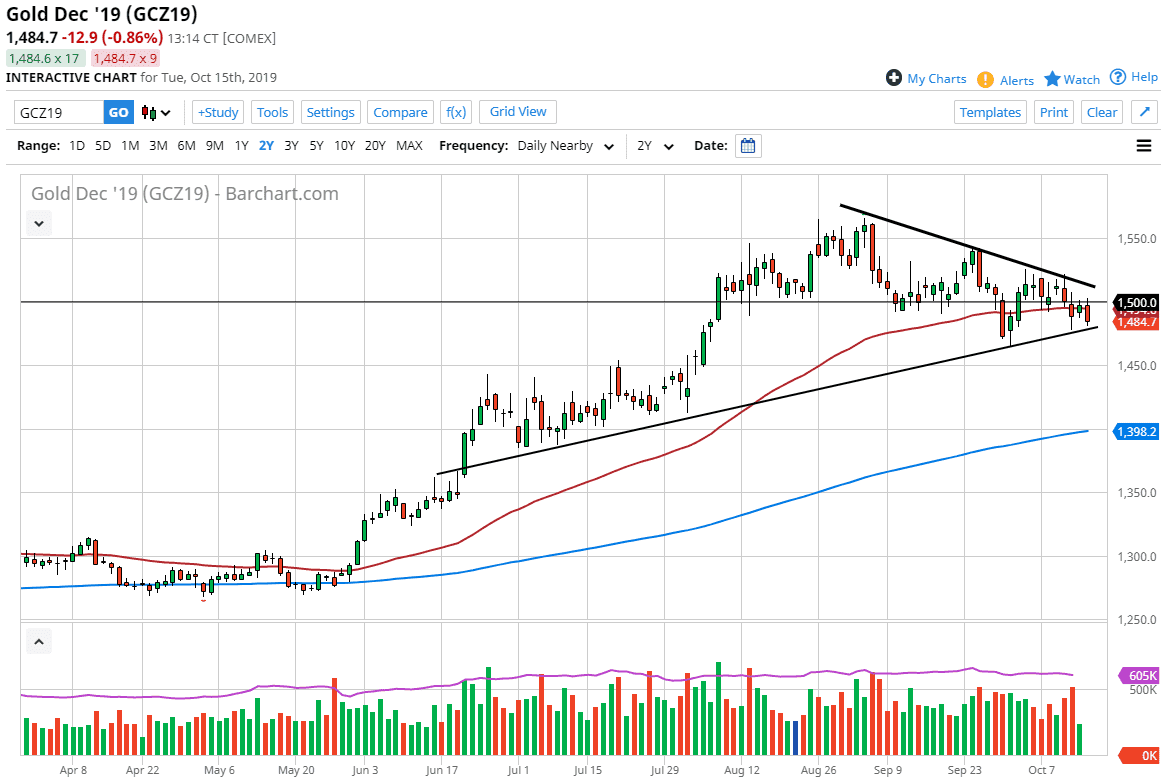

Gold markets fell somewhat stringently during the trading session on Tuesday but as you look at the longer-term chart, something should become relatively apparent. At this point, it looks as of the buyers are willing to step in and pick up value in the gold market, as the uptrend line has held. Ultimately, this is a market that is moving on a lot of different fundamentals and with the United States and China certainly going nowhere in the trade negotiations I suspect that gold will get a bid due to that quite soon. Granted, Brexit seems to be going better but at the end of the day I believe that’s a relatively minor reason for people to buy gold.

Just above at the $1500 level I see a significant psychological barrier, and an area that the market has gone back and forth from several times recently. With that being the case I suspect that it’s only a matter of time before we try that area and if we can clear it, we more than likely will get an opportunity to go higher. At that point, the downtrend line would come into play that either makes up the top of this overall wedge, or the top of the possible descending channel. Either way, it’s very unlikely that the market can continue to go lower without some type of catalyst. Quite frankly, we would need some good news to start seeing this market selloff.

If we do break down below that uptrend line, then it’s possible that the market should go down to the $1450 level. That area was the top of the previous ascending triangle that now seems destined to be rather supportive as it was so resistive. However, if we can break above the downtrend line it can open up the market to reach towards the $1540 level, and then eventually the $1560 level. After that, I become more of a “buy-and-hold” type of trader but currently I still prefer buying gold on dips in small bits and pieces in order to build up a larger core position. All things being equal, there are plenty of reasons to think that the Gold markets will continue to find enough “risk off” reasons out there to own the precious metals. Expect choppy behavior, but I do believe eventually the buyers show up as gold has gotten “relatively cheap” compared to what we had seen.