Gold markets have been all over the place during the previous day, as Friday was the amalgamation of the US/China trade talks. While the market awaits to see whether or not the Americans and the Chinese can come out with some type of agreeable situation, most markets are simply treading water.

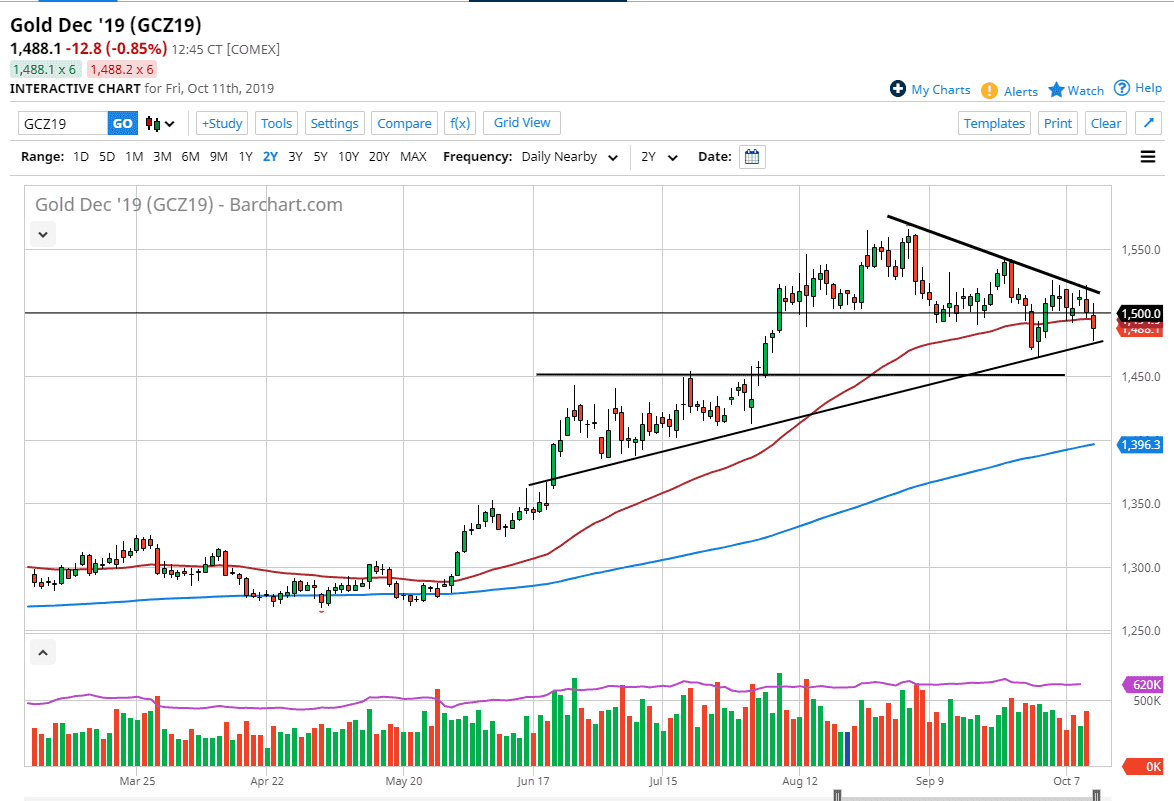

Gold markets have initially sold off based upon traders getting hopeful for the US/China trade situation working out quite nicely, but as time goes on it appears that the longer-term trade is still in effect, as the uptrend line has held. That is probably the most important thing to pay attention to simply because you don’t have to get bogged down in tweets or headlines coming out of Beijing. It appears that this is probably going to be more of the same, so I would anticipate that gold may make a turnaround but it’s not until after we get some type of significant announcement that we can trade with any type of confidence. Ultimately, the market looks likely to see a lot of volatility, and it is more than likely going to be in announcement comes out after the markets close so it’s going to be difficult to get overly excited ahead of time. After all, the tweets and rumors so far seem to suggest that although things aren’t falling apart, they aren’t exactly taking off either.

With all of that being said, the reality is that gold is also moving based upon central bank monetary policy, which of course continues to be ultra-loose and easy. As long as that’s going to be the case it’s likely that the Gold markets will continue to show signs of bullish pressure on these dips. That being said though, the last couple of weeks have not been very good to the Gold markets. As we held the second time we have tested this uptrend line though, it does give me some hope to think that we are eventually going to bounce. After all, it’s probably not too long before somebody says something to get the markets roiling.

If we can break above the top of the Thursday session, it’s very likely that the markets will continue to go higher, perhaps reaching towards the recent highs. That’s my base case scenario but I also recognize that if we break down below the trend line, that could open up the door to the $1450 level, possibly even the $1400 level where the 200 day EMA is approaching.