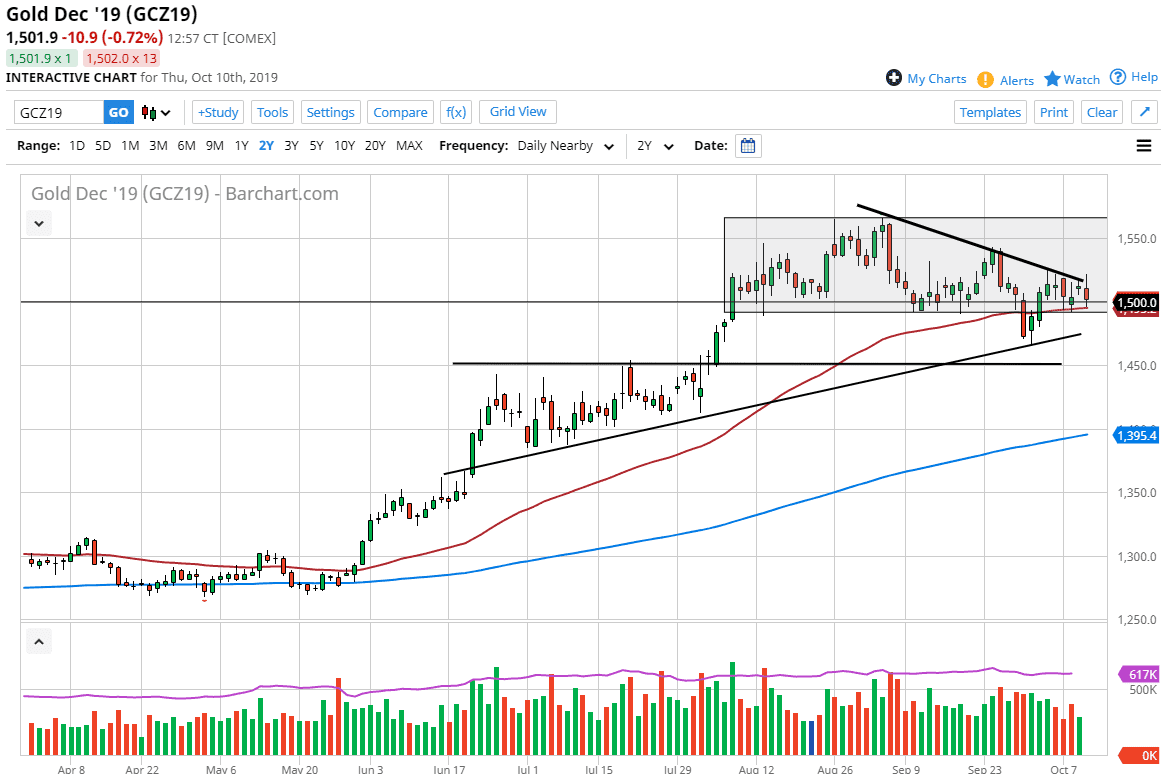

Gold markets have initially tried to break out during the trading session on Thursday as a rumor came out that the Chinese were going to leave the trade talks a day early. As soon as the South China Morning Post came out and denied the claims, the market turned right back over and started falling. The Gold markets had initially tried to break out above a significant downtrend, but then found enough support underneath at the 50 day EMA. Looking at this chart, we are in a larger wedge overall, and although we have pulled back quite a bit it suggests that we have still plenty of buyers underneath.

The uptrend line underneath also offer support right along with the 50 day EMA but the $1500 level extends down to the $1490 level offering support as well. It’s very likely that the market will continue to see buyers on dips, but I think ultimately the biggest driver of the gold market is going to be the nonsense coming out of the US/China situation. I don’t necessarily think that the market is going to get horrific headlines out of that meeting, but to expect some type of major deal is probably asking for quite a bit.

All things being equal I think that the volatility continues in the market continues to chop around in general but I do like the upside more than the down. If we can break back above that downtrend line that we tried to smash through on Thursday, that would be an excellent buying opportunity as well. To the upside I would anticipate the highest to be hit, and then broken through as the market goes looking towards the $1600 level, the $1800 level, and then possibly even the $2000 level.

If we were to break down below the uptrend line of the wedge, then it’s possible that the market could go looking towards the $1450 level which has been important in the past. That is probably the least likely of scenarios, so at this point I still favor buying dips and of course breakouts as previously mentioned. The Gold markets will continue to be very noisy, so at this point I suspect that given enough time we do in fact continue the overall uptrend that the market had been in previously due to central bank loosening, geopolitical concerns, the US/China trade talks, Brexit, and a whole host of other things.