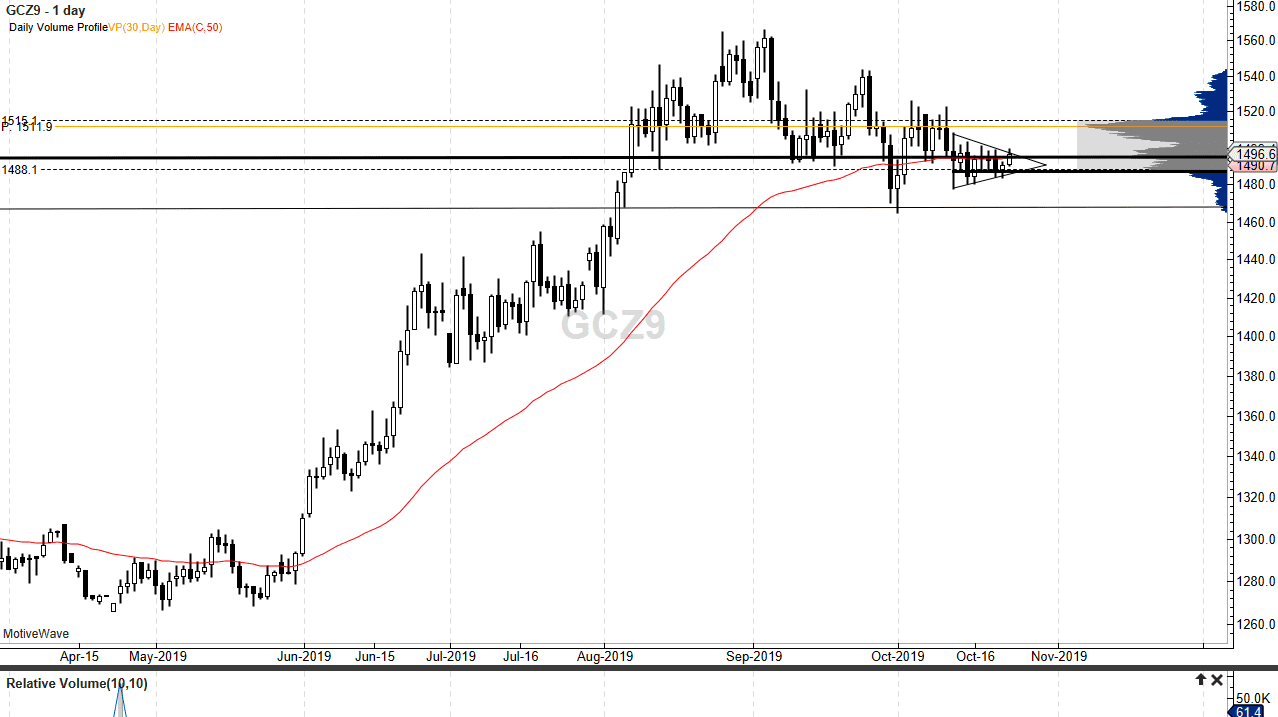

Gold markets have been grinding back and forth for the last couple of weeks, forming a bit of a triangle. This symmetric triangle suggests that we are getting ready to build up some type of move, but now the question is whether or not it’s going to be higher or lower. Based upon the volume profile of the last 30 days, the POC is closer to the $1511 level, an area that will attract a lot of attention as the most volume has been had there over the last 30 trading sessions.

For what it’s worth, it should be noted that the value area is just below where we have been trading, so we are getting a bit stretched as far as normalcy is concerned. It should continue to show signs of buying opportunities, but only for those of you who can hang on through a lot of volatility. Gold has seen a lot of noise as of late, as central banks have been cutting interest rates and adding quantitative easing. This is typically strong for precious metals, so gold of course is one of the first places that people go to take risk away from fiat currencies.

By breaking above the top of the candlestick for the trading session on Wednesday, it should allow gold to start looking towards the previously mentioned Point of Control, offering a short-term buying opportunity. Longer-term, gold should continue to rally based upon a whole host of issues out there not the least of which would be central bank easing, but there’s also geopolitical concerns and of course the US/China trade situation and Brexit. There are far too many things out there able to spook the market to think that gold doesn’t continue to go higher eventually.

The most recent pullback has been somewhat significant, but to be fair this is a market that has been extraordinarily bullish until then. That pullback is probably necessary in order to build a value and offer an opportunity to get involved again. A lot of profit-taking will have been taken over the last couple of months, and now that we are heading towards the end of the year and a lot of uncertainty, it would not be surprising at all to see gold take off again.

That being said, if we were to break down below the $1460 level, that could send this market lower and change the overall trend. All things being equal though, this looks like a market that has simply been trying to digest a lot of the gains.