Gold prices fell for the third day in a row, and the price of an ounce of gold reached the $1483 support, amid continued optimism over the US-China trade deal. The price of the yellow metal tried to rebound early this week, but gains did not exceed $1508 and stable around $1488 at the time of writing, ahead of the announcement of US economy growth rate for the third quarter of 2019. The Bank of Canada and the Federal Reserve then announced their monetary policy amid almost assured expectations that the first bank will keep its monetary policy unchanged. As for the US central bank, they are expected to cut interest rates by a quarter point for the third time before the end of this year in order to face the risks to the US economy from slowing global economic growth as a natural reaction to the global trade war between the United States and China.

Earlier this week, US President Donald Trump said the first phase of the trade deal with China could be signed "ahead of schedule". The goal was to sign the agreement at the APEC summit between him and Xi at the Chile summit next month. Trump and his Chinese counterpart Xi Jinping are scheduled to attend the Asia-Pacific Economic Cooperation forum from November 16 to 17 in Santiago, Chile. Trump described the deal as the first part of the process that could unfold in three phases.

In the same context, the US Trade Representative said he was considering whether to extend the suspension of tariff increases on Chinese goods worth 34 billion dollars, which is scheduled to expire later in December. Meanwhile, a Reuters report, citing a US administration official, said the United States and China are continuing to work on an interim trade agreement, but it may not be finalized in time for leaders to sign in Chile next month.

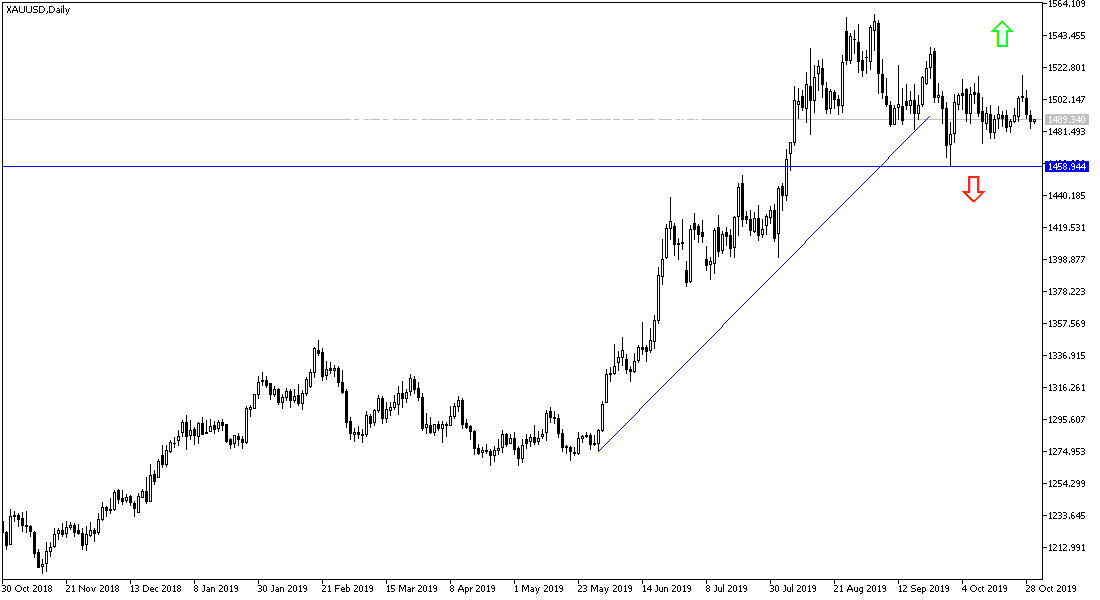

According to the technical analysis of gold: There is no change in my technical view for the future price of gold; the $1500 psychological resistance will remain key to the uptrend towards new record highs and at the moment the most important levels of resistance are $1500, $1515 and $1535 respectively. On the downside, moving around and below the $1480 support will support the downward correction and gold may move to 1473 and 1460 levels respectively. I still prefer to buy gold from every bearish level.

On the economic data front today: The strongest focus for gold prices will be on the monetary policy announcement from the Bank of Canada and the US central bank, before the announcement of the Q3 growth rate of the US economy.