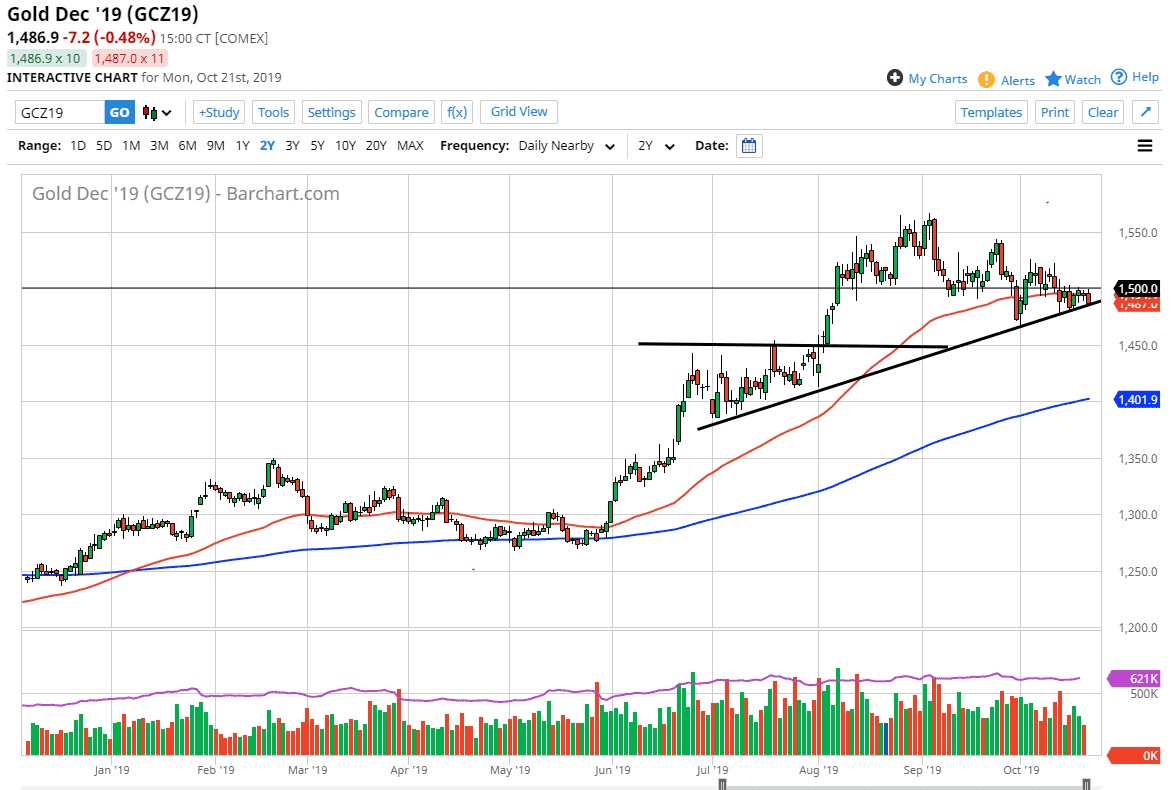

Gold markets tried to rally during the trading session on Monday but found resistance at the $1500 level again. By doing so, it looks as if the market is going to test a major uptrend line, and that could bring some buyers back into the market. At this point, it’s very likely that we will need to make some type of decision based upon the confluence of this area, so keep in mind that the buyers will more than likely make some type of statement.

That being said, the 50-day EMA is just above and that of course attracts attention as well. Ultimately, this is a market that has been pulling back rather significantly, but at this point we have spent enough time counting down the days after the initial push higher that eventually value hunters are going to come back in. There are a ton of reasons why the markets might enter more into a “risk of” situation. Beyond that, keep in mind that the central banks around the world continue to cut interest rates and liquefy the markets, and therefore it’s only a matter of time before the trading community will try to do what they can to preserve wealth. With fiat currencies crashing, gold of course makes quite a bit of sense. However, if we were to break down below the $1475 line, we are more than likely going to go looking towards the $1450 level. That is the top of the previous ascending triangle they could offer a bit of support to this mass.

To the outside, we can break the $1500 level it’s likely that we will continue to go higher. That move goods in this market looking towards $1540 level, which of course was the most recent high. The market has been grinding lower though, and with the uptrend line sitting here, we need to see this market make a move soon, or it could threaten the overall uptrend. From a fundamental standpoint, it does make sense that Gold would continue to go higher, but we follow price, not what markets “should do.” With that, I am cautiously optimistic, but I also recognize the next couple of days are going to be crucial. We will eventually get some type of impulsive candlestick that will tell us where we are going next and will be able to take advantage of a significant move.