Overall bearish sentiment continues to dominate the cryptocurrency market, but some cryptocurrencies show signs of decoupling as individual factors are dominating over general market sentiment. The upcoming Litecoin Summit which will be held between October 28th and October 29th, the second summit of its kind, is also attracting fresh interest with a promise by one of Litecoin’s directors of a big development which will be announced soon. LTC/USD gapped above its support zone, but started to retrace from its intra-day high and is now approaching the top range of its support zone. More upside is expected to follow and take this cryptocurrency higher as the summit date approaches.

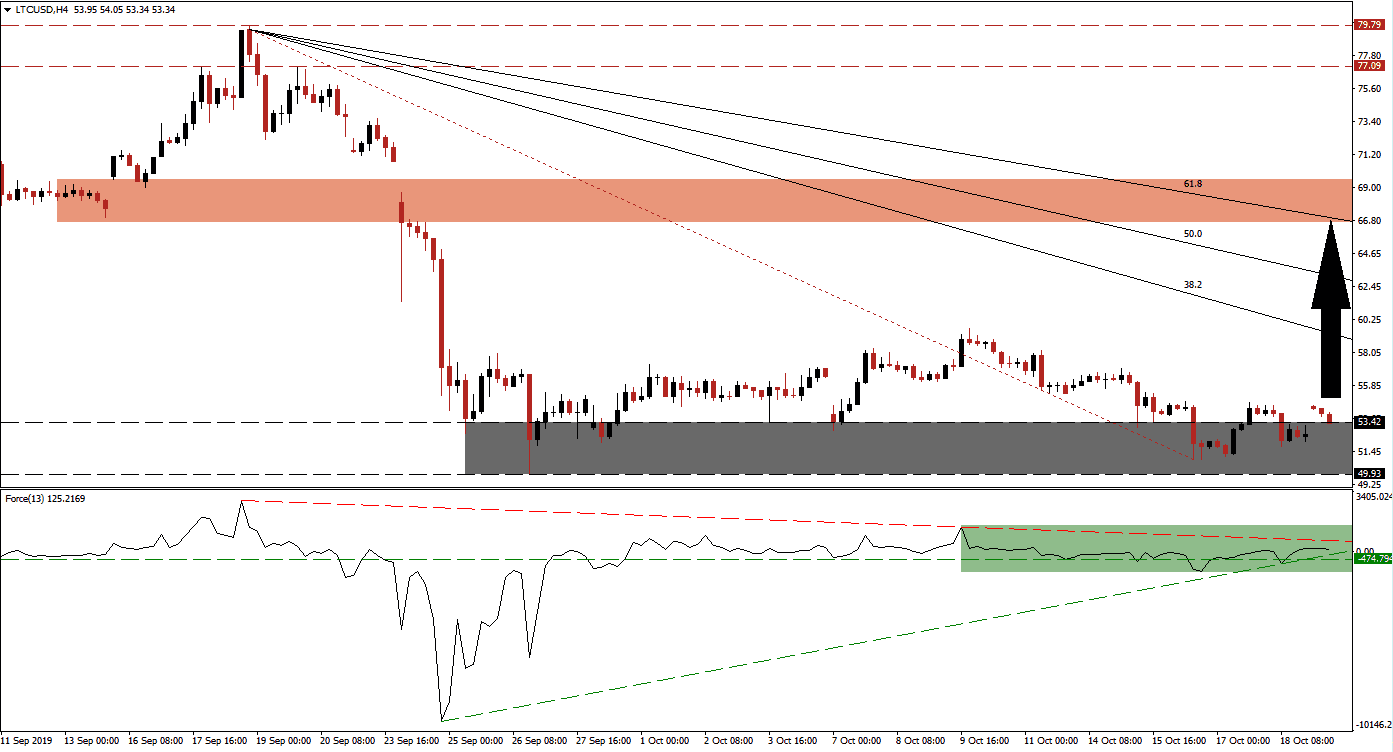

The Force Index, a next generation technical indicator, has been confined to a narrow trading range after LTC/USD plunged into its support zone. Since then, price action has spend most of its time in a tight range and above its support zone, but without a fundamental catalyst to proper it higher. The Force Index is currently in positive conditions and above its horizontal as well as its ascending support levels while its descending resistance level is closing in; this is marked by the green rectangle. With the rise in bullish momentum, a breakout is expected to follow and lead this cryptocurrency pair higher. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

While price action is currently retracing is gap to the upside which took it above its support zone, located between 49.93 and 53.42 as marked by the grey rectangle, bullish momentum is building. A test of the top range of its support zone following a breakout is normal and presents traders a second entry opportunity. This has additionally resulted in a re-drawing of the Fibonacci Retracement Fan sequence which remains in a bearish stance for LTC/USD. As long as the Force Index can maintain its position above its double support level in positive territory and price action will remain above 51.81, an intra-day low which marked a higher low and resulted in the rise in bullish momentum, the bullish bias will remain dominant and is expected to push price action further to the upside.

After LTC/USD will test the top range of its support zone, an accelerated move higher is expected to follow. The next key level to monitor is the intra-day high of 59.67 which marks the previous peak of a reversed advance; this will also elevate price action above its descending 38.2 Fibonacci Retracement Fan Resistance Level, turning it back into support. The next short-term resistance level is located between 66.67 and 69.59 as marked by the red rectangle; the 61.8 Fibonacci Retracement Fan Resistance Level is about to move below the bottom range of this zone. Additional upside would require a fundamental catalyst which may be announced at next week’s summit. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

LTC/USD Technical Trading Set-Up - Breakout Extension Scenario

- Long Entry @ 53.40

- Take Profit @ 66.70

- Stop Loss @ 50.95

- Upside Potential: 1,330 pips

- Downside Risk: 245 pips

- Risk/Reward Ratio: 5.43

In the event of a breakdown in the Force Index below its twin support level, LTC/USD could be pressured into a breakdown below its support zone. This is expected to be a short-term development and wont be sustained unless an unexpected fundamental development materializes. The next support zone is located between 42.01 and 44.45 which includes a price gap to the downside; any move into this zone should be considered an excellent long-term buying opportunity.

LTC/USD Technical Trading Set-Up - Limited Breakdown Scenario

- Short Entry @ 49.00

- Take Profit @ 43.85

- Stop Loss @ 51.30

- Downside Potential: 515 pips

- Upside Risk: 230 pips

- Risk/Reward Ratio: 2.24