Gold prices rose back to the $1518 resistance by the end of last week's trading, the highest level in a month, with renewed concerns about the future of Brexit and prolonged trade talks between the United States and China. Escape from risk and appetite for safe havens increase the gains of gold. Gold closed the week around $1504 an ounce after a statement from the US Trade Representative's office said the United States and China had made progress towards finalizing the first phase of a trade deal.

The statement was issued after a telephone conversation between US Trade Representative Robert Lightzer, Treasury Secretary Stephen Mnuchin and Chinese Vice Premier Liu He. "They have made progress on specific issues and the two sides are about to finalize some parts of the agreement," the USTR said. "Discussions will continue at deputies’ level, and managers will have another call in the near future."

On the US economic front, revised data from the University of Michigan showed consumer sentiment improved slightly less than the initial estimate in October. The report said that the October consumer confidence index was revised lower to 95.5 from an initial reading of 96.0. Economists had expected the index to be without change.

Despite the downward revision, the October consumer confidence index was still up from the final 93.2 reading for September.

The performance of gold will be on for an important date this week with three central banks announcing their monetary policy, notably the US Federal Reserve, the Bank of Japan and the Bank of Canada. The economic data highlighted are the US gross domestic product and US employment figures.

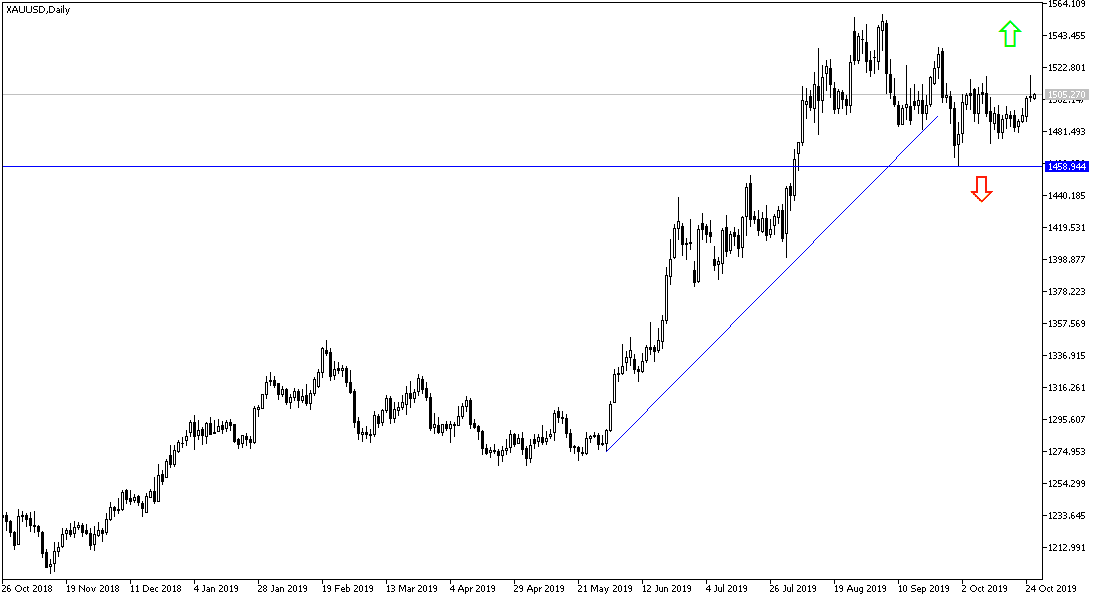

According to the technical analysis of gold: The general gold price trend is in upward corrective performance supported by a break above the $1500 psychological resistance. Stability above that will support the move towards resistance levels at 1515, 1527 and 1540 respectively. The closest support levels for gold are currently at 1496, 1488 and 1475 respectively and moving below the last level threatens the current bullish outlook. We still prefer to buy gold from every bearish level.

As for the economic calendar today: There are no important data affecting the price of gold today. It will react more closely to the developments of Brexit and the US-China trade war.