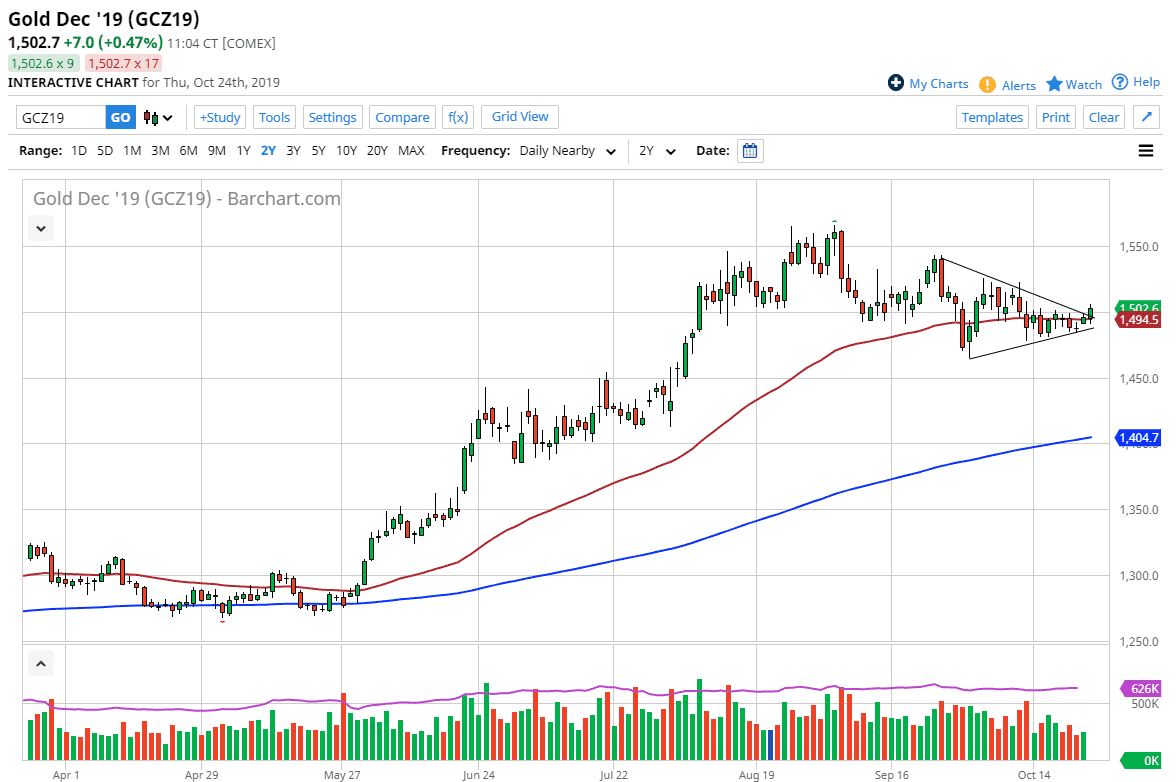

Gold markets have rallied a bit during the trading session on Thursday, breaking the downtrend line from the larger wedge that I have marked on the chart. Beyond that, it looks as if the 50-day EMA is starting to offer support, and therefore it’s likely that we continue to go higher. The next target will be the $1525 level, followed by the $1540 level. More than likely, we will get the occasional pullback but that should be thought of as a buying opportunity in a market that is obviously bullish from the longer-term stance but has been very choppy and sideways for some time.

The slight pullback that we have seen over the last couple months have been frustrating to say the least but overall this is a market still has plenty of reasons to go higher. Central banks around the world continue to cut interest rates and loose monetary policy in general so it’s almost impossible to imagine a scenario where gold doesn’t rally eventually. That being said, we may have gotten ahead of ourselves, so it makes sense that gold needed to digest some of the gains that had come so quickly.

Next week we have the Federal Reserve coming out with an interest rate decision and more importantly a statement, and that will probably be the next major catalyst to directionality of the US dollar and of course gold as a result. It really comes down to how dovish or hawkish the central bank sounds, and at this point in time it looks like the market is simply grinding away trying to figure out a direction ahead of time. I anticipate that moves will be very choppy and slight, so I would not get too excited about major transforming anytime soon. In fact, I suspect it won't be until next week that we have any opportunity at all of seeing that barring some type of anomaly in the news.

To the downside, if the market breaks out below the $1475 level then it could unwind down to the $1450 level followed by the 200-day EMA which is closer to the $1400 level. However, I still believe that the upside is the most likely over the longer term as gold looks to be very bullish and then offers value every time it pulls back if you can bring in a small enough position to hang onto for longer-term trading.