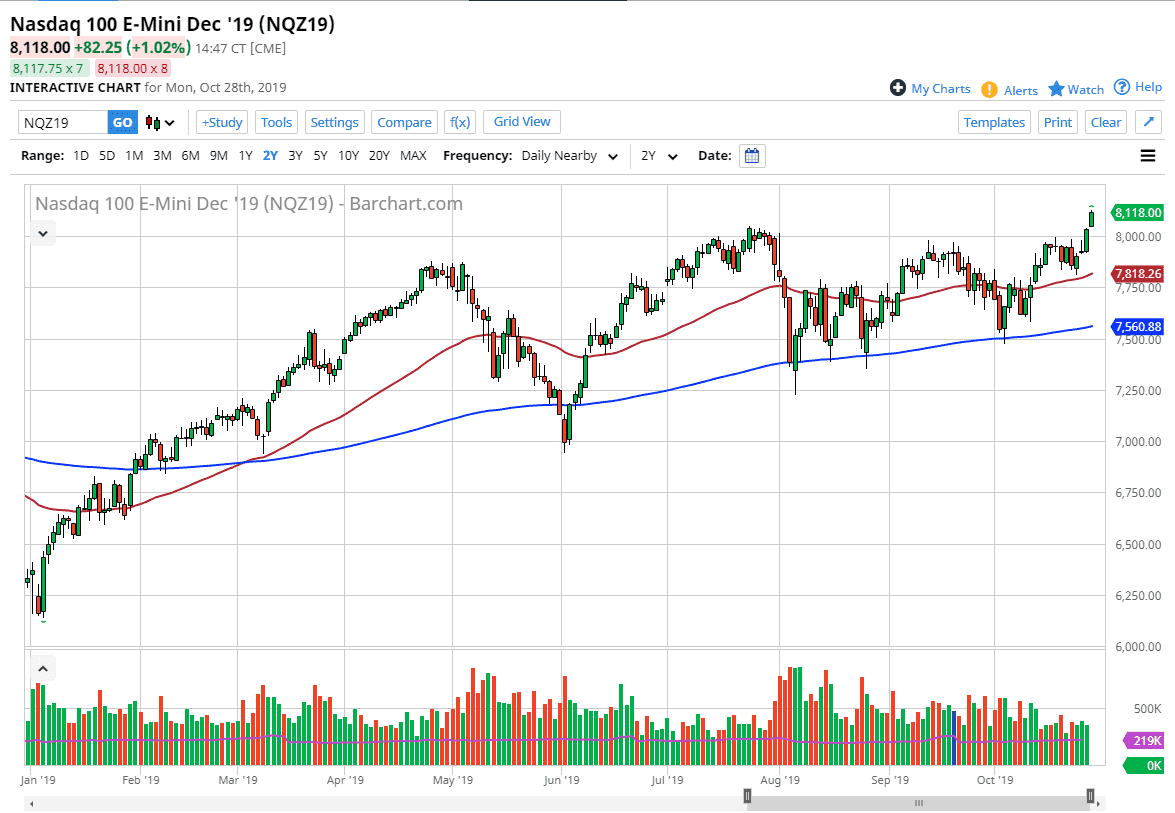

The NASDAQ 100 has shown signs of resiliency again on Monday, finally breaking out to the upside in making a fresh, new hire. Stock markets have been relentless in their buying pressure, and earnings season has been relatively strong. Beyond that, we have the FOMC Statement coming out on Wednesday, almost certainly promising more sugar for the markets in the form of quantitative easing and low interest rates.

The market will continue to squeeze higher, and it now looks likely that the 8000 level will be a bit of a “floor” in this uptrend. The 50 day EMA has offered a lot of support near the 7800 level, and therefore that should also be an area where value hunters would come back in, assuming that we can even get down to that area. It seems to be very unlikely to do that, so at this point I would suspect that short-term dips are buying opportunities.

The 8200 level could offer a bit of resistance, but at this point it seems but a foregone conclusion that we will continue to go higher. However, with the Federal Reserve announcement, if the statement isn’t strong enough for the dovish side, this could throw this market into absolute chaos. The FedWatch Tool at the CME suggests that the interest rate cut of 25 bps for the month of October has a 94.1% chance of being fact. In fact, now there is priced in a 50% chance that December will also see another 25 bps code.

If the Federal Reserve disappoints the market and sounds much more hawkish than anticipated, this could throw everything into disarray. Another potential problem will be the US/China trade talks, which although a little bit more amicable recently, the reality is that there is a long way to go before anything substantial was signed. “Phase 1” is a start, but it’s basically China suggesting that they will buy agricultural products that quite frankly they don’t have much of a choice in doing so. Because of this, the question then will be whether or not there can be a significant gain in the trade situation after that. While it is a good sign that the Chinese are willing to do what they absolutely have to, the question is will they do what the Americans are asking? That remains one of the biggest potential issues in this murder. Until then, pullbacks are going to continue to be buying opportunities.