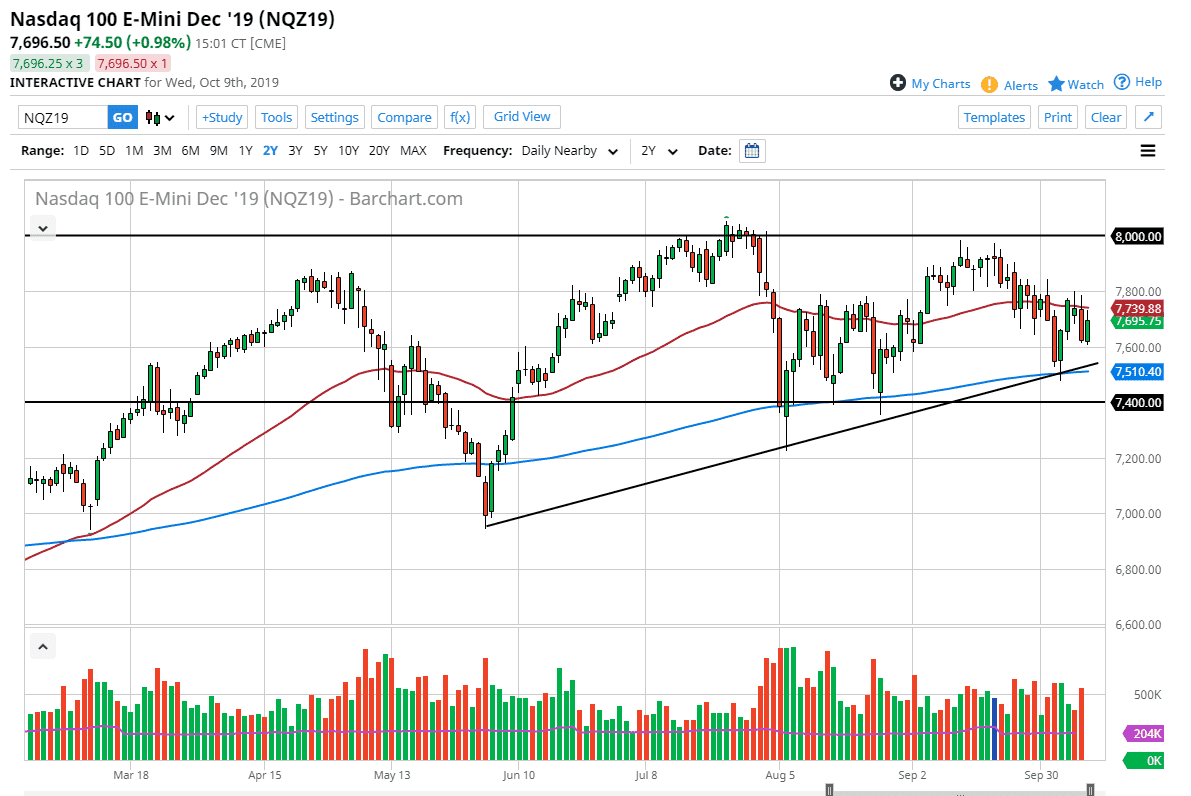

The NASDAQ 100 has rallied a bit during the trading session on Wednesday as we await the US/China trade talks. At this point I can’t imagine a scenario where there is a whole lot of optimism, but here we are. Looking at this chart, it’s obvious that we have been in an uptrend for several months, but the most recent high was just slightly below the one before it. The question now is whether or not that is a bit of a trend change, or is it going to simply end up being a pullback for the bigger move?

Looking at this chart, you can see that the 50 day EMA has continued to offer quite a bit of resistance, so it’s likely that it may struggle to break above there. Beyond that, the 7800 level seems to be offering resistance so think of it as a complete “zone” where sellers are willing to step in. Until we can break above that level, it’s difficult to imagine a scenario where the NASDAQ 100 can take off for significant moves. To the downside though, we have just as much in the way of support extending from the 7600 level down to the uptrend line and of course the 200 day EMA.

At this point, with the US and China talking over the next couple of days I would anticipate that the market probably just going to jockey back and forth, slamming around between the 50 day EMA and the 200 day EMA. After that, then the stock market will focus on earnings season, but never forget that at the end of the day the most important thing is going to be whether or not the Federal Reserve steps in and offers interest rate cuts and cheap money. That’s been the case for well over a decade, so it’s hard to imagine that it changes in the next couple of days.

All that being said, the US/China situation could get uglier, and if it does then that could break this market down, if we can slice down through the 7400 level, it’s likely that the market unwinds quite drastically, perhaps down to the 7000 handle. At this point, that would be an extraordinarily negative sign, and therefore I think that the market would perhaps enter a bit of a tailspin if that does happen.