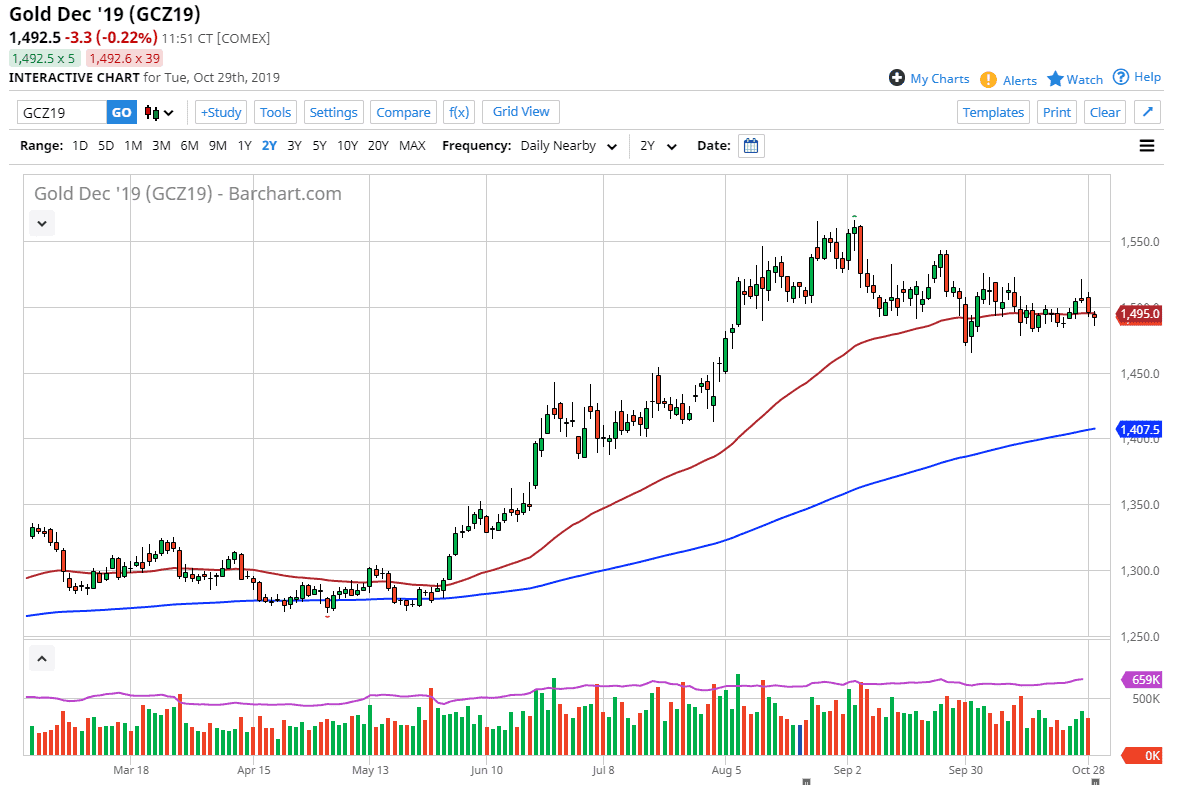

Gold markets have fallen a bit during the trading session on Tuesday but have also bounced from the lows to turn around and show signs of resiliency. The daily candlestick looks very much like a hammer, as we are showing signs resiliency right around the 50 day EMA and the market continues to pay quite a bit of attention to the $1500 level. This is an area that will obviously be very important for the longer-term aspect of gold, but keep in mind that the FOMC Statement comes out during the trading session on Wednesday and that will have a major influence.

The FOMC Interest Rate decision is already thought to be a 25 basis point cut, but the real question is going to be the accompanying statement that will give the market an idea as to whether the central bank is going to be overly bullish or dovish, so at this point the gold markets will decide which direction they want to go for the longer-term move. When you look at the longer-term chart you can see that we have been in the bullish flag for some time, so a move to the upside could kick off something rather drastic.

At this point, if we can wipe out the shooting star from the Friday session, it’s very likely that the market will continue the bullish flag and go looking towards the $1800 level. To the downside, I see the $1450 level as massive support, and a breakdown below there could probably reach down towards the 200 day EMA. All things being equal, this is a market that is going to continue to chop around and try to get position ahead of the move, which will most certainly be rather drastic. If we do break down though, it is probably going to be more or less due to a misstep by the central bank. That being said, Jerome Powell has been taught recently not to raise interest rates or even suggest it, as Wall Street through a massive tantrum in December of last year from the mere mention of hawkishness. With that I would anticipate that the market should continue go much higher over the longer term. We have had a decent pullback, but at this point we have seen the market digest gains, something that it needs to do before continuing and impulsive move forward.