There is no doubt that the US dollar weakness is a good opportunity for the gold prices rise, which happened after the Federal Reserve announcement, which increased the dollar losses, and thus launched the price of gold ounce from the $1481 support to the $1499 resistance at the time of writing. Also weakening the US dollar was the announcement of slowing GDP growth for the third quarter of 2019, confirming the weakness in recent US economic releases, which was a good reason for the US central bank to continue cutting interest rates to revive the economy.

The comprehensive trade war with China prompted the US central bank to cut its key interest rate for the third time this year in a bid to keep economic growth in the longest period in the country's history. The bank hinted that it will not cut interest rates again at its next meeting. The bank's plan will affect many consumer and commercial loan rates - and the interest rate is now between 1.5% and 1.75%. In its monetary policy statement, the bank abandoned a key phrase it has used since June to signal a possible rate cut in the future. This means that Fed officials will prefer to leave interest rates until they assess how the economy will perform in the coming months.

The US economy is in its 11th year of growth, driven by consumer spending and a strong labor market. The bank was forced to cut interest rates in a bid to counter uncertainties that have escalated due to President Donald Trump's trade disputes, weak global economic growth and a frightening downturn in the US manufacturing sector.

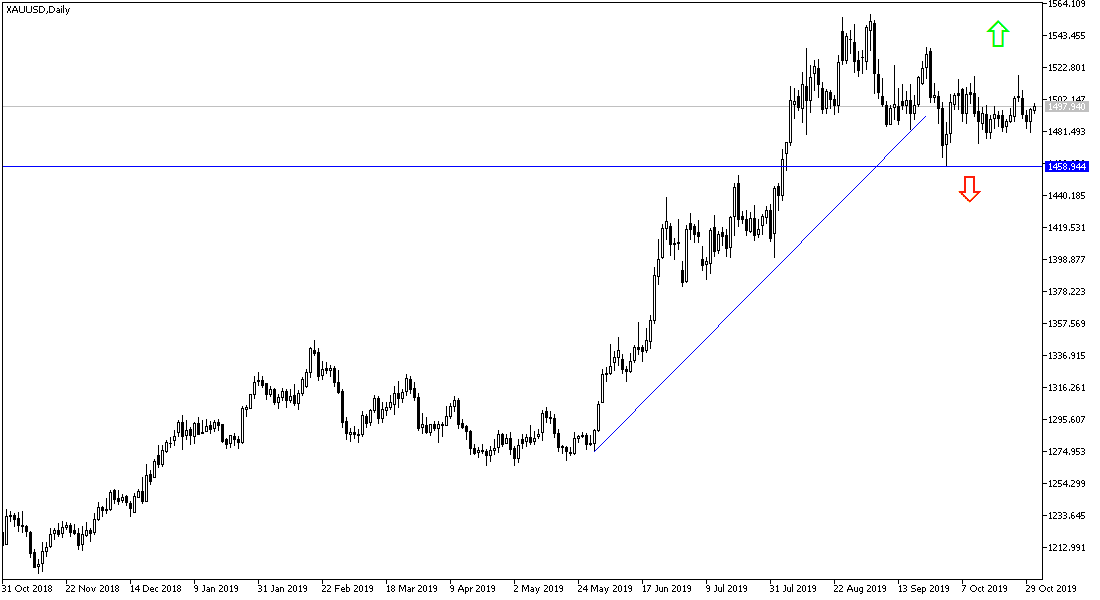

According to technical analysis: As we expected before, the price of gold around and above the $1500 psychological resistance will remain the key to the strength of the gold’s bullish correction. It will give gold the momentum needed to test stronger levels. Close record peaks currently are 1515, 1527 and 1540 respectively. On the downside, the nearest gold support levels are currently at 1491, 1485 and 1470 respectively. I still recommend buying gold from every bearish level.

As for the economic calendar data today: Economic Calendar today is filled with many economic data, the most important of which are the release of Chinese manufacturing figures, monetary policy decisions of the Bank of Japan, and inflation and growth figures from the Eurozone. During the US session, the Federal Reserve's preferred inflation gauge, the personal consumption expenditure price index, will be announced, as well as the average US citizen's spending and income, the jobless claims and the cost of employment index.