Although the US dollar benefited from the announcement of the Federal Reserve minutes of the last meeting, which saw that financial markets exaggerated their expectations on the pace of US rate cuts, gold prices rose to the $ 1512 before settling around $1505 in early trading on Thursday. Most importantly, the US dollar will be affected by the release of US inflation figures and the release of the consumer price index. The price of gold will also interact with the results of these important data as well as the outcome of the round of high-level trade negotiations between the United States and China today. If that round fails to reach a deal that ends, or at least reduces, the pace of trade war that threatens global economic growth as a whole, gold will have the opportunity to set new highs.

If a limited deal is agreed, as the stronger expectations are, gold could lose some of its gains, but not much, as the dispute between them will continue for a longer period of time, because the two sides will have more negotiation to finally end the world trade war. China may want to postpone this until after the US presidential election 2020 to see whether Trump will win and complete with his wars, or will there be a successor that China can maneuver and overturn Trump's decisions on China.

According to the contents of the last Fed meeting , we noticed a split among members of the Fed's policy on the future of US interest. A split suggests that the future of interest rate cuts remains cloudy. At the September meeting, the majority of Fed officials believe that the second quarter cut was appropriate given the growing economic uncertainty due to trade tensions and a slowing global economy. However, two members indicated that they would prefer a half-point cut. A further rate cut would reduce the risk of a possible recession, they said.

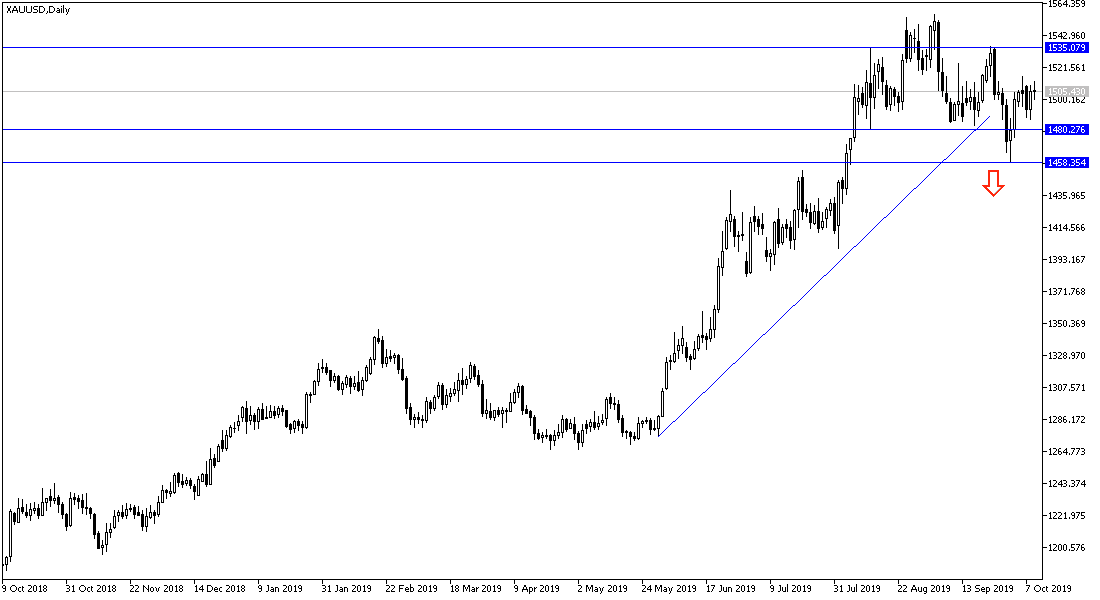

According to the technical analysis of gold: There is no change in our technical view of the gold performance, that stability around and the above the $1500 psychological resistance will continue to support the strength of the upward trend. The trend will be strengthened if it returns to test resistance levels at 1515, 1527 and 1540 respectively, which happen quickly if the US-China round of negotiations fails, and US inflation figures fall short of expectations. The price of the yellow metal may return to a correction downward if the summit was successful between the two sides of the World Trade War and US inflation figures came in better than expected. The nearest support levels for gold are currently at 1493, 1480 and 1465 respectively.

As for the economic calendar data today: The most prominent and affecting items on gold prices are growth rate of the British economy along with manufacturing figures. Then the release of the US consumer price index and any updates from the negotiating parties to resolve the largest global trade dispute.