As global economic reports this week highlighted, the economy continues to slow down faster than most economists have predicted. Tensions between the US and China remain elevated and Brexit is facing yet another delay which has added to demand in gold and ended the corrective phase. The choppy trading action which followed the initial breakdown in this precious metal has resulted in a re-drawn Fibonacci Retracement Fan sequence which is expected to pull price action back into its resistance zone.

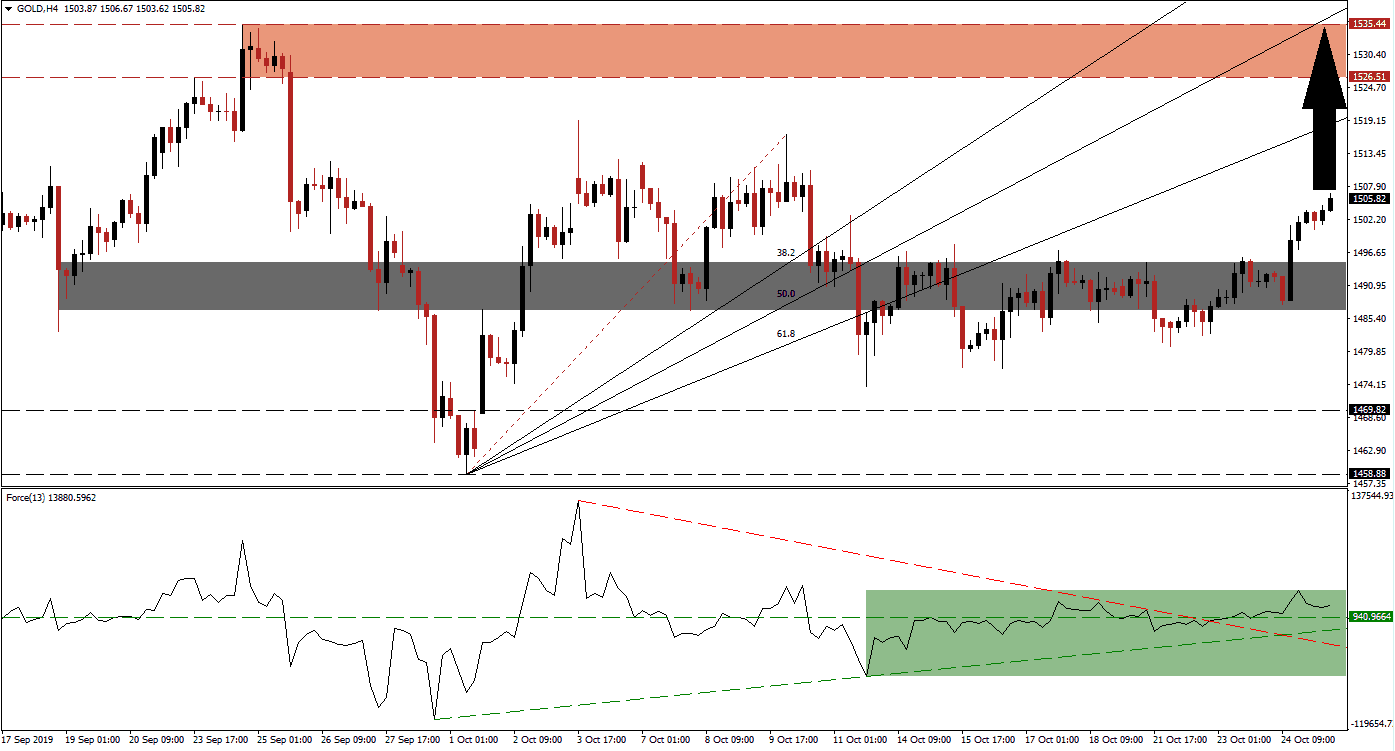

The Force Index, a next generation technical indicator, indicates the build-up in bullish momentum with a breakout above its horizontal resistance level; its ascending support level assisted in the advance which turned resistance into support. The Force Index also completed a breakout above its descending resistance level which represents another major bullish development. The advance also elevated this technical indicator into positive territory, as marked by the green rectangle, which placed bulls in charge of gold. You can learn more about the Force Index here.

Following the breakdown in gold below its short-term support zone and its ascending 61.8 Fibonacci Retracement Fan Resistance Level, price action created a series of higher lows which led this precious metal back into its support zone. This zone is located between 1,486.73 and 1,494.94 which is marked by the grey rectangle and the rise in bullish pressures resulted in a breakout. Traders are now advised to watch the intra-day high of 1,510.64; this marks the peak prior to the breakout sequence which took price action to a higher low and ended its descend. A push above this level is expected to initiate the next wave of buy orders.

With the rise in bullish momentum, supported by fundamental developments, price action is expected to extend its rally until it can challenge its next resistance zone which is located between 1,526.51 and 1,535.44, marked by the red rectangle. This zone is nestled between the 61.8 and 50.0 Fibonacci Retracement Fan Resistance Levels and more upside is possible, especially with next week’s US central bank meeting where an interest rate cut is expected. Since gold is priced in US Dollars, the pair often enjoys an inverse relationship while central bank gold buying has provided a floor under each retreat. You can learn more about a resistance zone here.

Gold Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 1,505.50

Take Profit @ 1,535.25

Stop Loss @ 1,495.90

Upside Potential: 2,975 pips

Downside Risk: 960 pips

Risk/Reward Ratio: 3.10

In case of a triple breakdown in the Force Index, below its horizontal support level, its ascending support level and its descending resistance level, gold may temporarily push below its short-term support zone. The next long-term support zone is located between 1,458.88 and 1,469.82 and any descend into this zone should be taken advantage of as it represents a great buying opportunity in this precious metal.

Gold Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1,482.00

Take Profit @ 1,463.50

Stop Loss @ 1,490.50

Downside Potential: 1,850 pips

Upside Risk: 850 pips

Risk/Reward Ratio: 2.18