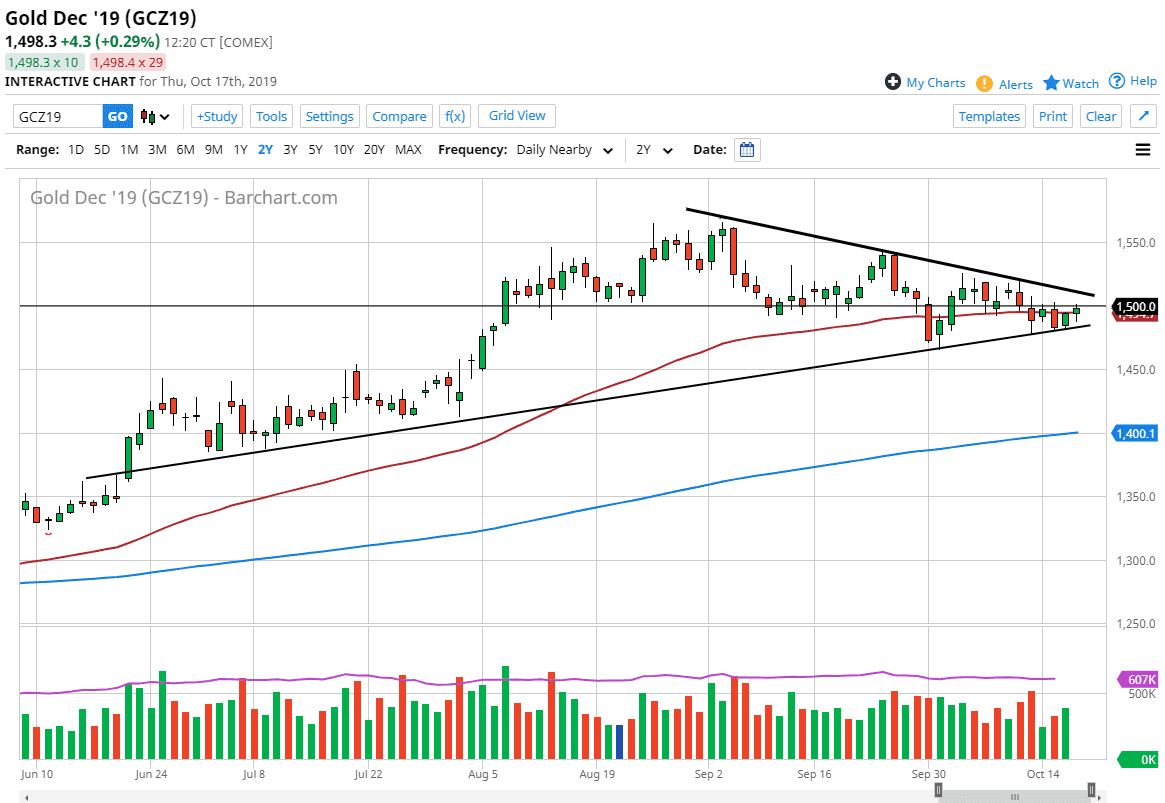

The Gold markets initially fell during the trading session on Thursday, dipping down towards the uptrend line underneath that makes up a larger wedge that I have drawn on the chart. This is an area that has been crucial, and the bottom of the wedge is defined by an uptrend line that has defined the overall uptrend for several months now. Because of this, it makes sense that we saw a bit of buying underneath, as the market respects that trend line.

The 50 day EMA has sliced through several candlesticks lately and is starting to flatten out. This tells me that the market isn’t quite ready to go in one direction or the other, and the overall trend is starting to slide into sideways action. The uptrend line and the downtrend line both are compressing price, and the fact that the daily candle stick was a hammer suggests that the pressure is starting to shoot into the market and perhaps looks ready to break out to the upside.

That being said, the market was to break down below the uptrend line, it would not only be a negative sign due to the trend line being broken to the downside, but it would also be negative due to the fact that we would see the market break down through the back of a hammer which in and of itself is very negative. However, a break to the upside makes more sense as it continues the overall rally that we have seen, and of course the value proposition that gold has offered. The $1500 level being broken above in and of itself is a relatively bullish as breaking through a large, round, psychologically significant figure is always a good thing.

The geopolitical situation out there does of course suggests that perhaps Gold should rally, as there are problems in places like Syria, Venezuela, China, Hong Kong, and a whole host of other nations. Beyond that, central banks around the world continue to cut interest rates and use quantitative easing for monetary policy, so at this point in time it makes sense that fiat currencies will continue to fall against precious metals and hard asset such as gold. Ultimately, if we can break out above the downtrend line it’s likely that we would go to the $1540 level, and then possibly the $1560 level. I like buying gold, but would not argue if the market breaks down, as the trend line would be a significant break down.