The risk appetite and the abandonment of safe havens pushed the price of gold down to the $1488 support an ounce, after opening the week's trading around the $1508 resistance. It was stable at the beginning of Tuesday's trading around $1492. The yellow metal still has the opportunity to hold onto its overall bullish trend by returning around $1,500 an ounce. Gold's reaction to the disappointing US jobs report did not exceed the $1515 resistance. Investors focused on the positive point in the report - the US unemployment rate falling to a 50-year low. They saw the decline in non-farm payrolls and average wages as temporary factors.

The US dollar index, DXY, which is inversely moving with the gold prices, began trading this quarter by testing the highest level in two and a half years before moving downwards. The 99.65 area represents a starting point for new record gains. The recent sell-off saw the dollar index drop to almost 98.65 before consolidating ahead of the weekend.

The performance of the gold price this week will monitor several important events, especially the round of trade talks between the United States and China, the contents of the US Federal Reserve minutes of last meeting, in which they lowered the US interest rate for the second time this year. In addition to that, Bank of England Governor, Jerome Powell will make remarks on several occasions. The importance of announcing US inflation figures is also very important.

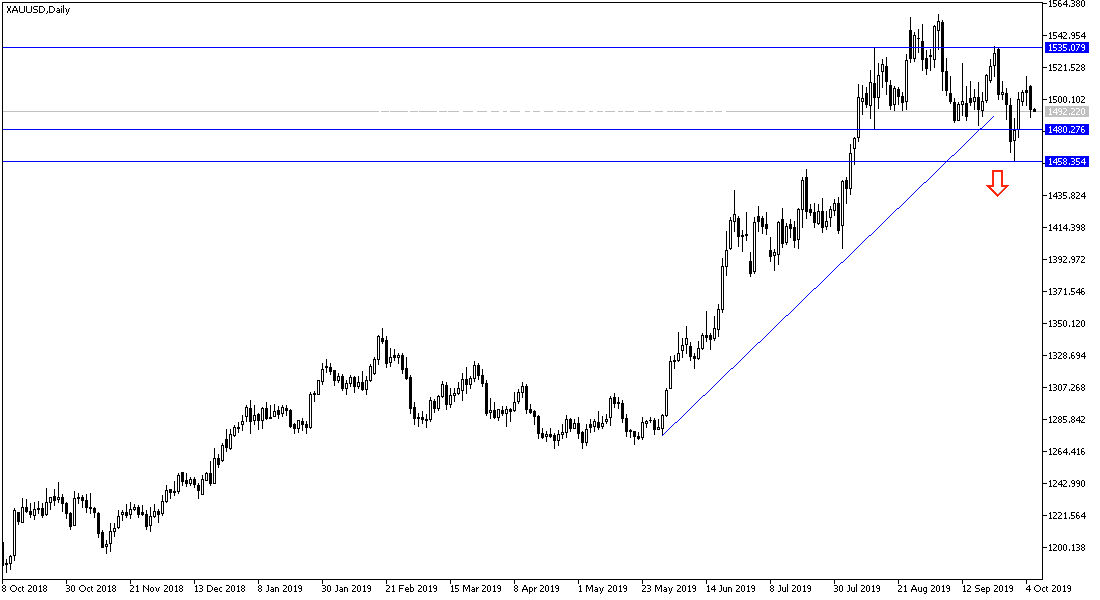

According to the technical analysis of gold: On the daily chart, the price of the yellow metal still has the opportunity to rise and complete the process of testing the peaks of record high by stabilizing above the $1500 psychological resistance. We believe that this is the strongest chance, and we prefer to buy gold from every bearish level, as global trade and geopolitical tensions continue to motivate investors to buy gold continuously. The recent correction is very normal as bulls usually prefer to go from the lowest price to make higher profits. Currently, the closest support levels for the pair are 1488, 1475 and 1460 respectively, and the recent level confirms the strength of the reversal of the general trend to the downside.

As for today's important economic data: Gold will be affected by the release of the Caixin PMI for China's service sector. The comments by the Bank of England Governor Mark Carney and Fed Governor Jerome Powell, as well as the release of the US producer price index, the first inflation figures in the country.