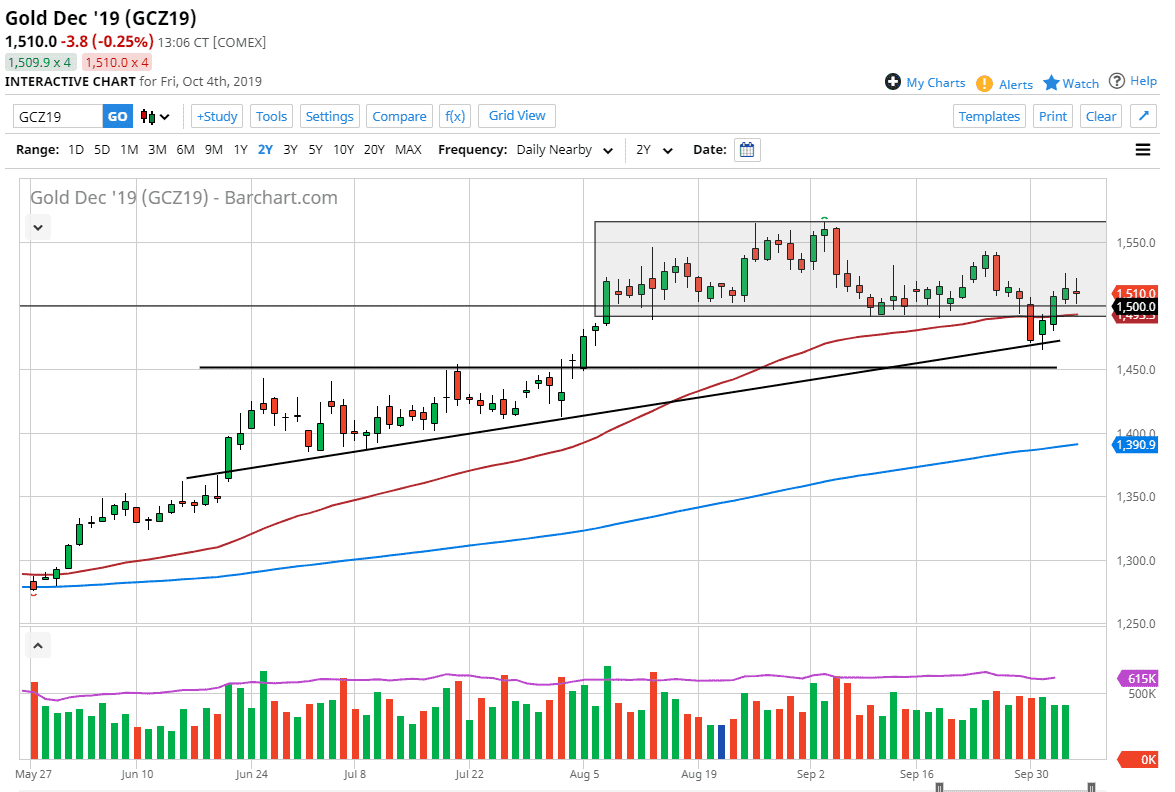

Gold markets went back and forth during the trading session on Friday as we had got the jobs number out of the United States. However, what is crucial to notice is that the market is sitting comfortably above the $1500 level, which extends support all the way down to the $1490 level. Beyond that, the 50 day EMA underneath is sitting at the $1493 level, so I do think at this point is probably more support than resistance.

Gold continues to get a bid due to a safety bid and of course central banks around the world cutting interest rates. Beyond that, central banks are doing quantitative easing and that helps the precious metals as well. Money tries to run away from fiat and into solid asset such as gold or silver. With that, and the fact that the jobs number wasn’t bad at all, and probably best summed up as “solid”, it’s likely that the fact that gold has sit in this area all day suggests that traders are starting to become a little bit more comfortable up here.

Looking forward, a break down below the 50 day EMA would have a lot of support underneath at the uptrend line, so therefore I think it’s only a matter time before the buyers come back. However, the shooting star like candle stick from the Thursday session being broken to the upside should send this market looking towards the $1540 level. After that, the market could then go to the $1560 level. We have made a “lower high” recently, so that is something to pay attention to, but until central banks change their behavior and of course the geopolitical issues calm down, it’s hard to imagine that gold will break down for a longer-term move. Not only do I see those support levels underneath offering an opportunity to go long, but I also see the $1450 level as a massive support level. To the upside, I believe that the market will continue to go towards the $1600 level, $1800 level, and then my longer-term target of $2000 after that. That doesn’t mean that we will get the occasional pullback, but I think it’s only a matter time before the buyers come back in. Gold has been one of the more reliable trends of the year and should continue to be as chaos reigns.