The NASDAQ 100 rallied rather significantly during trading on Friday, as global trade optimism has returned. The United States and China are getting closer to signing “phase 1” of the trade agreement that was discussed back on October 11. At this point, the market has priced then a considerable amount of good news, so at this point we will have to see if this can continue.

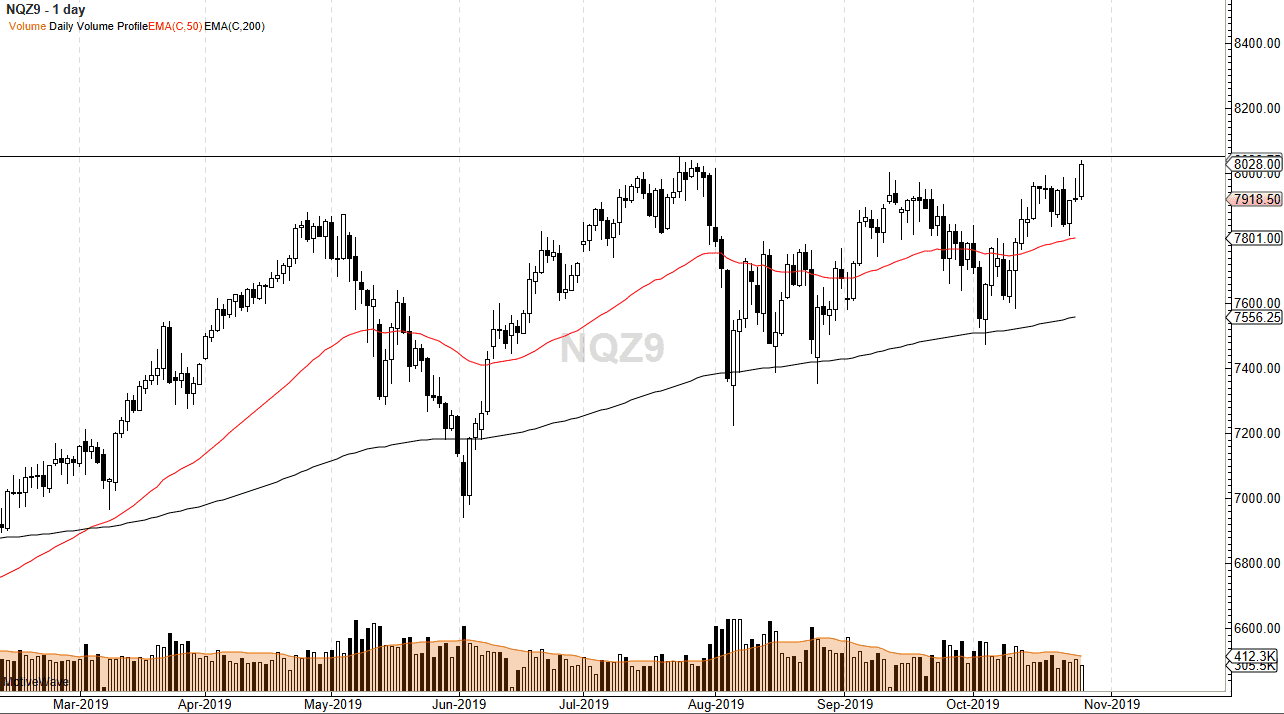

Looking at this chart, it’s obvious that the 8051.75 level is going to continue to cause some issues, as it was the most recent high. If we can break above that level, then the market is likely to continue going higher. When you look at the longer-term trend, it’s obvious that it’s bullish and it’s also obvious that we have been forming a bit of an ascending triangle, which is also a very bullish sign. Underneath, we have the 50-day EMA at the 7801 level, and that should be supportive as well. The day had a roughly 125-point range, so that is a very good sign as well. However, we are still susceptible to headlines in general, and over the weekend we could see some type of negative headline to turn this market right back around.

Looking at the chart, it still looks as if it’s going to be a scenario where you can go long on dips as it offers value. The market has plenty of bullish pressure underneath, and you should continue to look at pullbacks as a buying opportunity. This is a market that will be heavily influenced by the US/China trade situation, but it will also be influenced by the Federal Reserve meeting on Wednesday, which could give us an idea as to where interest rates and monetary policy is going. The looser the monetary policy, the better it is for the stock market. A break above the shooting star from the Thursday session could be a very strong sign for the buyers. Overall, the market would continue to look bullish in general, and if the Federal Reserve does have a dovish statement, that could be reason enough to push this market to the upside. However, if the Federal Reserve fails to cut interest rates or suggests that it is “one and done”, it’s likely that the market pulls back from here and shows extreme weakness. The Federal Reserve has been trained recently not to do that though by the market, so it’s likely that won’t happen.