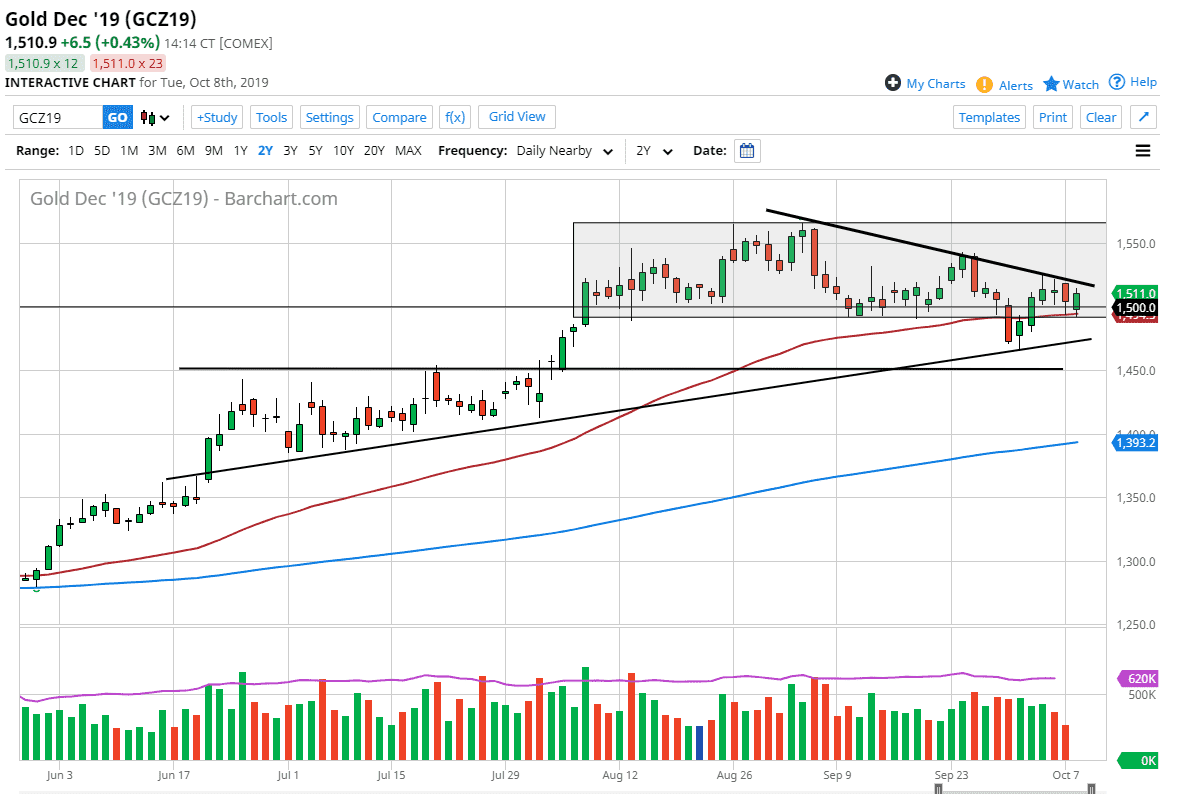

Gold markets have rallied during the trading session on Tuesday, bouncing from the 50 day EMA. The market has seen a significant amount of support at the 50 day EMA, and of course the $1490 level. At this point, the $10 range between the $1500 level and that area has offered support and now it looks like we are getting ready to test the downtrend line from what could be thought of as a larger wedge. All things been equal though, I do think that gold eventually breaks out as we will more than likely try to test this area.

But first, let’s start with the negative potential. If we were to break down below the 50 day EMA, and essentially the bottom of the candle stick during the trading session on Tuesday, this market could and up going down to the uptrend line underneath. That means the $1475 region. That’s an area where I would expect to see a lot of interest in the market, and then perhaps even a break down below there could open up the door to the $1450 level. That is an area that is the top of the previous ascending triangle. That obviously is an area that will have a lot of influence on the market, so I believe that’s essentially the “floor” in this contract right now. However, if we were to break down below there we would almost certainly go looking towards the 200 day EMA which is closer to the $1393 level.

To the upside, and what I believe is more likely, we will more than likely take off to the upside if we can clear the $1520 level, which would be slicing through the downtrend line. At that point I would expect the market to reach towards the $1540 level, and then eventually the $1560 level. Longer-term, I think the market could go to the $1600 level and beyond. Keep in mind that central banks around the world continue to loosen monetary policy and involve themselves in something along the lines of quantitative easing, and that should drive the idea of precious metals much higher in the minds of traders as they worry about damage to fiat currency. In the meantime, I’m a buyer of short-term dips that show signs of strength as the market is in a longer-term uptrend, despite the pullback that we have seen recently.