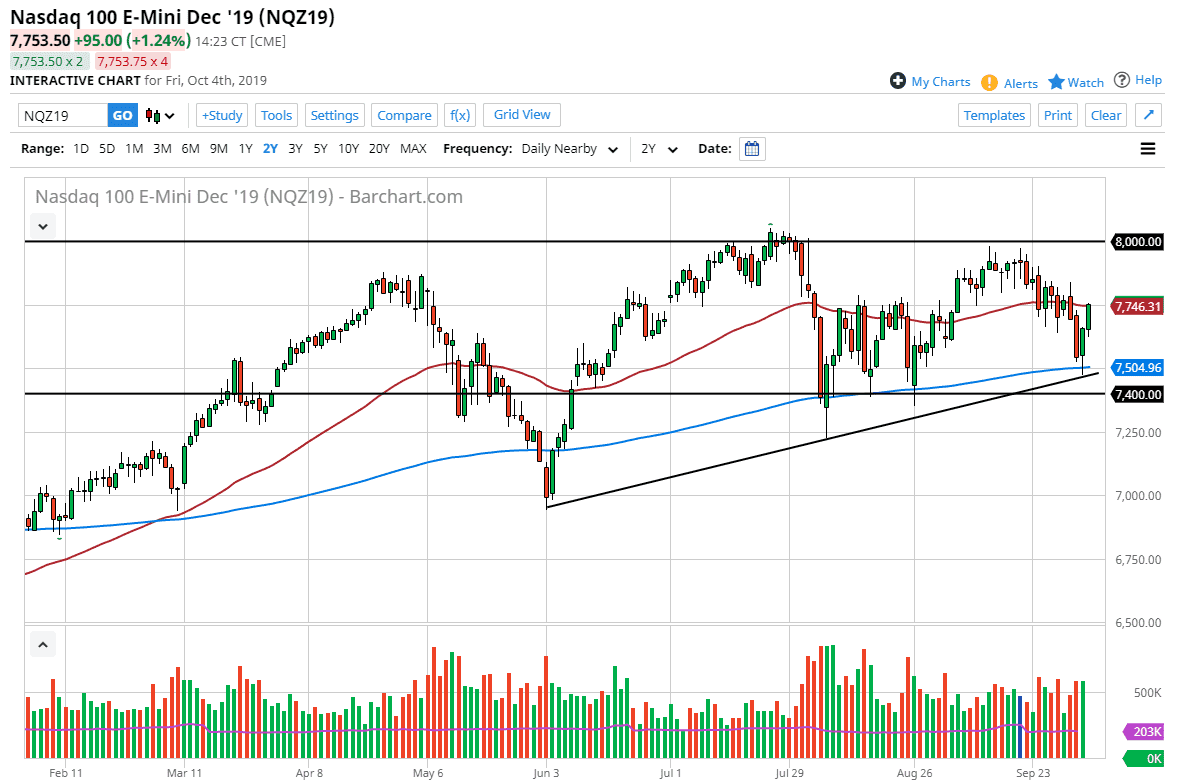

The NASDAQ 100 has had a good session on Friday after the jobs number came out, reaching towards the 50 day EMA. At the end of the session we started to see more volume coming, so that of course is a good sign as institutional money seems to be jumping in as well. Beyond that, we have the US/China trade talks coming this week, and it’s very likely that we are going to see a lot of volatility coming back into the marketplace.

The market has started to grind to the upside, after breaking down rather drastically earlier this week. That is a very good sign, and it suggests that we are going to go back towards the highs again. At this point, I am a buyer of dips, especially if we get some type of good news coming out of that meeting. Keep in mind that the NASDAQ 100 is highly sensitive to the trade war, as technology is so highly sensitive to movement between the United States and China. All of that being said though, the market is in and uptrend and has been simply consolidating for several months. It doesn’t feel like it, but we are still hanging around in a 600 point range.

To the downside, we have a massive amount of support at the 200 day EMA and the uptrend line. Below there, I see the 7400 level as support as well, so I do think that the NASDAQ 100 is going to continue to go higher. At this point in time, the market will continue to be volatility, but the last couple of candles on the daily chart has certainly built a lot of confidence in this market. I think ultimately this is a market that is going to go back towards the highs but there are a couple of different areas that could cause some issues. The 7850 level is going to cause some issues, and then of course the psychologically important 8000 level. If we can finally break above the 8000 handle, this market could really take off to the upside. If we break down below the 7400 level, the market falls apart and goes much lower, perhaps down to the 7000 handle. At this point though, I do favor the upside but recognize that we are going to continue to see lots of choppy behavior in this market.