As Bitcoin struggles to gain traction, Litecoin has been able to use its 8th anniversary and push back above its 38.2 Fibonacci Retracement Fan Resistance Level, turning it back into support. Following the second halving event, which occurred on August 5th 2019, this cryptocurrency retraced its powerful rally which preceded the event. The Bitcoin inspired sell-off as a result of its hashrate flash crash kept sentiment low and Litecoin has been under pressure as profitability for miners was slashed with the halving. The effects of the halving event this summer are now behind Litecoin which is expected to resume a healthy growth rate moving forward.

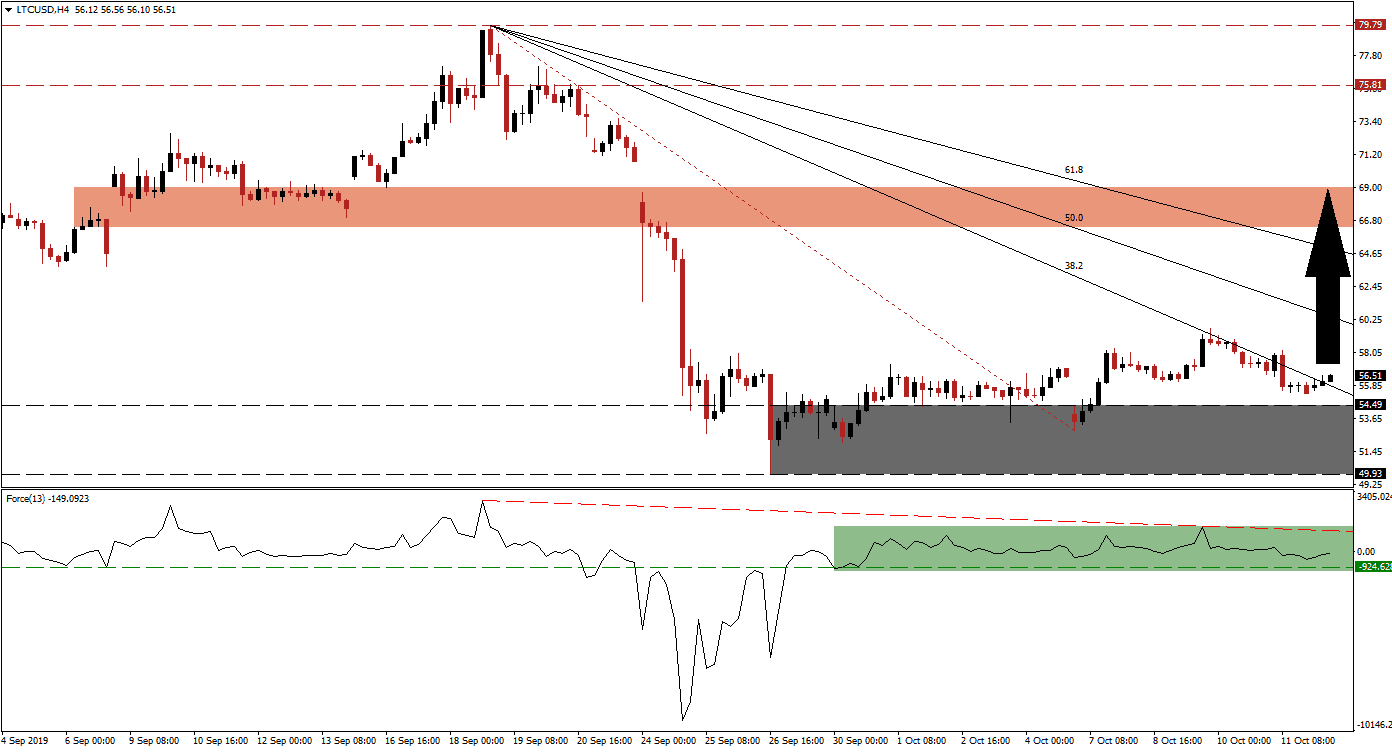

The Force Index, a next generation technical indicator, has entered a sideways trend as this cryptocurrency pair completed a breakout above its support zone and maintained its bullish bias which elevated it above its 38.2 Fibonacci Retracement Fan Resistance Level. The breakout in LTC/USD was confirmed by a breakout in the Force Index above its horizontal resistance level, turning it into support. This technical indicator remains in negative territory with its descending resistance level approaching which is marked by the green rectangle. The bullish bias could result in a breakout and lead price action to the upside. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

After the breakout above its support zone, located between 49.93 and 54.49 which is marked by the grey rectangle, a series of higher highs and higher lows has formed which represents a strong bullish trading signal. Forex traders should now monitor the intra-day high of 59.67 which marks the recent high if its breakout which also took LTC/USD briefly above its 38.2 Fibonacci Retracement Fan Resistance Level before reversing into a higher low. A sustained move above this level is expected to result in the addition of new net long positions and also elevate this cryptocurrency pair above its 50.0 Fibonacci Retracement Fan Resistance Level, turning it into support.

While cryptocurrencies extend their reach and the global financial community starts to not only accept them as an asset class, but seeks exposure to it, the long-term fundamentals for established assets remains positive. Volatility will remain part of it, but the limited supply of coins provides a solid floor under price action. Roughly 21 million Litecoin remained to be mined with a current value of $2 billion. The next short-term resistance zone is located between 66.39 and 69.05 which is marked by the red rectangle; this also includes a price gap to the downside and more upside is possible beyond this level. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

LTC/USD Technical Trading Set-Up - Breakout Extension Scenario

- Long Entry @ 56.25

- Take Profit @ 69.00

- Stop Loss @ 54.25

- Upside Potential: 1,275 pips

- Downside Risk: 200 pips

- Risk/Reward Ratio: 6.38

In the event of a breakdown in the Force Index below its horizontal support level, LTC/USD could reverse its advance back into its support zone from where further downside remains limited. Should bearish pressures mount and force a breakdown, the nest support zone is located between 42.01 and 45.60 which covers a price gap to the downside. Any potential move to the downside by this cryptocurrency will represent an excellent long-term buying opportunity.

LTC/USD Technical Trading Set-Up - Limited Breakdown Scenario

- Short Entry @ 52.50

- Take Profit @ 45.50

- Stop Loss @ 56.00

- Downside Potential: 700 pips

- Upside Risk: 350 pips

- Risk/Reward Ratio: 2.00