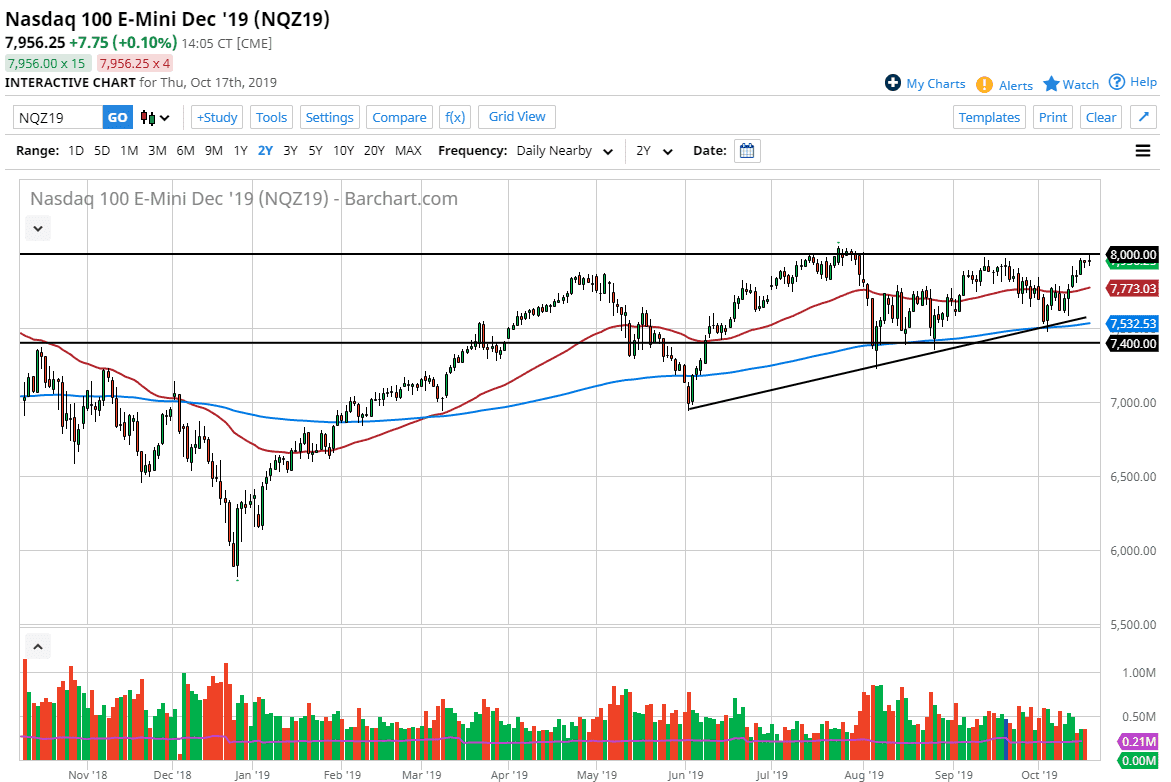

The NASDAQ 100 has gone back and forth during the trading session on Thursday, trying to break above the 8000 level which of course has a significant amount of resistance at it. Ultimately, this is a large, round, psychologically significant figure, and at this point looks to be holding. That being said, it is also a market that continues to find buyers on dips and therefore it’s likely that the overall trend will eventually break to the upside.

A pullback from here will more than likely have quite a bit of support underneath at the 50 day EMA, which is starting to curl higher again. That being said though, the market has simply gone back and forth around that moving average, and we are starting to get a bit of overextension in this market and it is likely that we will continue to see this market pull back from this area. That being said though, if we were to break above the 8000 handle, then the market could go much higher. This is an ascending triangle, and it’s likely that it will eventually kick off. That being said, there is always the bearish case which really doesn’t take hold for a longer-term move until we break down below the blue 200 day EMA which is closer to the 7532 level.

This is a market that will be highly driven on the US/China trade situation, as most of the leaders in the NASDAQ 100 do a lot of business between these two economies. Ultimately, this is a market that is bullish, and it certainly has a lot of resistance just above. I tend to think of it as very akin to “a beach ball being held underwater”, showing signs that the break above the high could be rather explosive. At this point, the market is very likely to see that happen, but we need some type of catalyst in order to have that happen. At this point, short-term pullbacks will continue to see buyers jump in though, and I suspect that’s probably how this plays out over the next several days. Beyond that, let’s not forget that the earnings season is going on right now, and that of course has a major influence on where this goes next as well. I expect a short-term pullback, and then eventually another attempt to break out for a huge move.