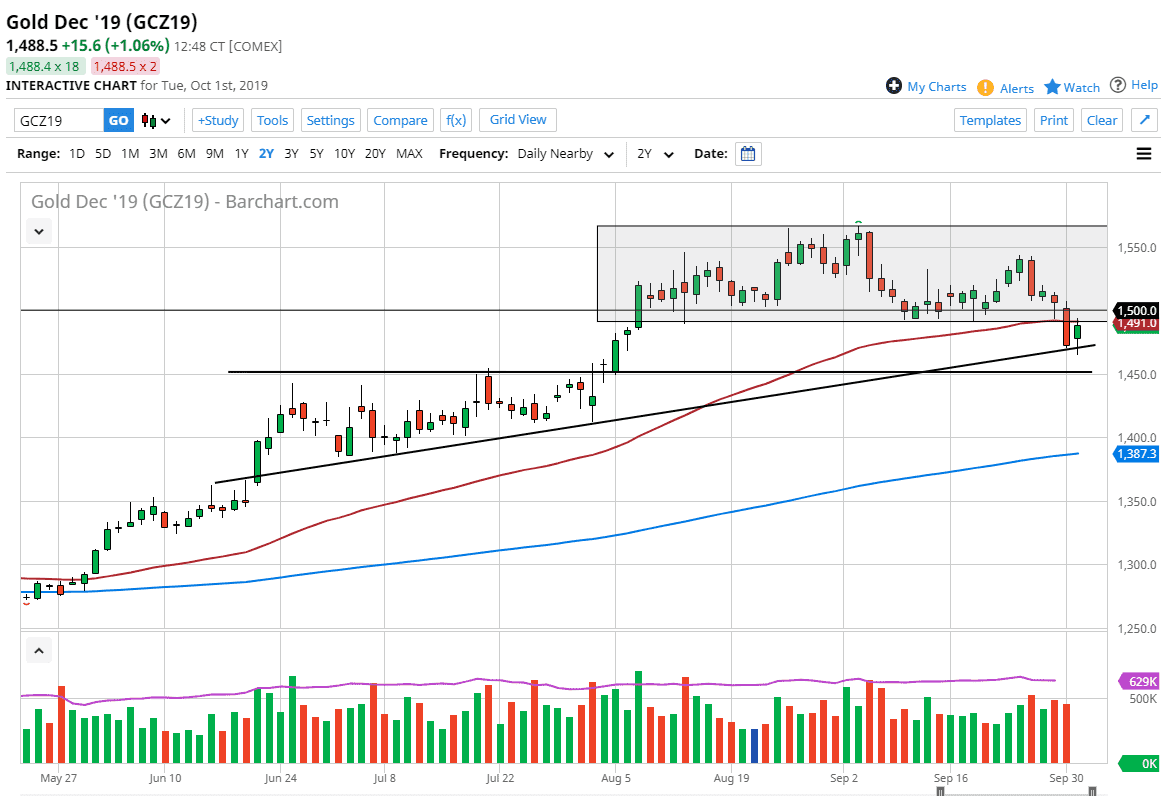

Gold markets initially fell during the trading session on Tuesday after gapping higher. By breaking down through the trend line, it was a sign that perhaps the market was ready to break down. It would have been a bit of a continuation of the massive resistance and selling pressure that had been seen on Monday, but as the ISM number came out weaker than anticipated, money flew into the Gold markets as a bit of a hedge against the idea of the Federal Reserve cutting rates even further.

From a technical analysis standpoint it’s easy to see that the trend line has held, and the market even ran higher to test the 50 day EMA at $1490. That of course is an area that would cause some resistance based upon not only the moving average, but the fact that the market had found support in that area previously. Ultimately, this is a market that has a lot of external influence on it, but looking at this chart there’s nothing that says it isn’t still in and uptrend. The trend line holding of course makes a huge statement, but I also believe that the $1500 level is probably going to be a bit of a challenge for the bullish traders out there.

Given enough time, it’s likely that we will get some type of headline that sends traders looking for cover again, as gold has been so bullish for quite some time. After all, we have the US/China trade war still going on, the Brexit situation, the EU will going into a recession, and central banks around the world continuing to cut monetary policy back to drive this market higher. Beyond that, it’s very likely that there will be support extending down to the $1450 level as it is the top of the previous ascending triangle.

I believe that buying on the dips continues to work with gold, and the action on Tuesday of course has done nothing to change that look or feel to this market. Short-term pullbacks should be buying opportunities to take advantage of as there are plenty of uncertainties out there to drive gold higher, and of course monetary policy should come into play as well. It’s not until we break down below the 200 day EMA that the uptrend would be threatened from a longer-term standpoint. After the action on Tuesday, that seems less likely.