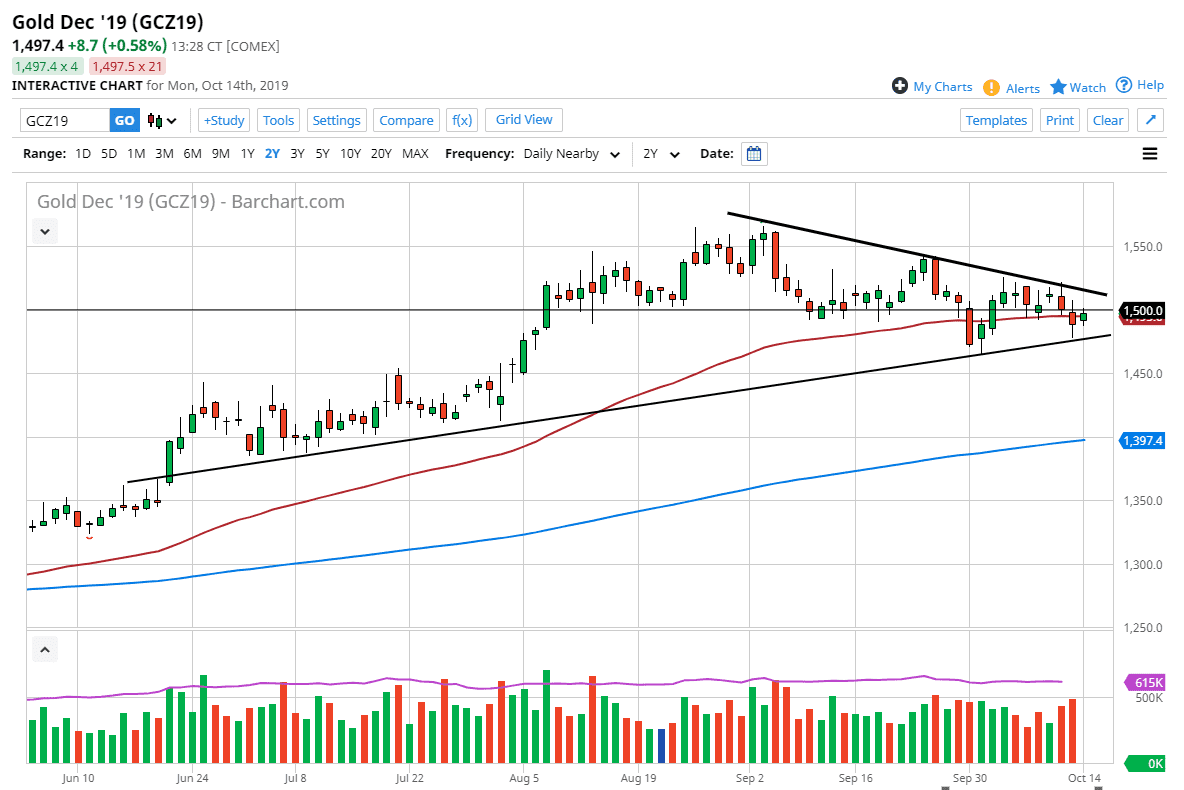

Gold markets rose a bit during the trading session on Monday to kick off the week, as we said just below the crucial $1500 level. That’s obviously an area that is going to attract a lot of attention because it is a large, round, psychologically significant figure, but more importantly it seems to be as if it is the middle of the range, making it essentially “fair value.”

That being the case, some things that you should pay attention to would be the trendlines that the markets have marked up, and of course the 50 day EMA. Think of this as to levels within the wedge. We are either above the $1500 level and bullets, or below it and barriers. However, this is a temporary situation, and therefore the real trait is going to be a breakout of this wedge. A break down below the uptrend line would of course be negative and could send this market towards the $1450 level. Having said that, if we were to break above the downtrend line, that opens up the door to the $1540 level, and then eventually the $1560 level.

Pay attention to the central banks out there, as the loose monetary policy should continue to help gold, not to mention the fact that there are a lot of geopolitical concerns. The US/China trade situation continues to cause a lot of issues, but although they did talk last week, it seems as if we are essentially where we were several weeks ago. In other words, we are all over the place with risk appetite and that of course has a lot of influence on gold. All things being equal, I do favor the upside, because I think between the Turkish invading Syria, the Americans and the Chinese bickering, global growth slowing down, central banks around the world cutting rates, Brexit, and a whole list of other things out there suggests that gold should continue to see interest.

If we were to break down below the $1450 level, then it could signal a bit of a trend change. It’s been a long grind lower, but now that we approach this major uptrend line, we should start to see buyers come back in. We are only a headline or Tweet away from seeing some type of major move in one direction or another. To the upside, I believe eventually we are probably looking at a move towards the $1800.