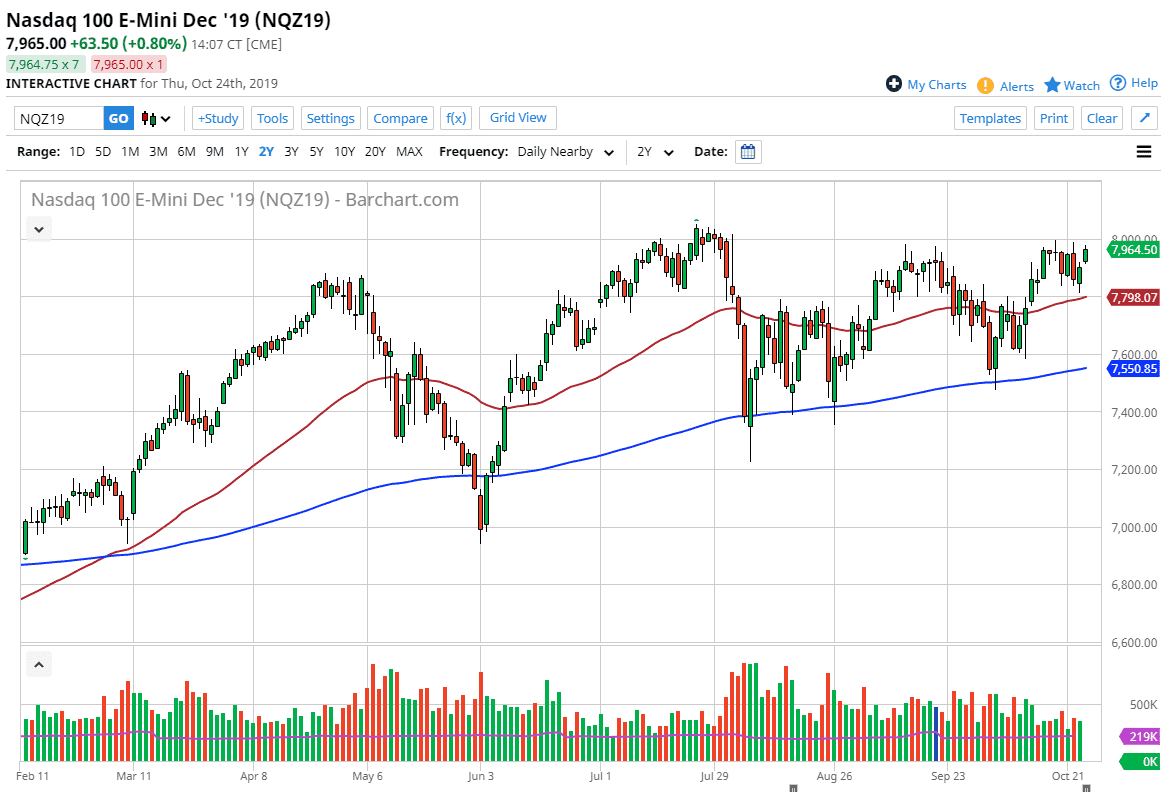

The NASDAQ 100 has gapped higher to kick off the trading session on Thursday, reaching towards the 8000 level above which of course is a massive psychological figure and an area where we have seen sellers come back in several times. At this point, the market looks likely to continue to try to build up enough momentum to finally break out. The earnings season is currently going on, so that of course causes headlines in and of itself.

At this point it looks as if we are trying to build up the proper inertia to finally break out, but we have some work to do. Ultimately, I do think that we get it done, but it’s going to take some type of larger catalyst. The market has recently tried to break above the 8000 level but could not stay above there. By making a fresh, new high it’s likely that the market will continue to go much higher. The 50-day EMA continues to offer short-term support so pull back to that level would be a very interesting place to start buying. Beyond that, there’s also the 200-day EMA underneath is 7600 level, so ultimately this is a market that is a longer term buy on the dips type of scenario.

Expect lots of volatility, but that should be nothing new for those who have been trading this contract this year. We essentially go nowhere over the longer term, but it does suggest bullish pressure due to the fact that every low continues to get a little bit higher. The ascending triangle is of course a sign that we are eventually going to break out, but the question now becomes when does this happen? All things being equal, this is a market that continues to be very noisy, and with the US/China trade situation going on it’s probably going to be more of the same. Technically speaking, it is bullish but it’s also very frustrating for anybody who’s trying to hang onto a trade. Short-term buying on the dips continues to work, at least until we finally get that break out. As far shorting is concerned it’s probably almost impossible to do, simply because the larger push has most certainly been to the upside and therefore it simply a matter of trying to find value as it occurs, taking advantage of cheaper pricing on the occasion.