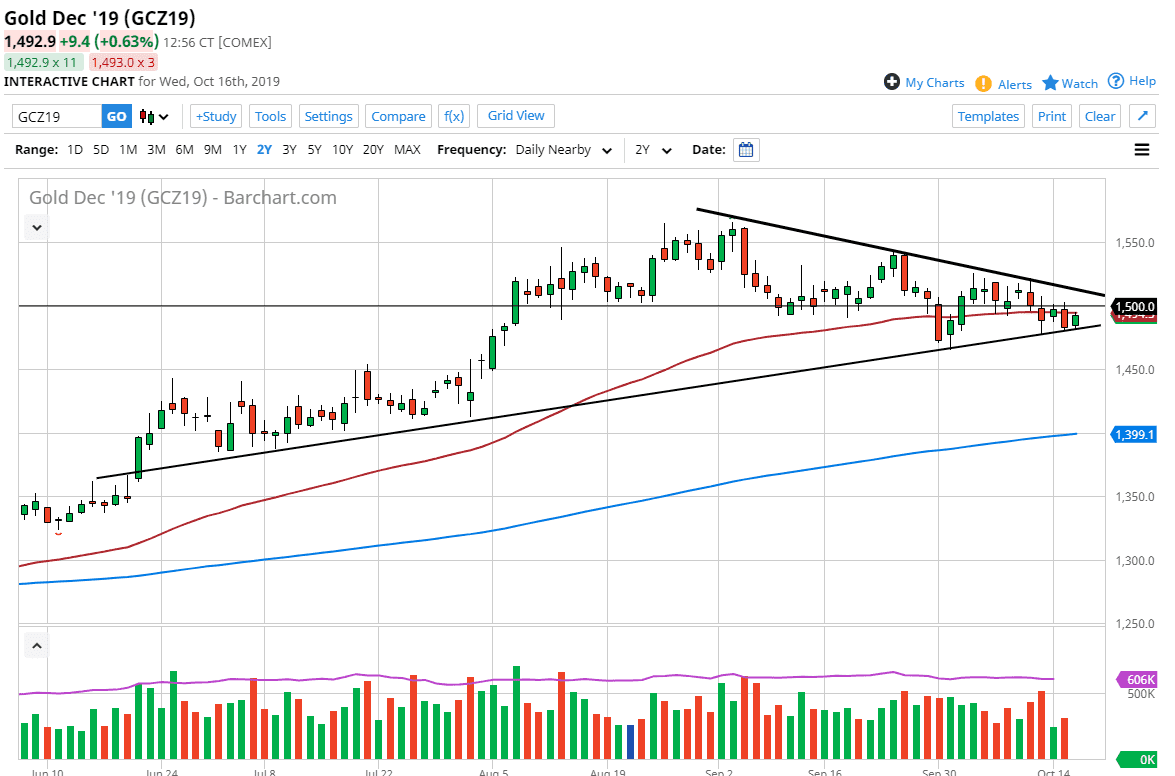

Gold markets have rallied slightly during the trading session on Wednesday, as we are testing the 50 day EMA. That’s obviously a very important and significant technical indicator that people pay attention to, especially longer-term traders and larger funds. Looking at the overall chart though, the $1500 level is just above, and it is an area that will always attract a lot of attention as it is a large, round, psychologically significant figure.

Looking at the chart, there is also a larger wedge that marked on the chart, so I have course to pay attention to that. Ultimately, if we break out of that wedge then you can start to see a more significant move. A break down below the uptrend line and could send this market down to the $1450 level, which of course is the top of the overall ascending triangle that had been broken out. At this point, the market should continue to show signs of volatility which makes quite a bit of sense considering that gold can be a safety asset. Ultimately, this is a market that will continue to be very noisy, because there are plenty of headlines out there that could get this thing going.

A break above the top of the wedge could send this market towards the $1540 level, and then the $1560 level. Ultimately, the market has been grinding a bit lower as of late, but at this point in time it is more or less a pullback from a huge move to the upside. That being said though, I am a bit concerned with the market uptrend due to the fact that the silver market has formed a descending triangle, which of course is a negative sign. There is a bit of a “tit-for-tat” scenario for these two markets. Ultimately, if the Silver markets break down it will certainly weigh upon the Gold markets.

All things been equal though I do believe that there are plenty of buyers underneath. As long as that’s going to be the case then we will make it go at the top of the wedge. If that happens, then a breakthrough could come, which of course would send this market to the upside, towards those higher levels. However, the question that we will be answering over the next couple of days will be whether or not we are going to continue going higher. An impulsive candle will more than likely kick off the next move.