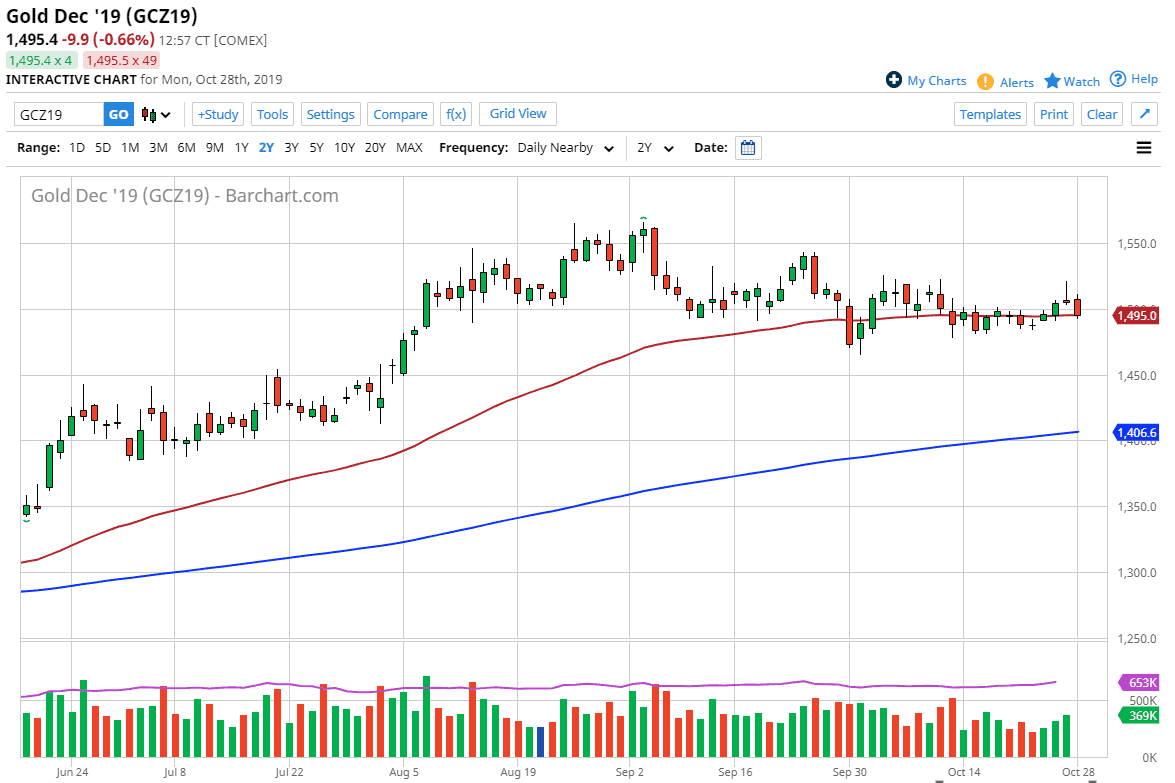

Gold markets have fallen a bit during the trading session on Monday, crashing into the 50 day EMA. The $1500 level has been sliced through again, but that’s not a huge surprise. At this point it’s likely that the market will continue to see lots of volatility, but I do think that there is significant support just below near the $1480 level. Because of this, I am waiting for signs of a bounce to take advantage of “cheap gold”, which will of course attract a lot of buying pressure. After all, the market has been in an uptrend previously, and currently is trying to form a little bit of a base as we are starting to climb ever so slightly with the moving averages.

Looking at the chart, the $1450 level is also massive support as it was the previous ascending triangle, and it should be support as it previously had offered so much in the way resistance. That being said, I don’t necessarily think that we are going to fall to that area but if we did that be looking for buying pressure in that area as well.

I believe that the market is getting ready for the Federal Reserve FOMC statement on Wednesday, and therefore it’s likely that the market will probably try to “front run” the decision. The decision is expected to be to cut rates by 25 basis points, but now we are going to be focusing on the statement more than anything else. The market is going to try to press the idea of whether or not the Federal Reserve is going to continue cutting rates. The more dovish the Federal Reserve sounds during the statement, the higher gold should end up going.

However, if the Federal Reserve does end up sounding more hawkish than anticipated, then gold markets will be hammered as a result. The next 24 hours will probably be more of a grind than anything else in preparation of the crucial Friday session. We are in a longer-term uptrend, so I would anticipate that a move higher would be easier than lower but recognize that the statement can change things in the blink of an eye. Trading will more than likely be very quiet on Tuesday, but I am still looking for buying opportunities due to the longer-term outlook for precious metals and of course central banks around the world cutting rates.