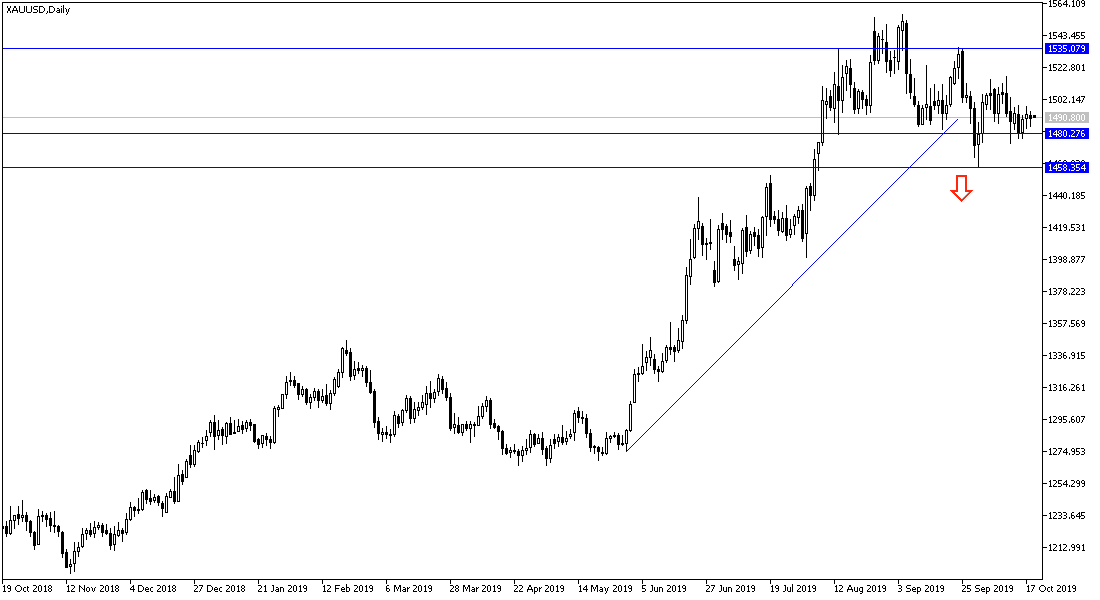

The British House of Commons has rejected the recent Brexit deal between British Prime Minister Boris Johnson and the European Union, which has given global financial markets a boost over the past two weeks. This will support the return of investor appetite for safe havens again and most importantly undoubtedly the yellow metal. Last week, the price of gold settled between the $1477 support and the 1498 resistance, and closed last week's trading around the $1490 resistance. We expect a new bullish rebound for gold by crossing the $1500 psychological resistance again and returning to test new highs.

The recent losses for gold were further weakened by the weaker US dollar, which is under pressure to cut US interest rates for a third time at the Federal Reserve meeting by the end of this month.

Weaker Chinese GDP in the third quarter had little impact outside China. China's GDP in the third quarter has slowed to a revised 6.0%. Less than expected, the slowdown of the world's second largest economy does not seem to have bottomed out. However, industrial production and retail sales for September have been boosted. It is estimated that the trade conflict with the US may have caused a loss of 0.5% of the pace of activity on an annual basis. In contrast, Chinese officials are still reluctant to offer big incentives soon, and measures by the People's Bank of China this week suggest preventive efforts to avert a financial crisis, as liquidity drains with the tax season ends in late October.

According to the technical analysis of gold: no change in our technical view towards gold, moving around and above the $1500 psychological resistance will remain the key to the upward correction and the return of the test to the peaks again. Resistance levels at 1515, 1527 and 1540 respectively will be targets for the bulls who have control over performance on Long-term. On the downside, stability below $1480 support will increase the bearish momentum to move towards support levels at 1473 and 1460 respectively. I still prefer to buy gold from every bearish level.

Today, it is relatively quiet on the effective economic data front, and gold will move according to the easing of fears or increasing global trade and geopolitical tensions.