For more than two weeks in a row, the GBP/JPY pair continues the downwards correction, with losses reaching the 131.21 support level recorded earlier this week. Continued pressure on the GBP will support the pair's move towards 130.00 psychological support as soon as possible. The pair's recent losses were supported by the uncertainty of Brexit's future and growing expectations of a no-deal Brexit despite Boris Johnson's new proposals to the EU to get out of the crisis. This is in addition to the strong gains of the Japanese yen from the growing demand for safe haven.

The UK recently put forward an alternative proposal to resolve the Irish “support” problem, but the initial reaction of EU negotiators has not been very positive. "There has been improvement ... but we have not yet reached consensus," said EU chief negotiator Michel Barnier. The private sector remains concerned about the proposal on the island of Ireland, a red line for the EU. Guy Verhofstadt, who chairs the Brexit committee, commented that the proposals "were not positive in that we do not really believe that there are the guarantees that Ireland needs."

At the same time, the proposal was well received by the government itself, including Brexiteers on the one hand and conservative independents on the other. We have noticed that there is a good chance that the government will win a majority if it makes a deal based on its latest plans, which is a positive overall development for the Pound.

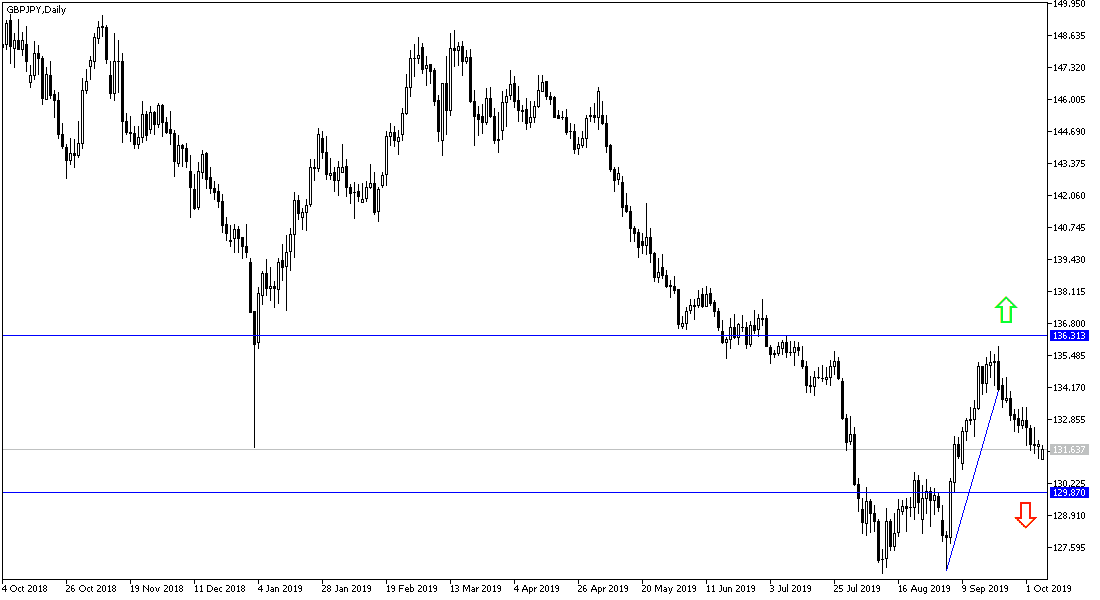

According to the technical analysis of the pair: On the daily chart, the general trend of GBP/JPY is still bearish and a test of the 130.00 psychological support will consolidate the strength of this trend, and then warn to test stronger support levels, especially if there is a negative development for the future of Brexit. On the upside, there will be no strong chance of an upward correction without the pair settling above 133.60 resistance. Otherwise, the bears will remain in full control of the pair's direction.

Today, the pair is not expecting any significant economic data from either the UK or Japan. But the Japanese Yen may get more support from growing global trade and geopolitical tensions.