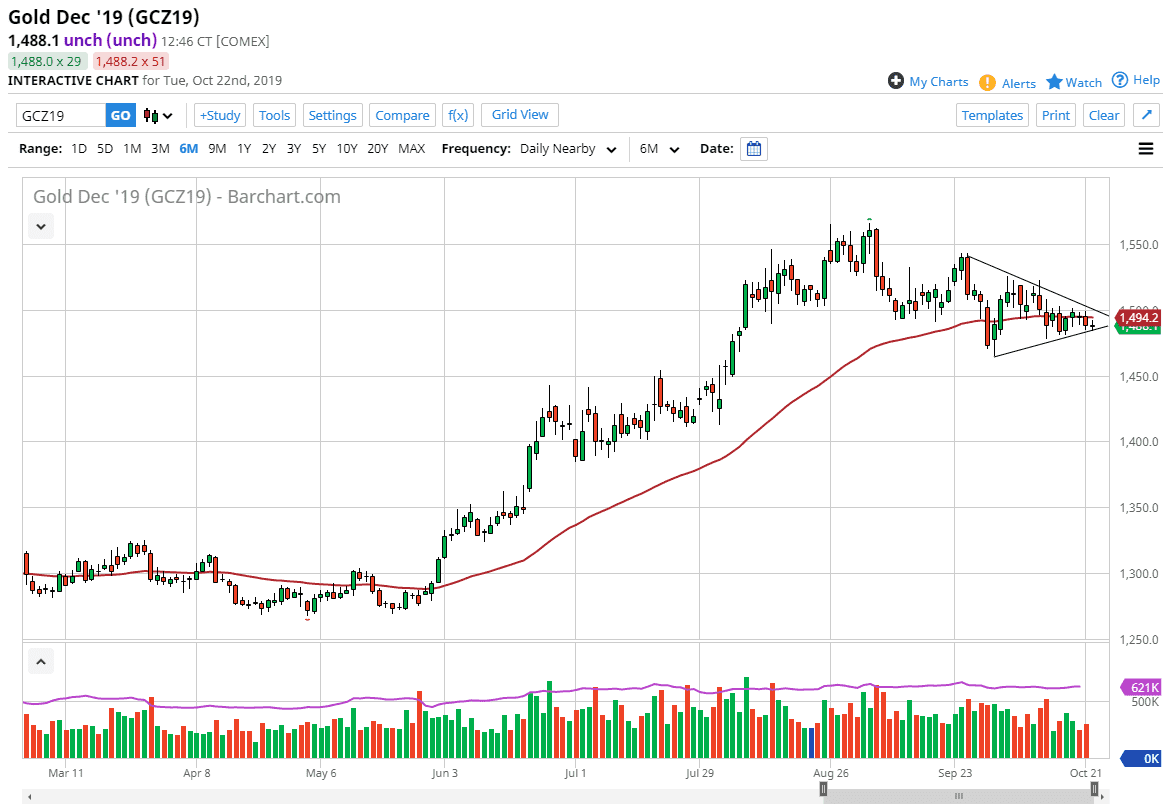

Gold markets have been compressing for a couple of weeks now, forming a bit of a symmetrical triangle. This suggests that we are starting to build up a bit of inertia to make the next move. At this point, the 50-day EMA is just above and in the middle of this triangle. This tells me that the gold market is revving up for a bigger move. If we can break down below the uptrend line, the market could very well go down to the lows of the triangle down to the $1475 level, possibly even the $1450 level.

To the upside, the markets will have to break above the downtrend line of the triangle. If we can break above that level, then the market is likely to go towards the $1540 level. That would jive well with the long-term trend that has been going higher and therefore could suggest a certain amount of concern out there when it comes to the global markets. With that being the case, it makes quite a bit of sense that the gold markets could give us a heads up as to where we’re going next and several other assets.

The Gold market does tend to react to a lot of geopolitical concerns, and of course there are plenty of them out there to drive markets back and forth. Compression normally proceed some type of significant move so pay attention to what happens next. We should get some type of impulsive candle that we can follow, giving us a signal to start aiming for longer-term trades. All things being equal, I do prefer going long as I think there are plenty of things to worry about.

Ultimately though, the US stock markets continue to try to drive higher, and if the US dollar starts to lose value, that could also provide more rocket fuel for the gold market. Looking at this, I believe that we will eventually see this market take off but we need some type of catalyst. We are in the middle of the earnings season, so if the stock market breaks out to the outside bank could send this market down to the lower levels underneath that offer support. The $1450 level is another support level, which would be an interesting area due to the fact that it is the top of the ascending triangle from previous moves. At this point, use the trendlines as a bit of a guide.