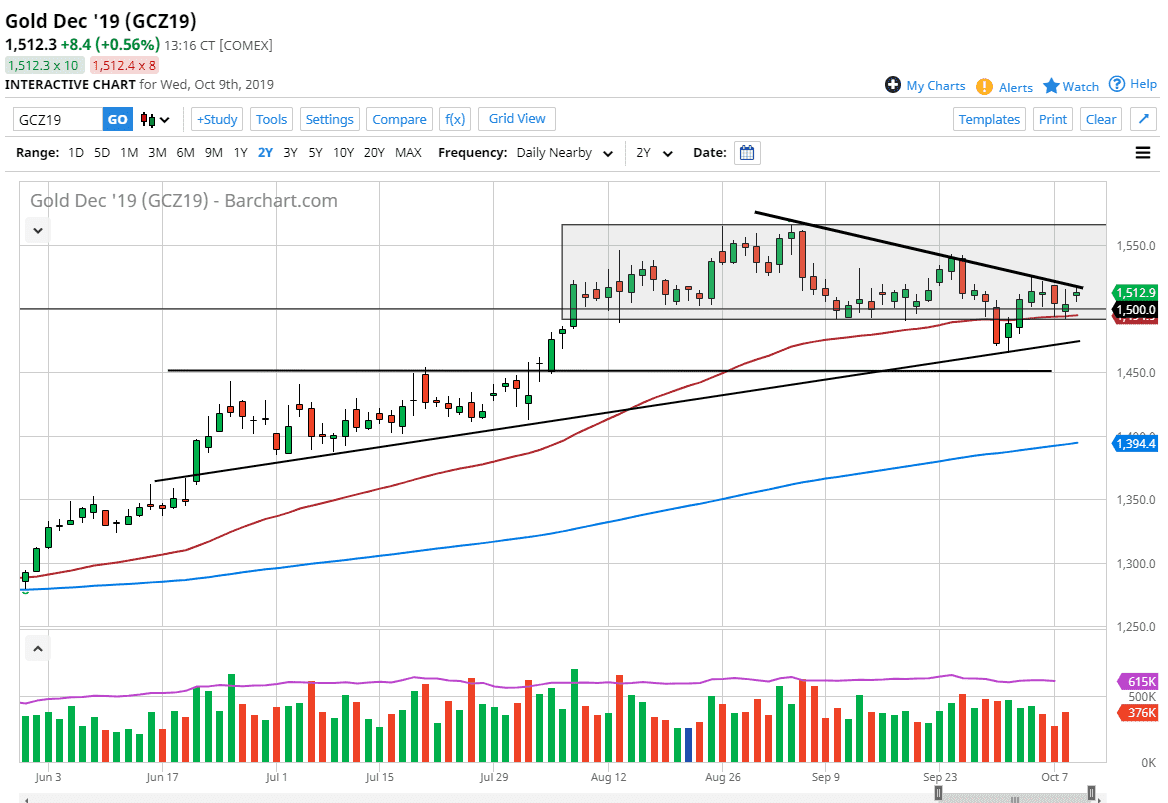

Gold markets gapped higher to kick off the trading session on Wednesday, and then spent the day back and forth in what would have been most accurately described as choppy trading. There is a major downtrend line just above, and if we can break above that, which is substantively at the highs of the Wednesday session, the market could take off to the upside. There are a whole multitude of reasons why gold could rally from here, so I would not be surprised at all to see this happen.

The Americans and the Chinese are talking this week, and expectations have to be relatively low for some type of positive outcome. Ultimately, this is a market that is thought of as safety, and safety is something that a lot of traders around the world will need to as we have US/China trade issues, geopolitical concerns, Turkey entering Syria, the European Union heading into recession, central banks around the world cutting rates and adding quantitative easing, and a whole host of other potential problems. In other words, it makes quite a bit of sense at this point as there is so much uncertainty out there.

Gold markets also feature a lot of support underneath in the form of the $1500 level that extends down to the $1490 level. The 50 day EMA underneath offers significant support, so it’s likely that buyers will continue to pay attention to it as well. On a break of that downtrend line, then the market will more than likely go towards the highs at the top of the downtrend line. After that I would assume that the market is ready to go to the $1600 level, perhaps followed by the $1800 level after that. We have been in the longer-term consolidation area, as drawn on the chart. Because of this, it certainly looks as if we are trying to build up a significant amount of momentum to break out one way or the other, and it’s very likely that the overall trend should continue. The trend has been bullish for some time, and for good reason so I do like the idea of following the longer-term trend. This isn’t to say that I expect the market to be easy to trade to the upside, but clearly the pullback has been relatively orderly over the last several weeks, not exactly the sign of panic.