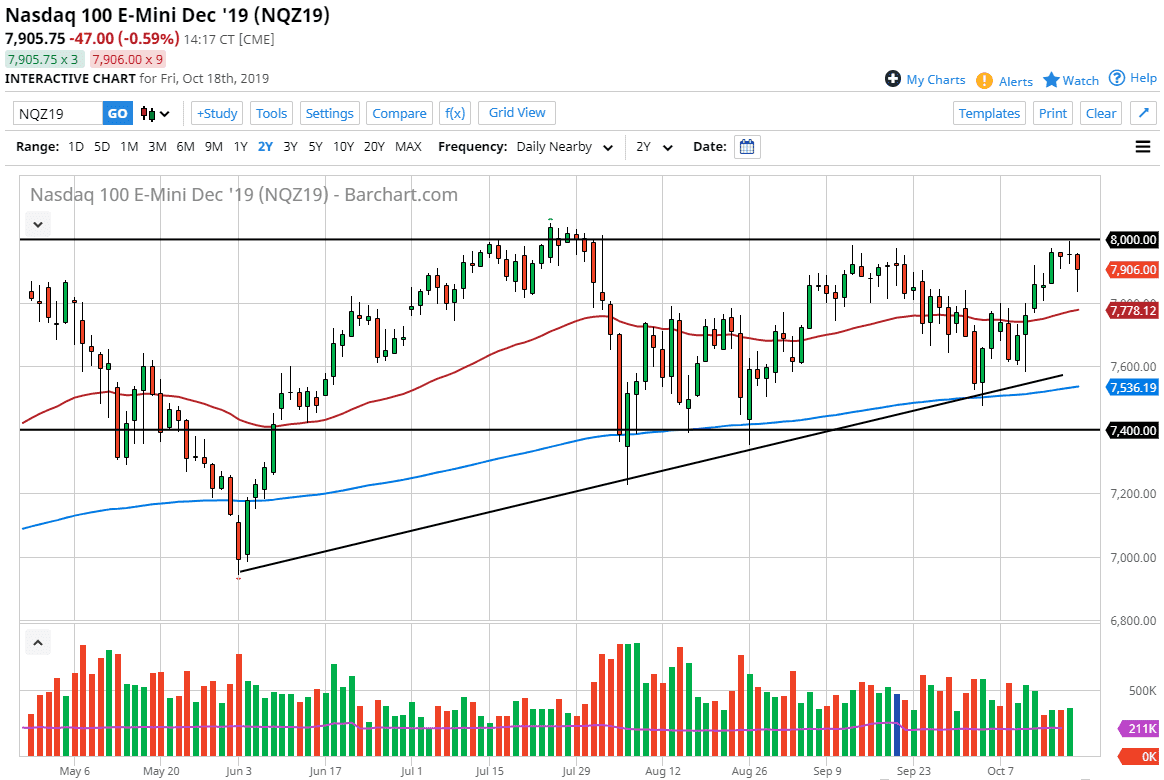

The NASDAQ 100 has fallen a bit during the trading session but did find enough buyers later in the day to turn things around. That being said the recovery wasn’t as strong as it was in the S&P 500, and that might be due to the fact that the Chinese GDP numbers were a little bit light, and this market does tend to react more to the US/China trade relations and commerce. Ultimately, this is a market that is very much in and uptrend anyway, so I do like buying dips and obviously other people do. The 50 day EMA has not been tested recently, but it certainly looks as if it is going to offer support if Friday’s action is any type of indicator.

All that being said it’s obvious that the 8000 level offers a lot of resistance and is difficult to overcome. If we were to do that, the market could really start to take off but I suspect we have some building up to do as far as inertia is concerned. You should also keep in mind that it is earning seasons a lot of different things are happening at the same time.

If this market rallies it won’t have anything to do with the US/China trade talks, because quite frankly those are going nowhere. It will have more to do with the Federal Reserve easing monetary policy and people just simply buying certain stocks because “there is no alternative.” If that’s the case, then the NASDAQ 100 should do relatively well, as companies like Amazon, Alphabet, Adobe, and of course Apple are all on this list. Those are the go to companies for a lot of traders, so keep in mind that the NASDAQ 100 will be a beneficiary as these larger stocks are so heavily owned.

The alternate scenario of course is that we crack below the 50 day EMA but I don’t think that happens anytime soon. Even if it did, there’s a nice uptrend line in the 200 day EMA underneath to offer plenty of support, so I do like the idea of buying dips. Given enough time, this market probably breaks out to the upside as well as we are also forming an ascending triangle over here just as it appears to be in the S&P 500. The buyers are still in control, mainly because they have been so stubborn.