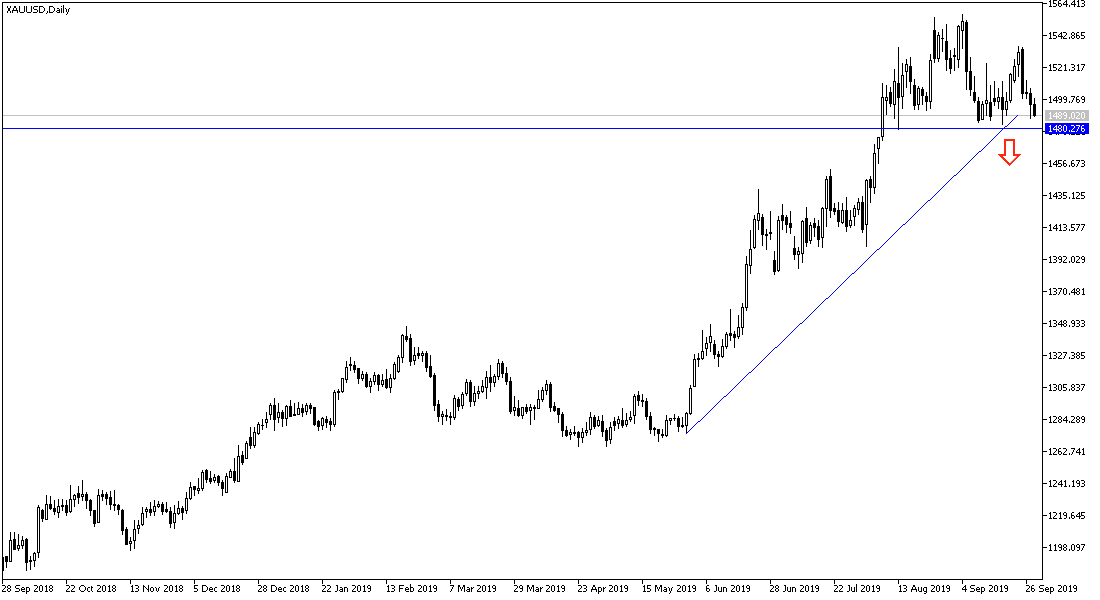

Risk appetite and the strength of the US dollar contributed to stronger losses for gold prices, which fell to the $1465 support, down from the $1500 psychological resistance, with a loss of 35 dollars in one trading session. In the last three trading sessions last week, the price of the yellow metal fell from the $1535 resistance level to the $1487 support. The latest performance has broken a strong upward trend in gold which dominated the performance for two months in a row. Investors have temporarily abandoned gold amid fresh optimism that the two sides of the global trade war will return to the negotiating table instead of imposing more retaliatory tariffs between them which could eventually lead to a global economic recession. The beginning was also from the Eurozone, as economic indicators from the world's two largest economies began to show weakness.

US stocks closed higher in the last trading session for September and the third quarter, after Trump administration officials downplayed or questioned reports that Washington was considering plans to block US investment in Chinese companies, easing concerns that pressured stocks over the weekend. However, investors are watching developments surrounding the investigation into the possible dismissal of US President Trump by the House of Representatives.

Bloomberg News, citing Treasury spokeswoman Monica Crowley, said the Trump administration is not considering preventing Chinese companies from "listing on US stock exchanges at the moment." The comments by Treasury officials came after Bloomberg said on Friday that the White House was discussing ways to curb US portfolio flows to China, a campaign that could hit billions of dollars in investment and escalate the Sino-US trade war.

Chinese negotiators will meet with the Americans from Oct. 10 to 11 in Washington. Chinese Vice Premier Liu He will head the Beijing delegation.

According to the technical analysis of gold: The recent decline in the price of gold to its lowest level in nearly two months may motivate investors to consider buying it again, where 1469, 1458 and 1444 levels, respectively, might be the best areas to buy. We still recommend buying gold from every bearish level despite the recent natural correction. Global trade and geopolitical tensions are not over, so the yellow metal will be the winning target for medium and long term investors. The uptrend might come back in the event that gold returns to move around and above the $ 1,500 psychological resistance again.

As for the economic data: Gold price will react today with the release of the Japanese Tankan survey, Eurozone inflation figures as well as the US ISM Manufacturing PMI.