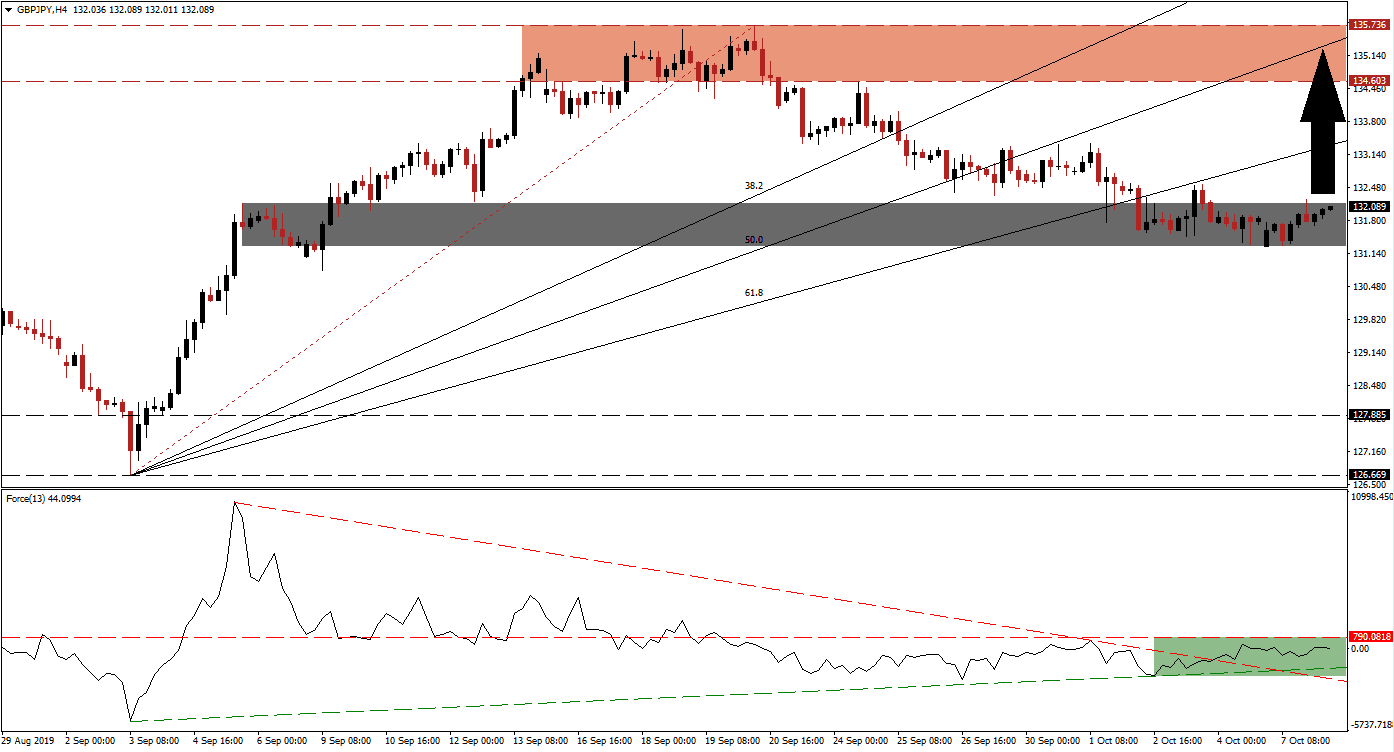

The risk-on mood which started in Asia this morning has pushed the Japanese Yen, a safe haven currency, lower; this was assisted by economic data which showed that cash earnings decreased further while household spending expanded. The GBP/JPY deflated bearish momentum, from the sell-off which took price action from its resistance zone through its entire Fibonacci Retracement Fan sequence, inside its short-term support zone. Price action started to recover and a breakout is now pending.

The Force Index, a next generation technical indicator, is confined to a narrow range between its shallow, ascending support level and its horizontal resistance level following the breakdown of the GBP/JPY below its ascending 61.8 Fibonacci Retracement Fan Resistance Level. A bullish bias emerged after the sideways trend elevated this technical indicator above its descending resistance level, which now acts as support, and the Force Index remains in positive territory as marked by the green rectangle. This suggests that the next move in this currency pair will be to the upside. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

A breakout above its short-term support zone, located between 131.276 and 132.153 which is marked by the grey rectangle, is expected to follow. Forex traders should monitor the Force Index together with the intra-day high of 132.541, the last peak in the sideways trend which took the GBP/JPY briefly above its short-term support zone and into its 61.8 Fibonacci Retracement Fan Resistance Level. A breakout in the Force Index above its horizontal resistance level is expected to push price action above the 132.541 mark from where more upside is possible.

Upside potential for a breakout should be limited to the next resistance zone as Brexit uncertainty, especially ahead of next week’s EU summit, remains elevated. The resistance is located between 134.603 and 135.736 as marked by the red rectangle and the GBP/JPY would need to complete a breakout above its 61.8 Fibonacci Retracement Fan Resistance Level. The 50.0 Fibonacci Retracement Fan Resistance Level is currently passing through the resistance zone where bearish pressures are expected to increase. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

GBP/JPY Technical Trading Set-Up - Breakout Scenario

Long Entry @ 132.000

Take Profit @ 135.100

Stop Loss @ 131.250

Upside Potential: 310 pips

Downside Risk: 75 pips

Risk/Reward Ratio: 4.13

Failure in the Force Index to push above its horizontal resistance level may prevent a sustained breakout in the GBP/JPY above its short-term support zone. This could lead to a breakdown in price action and the intra-day low of 130.806 should be watched closely; this level represents the low from the last breakdown below the short-term support zone from where an advance materialized. The next support zone is located between 126.669 and 127.885.

GBP/JPY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 130.450

Take Profit @ 127.900

Stop Loss @ 131.250

Downside Potential: 255 pips

Upside Risk: 80 pips

Risk/Reward Ratio: 3.19